Vietnam stock market's mark in 2023

The turbulent year 2023 with a series of difficulties has caused the Vietnamese stock market to experience strong "shakes".

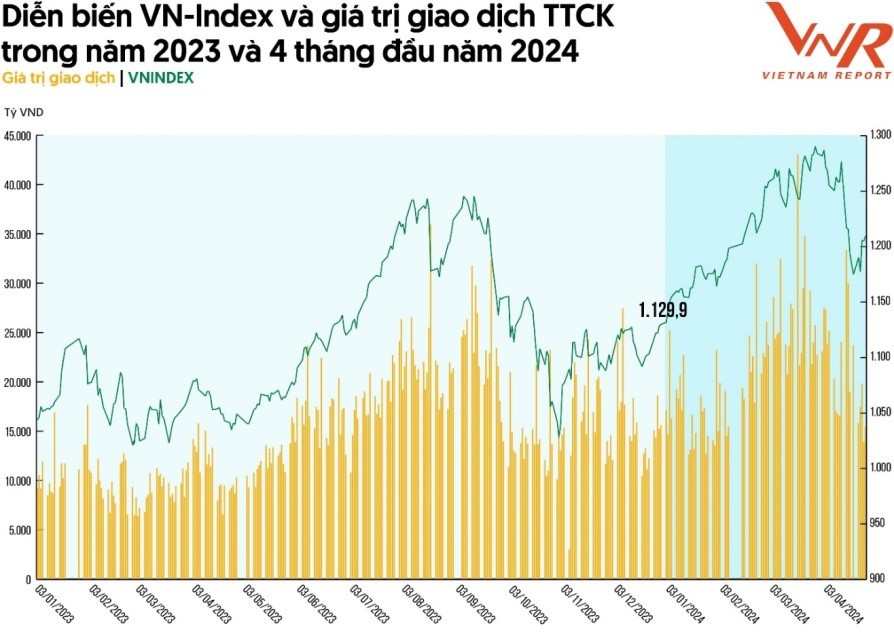

The market movement is clearly reflected through the fluctuations of the VN-Index, which can be divided into four main stages: the market was quiet in the first months of the year; the market gradually "heated up" from the beginning of May to the middle of the third quarter of 2023 thanks to the information about the temporary suspension of interest rate hikes by the US Federal Reserve (FED) and the 4 cuts in operating interest rates by the State Bank; the stock market declined from the end of the third quarter to the middle of the fourth quarter, when the State Bank withdrew money through the treasury bill channel to stabilize the exchange rate, foreign investors maintained net selling and the economy recovered more slowly than expected; the market gradually recovered, although not enough to return to the old peak in the last 2 months of the year.

Entering 2024, the Vietnamese stock market is showing signs of recovery. The low interest rate environment is maintained, many sectors such as import and export, FDI, public investment, etc. are improved, and the drastic actions of the management agency in removing bottlenecks have created "excitement" for the market. After 5 consecutive months of increase, the VN-Index peaked at 1,290 points at the end of March and established a liquidity level exceeding 30,000 billion VND. By the end of April, the market recovered after a strong correction in the first half of the month.

Trends and prospects of Vietnam's stock market in 2024

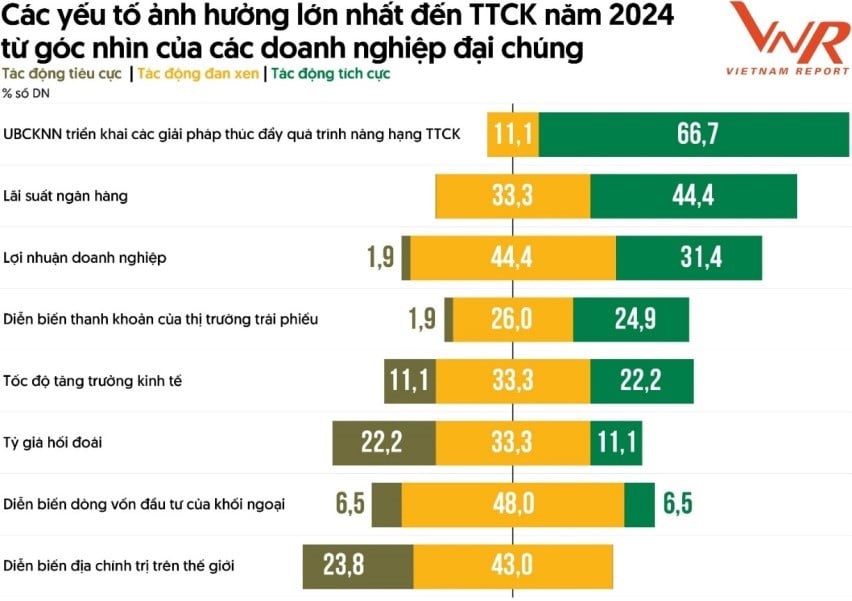

According to a survey by Vietnam Report with public enterprises, 2024 is a "battle zone" between market adjustments and recovery. The stock market still depends on many variables such as: the FED's monetary policy, liquidity of the system and corporate bond market, foreign investment capital flows, exchange rate fluctuations and gold prices.

In particular, the State Securities Commission has implemented solutions to promote the process of upgrading the stock market, including: improving the legal system, increasing transparency and professionalizing the market, helping to attract more foreign investment capital and enhancing the position of the Vietnamese stock market. This is considered the factor with the most positive impact on the current developments.

Some other factors that could have a big impact this year are: bank interest rates, corporate profits, bond market liquidity, economic growth, exchange rates, foreign investment flows and geopolitical developments.

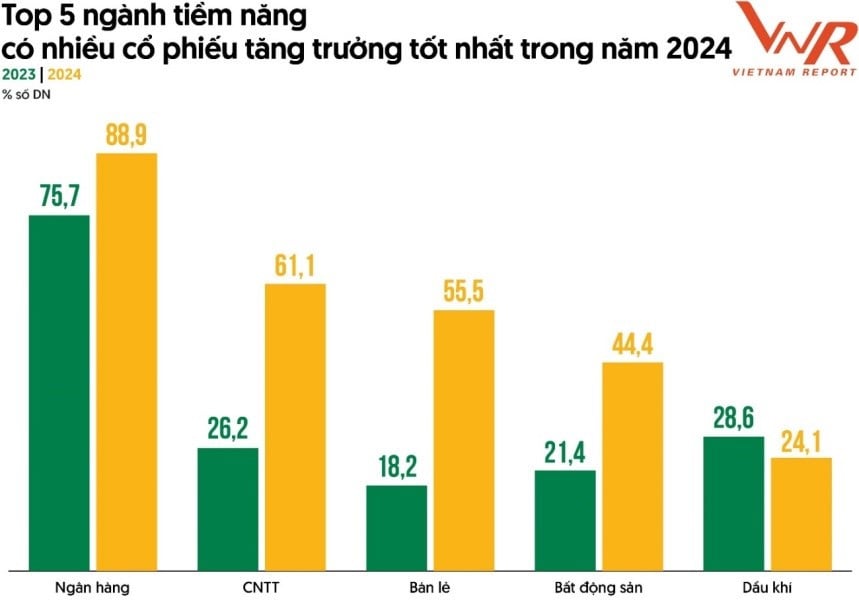

Vietnam Report's survey also pointed out 5 industries with many potential stocks based on four main criteria: business results, reasonable valuation, ability to attract cash flow and favorable macro factors: banking, information technology, retail, real estate, oil and gas.

Market upgrade - a step towards maturity for Vietnam's stock market

Since September 2018 - the time when Vietnam was put on the FTSE Russel's watch list for upgrading to emerging market status and was periodically monitored by MSCI, the upgrade story has always been a "hot" topic that is closely monitored. This is one of the major goals that the Government is aiming for, included in the Project "Restructuring the stock market and insurance market to 2020 and orientation to 2025" and the draft "Strategy for developing the stock market to 2030".

However, according to MSCI and FTSE Russell, the Vietnamese stock market still has problems related to information disclosure in English, the foreign exchange market, registration procedures for foreign investors, etc. To remove the "bottlenecks" and realize the goal of upgrading the market, it is necessary to promote extensive and comprehensive reforms, especially focusing on policies.

According to a survey by Vietnam Report, policy recommendations that businesses prioritize include: perfecting the legal framework for the stock market; modernizing information technology to serve trading and payment activities; strengthening management, supervision, and purification of stock market activities; improving the capacity of market intermediary organizations, etc.

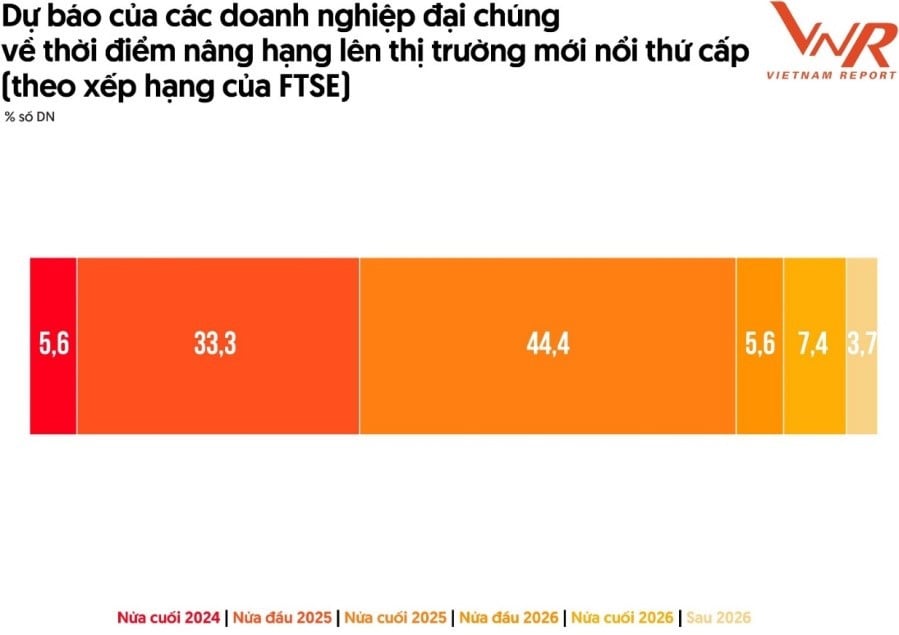

Commenting on the time when the Vietnamese stock market is upgraded by FTSE to a secondary emerging market, the majority of public enterprises participating in Vietnam Report's survey believe that 2025 will be the time to mark this milestone, after the existing "bottlenecks" in the market are removed.

The media aspect of public enterprise

The VIX50 ranking is the result of objective and scientific research by Vietnam Report, based on the Media Coding method - encoding press data in the media combined with market research.

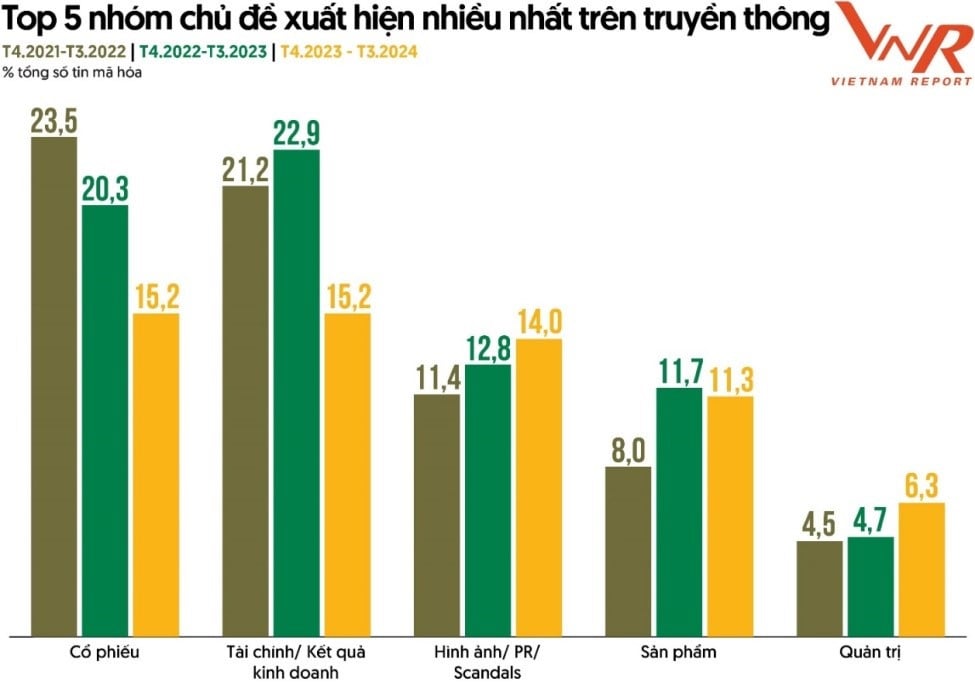

According to Media Coding analysis data from April 2023 to March 2024, the 5 most frequently appearing topics in the media of public enterprises remained the same as the previous year and only changed in the appearance rate, including: stocks; finance/business results; image/PR/scandals; products; management.

The data also shows that the five industries that receive the most media attention are: banking, real estate, retail, food and securities.

Enterprises are considered “safe” in terms of information quality in the media when the ratio of positive and negative information to the total amount of encoded information is 10%, the “best” threshold is over 20%. This year, Vietnam Report’s research recorded 62.7% of enterprises reaching the “safe” threshold, 48.2% of enterprises reaching the “best” threshold.

| See full announcement at: www.top50vietnam.net |

(Source: Vietnam Report)

Source: https://vietnamnet.vn/cong-bo-top-50-cong-ty-dai-chung-uy-tin-va-hieu-qua-nam-2024-2283408.html

![[Photo] Prime Minister Pham Minh Chinh attends the 2024 Outstanding Young Vietnamese Faces Award Ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/910d105845ce406ba15ed33625975a78)

![[Photo] Renovating the "green gem" in the heart of the capital](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/e5a1627db4504cd88b6b81163df1b18b)

![[Photo] Prime Minister Pham Minh Chinh attends conference on ensuring security and order in the Northwest and surrounding areas](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/933ce5c8b72e4663bd6c6cd8be908f23)

![[Photo] Overcoming the sun to remove temporary and dilapidated houses for poor households](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/824ba71165cc4f8fb6a3903ca0323e5d)

Comment (0)