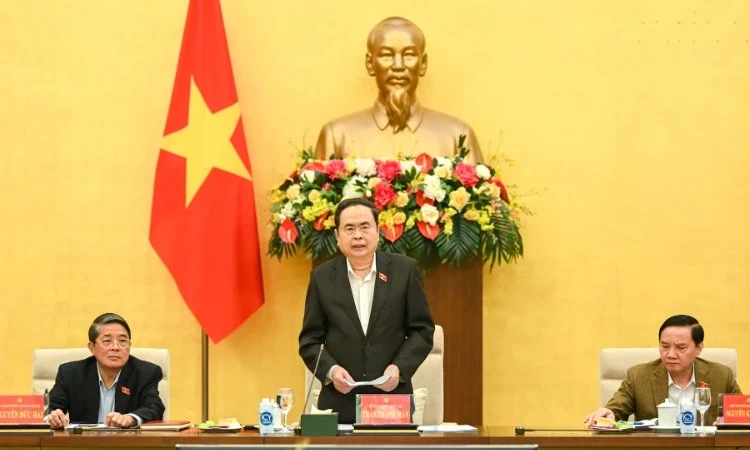

Deputy Prime Minister Ho Duc Phoc - Photo: GIA HAN

On the morning of November 28, the National Assembly discussed in the hall the draft Law on Corporate Income Tax (amended).

More support needed for journalism

Notably, many National Assembly deputies proposed reducing corporate income tax on the press.

Delegate Thach Phuoc Binh (Tra Vinh) said that currently, press agencies operate with non-profit goals, serving political, propaganda, and educational tasks instead of doing business.

But applying a common corporate income tax rate of 20% to revenues outside of core duties such as advertising and event organization puts great pressure on press finances.

He pointed out that public interest organizations enjoy corporate income tax exemption or reduction policies, but the press has not yet received similar support mechanisms despite its important role in society.

Especially in the context of fierce competition from digital platforms such as Google and Facebook, advertising revenue is decreasing, making it difficult for many press agencies to maintain operations.

“Unstable income such as sponsorship and small advertising contracts are still subject to corporate income tax without considering their specific characteristics, which weakens the financial capacity of the press,” Mr. Binh said.

In addition, the current Tax Law does not have specific regulations for press agencies, leading to the application of tax rates like normal enterprises without considering the special role of the press in the political and social system.

Some press agencies may enjoy preferential treatment through other regulations such as geographical areas and encouraged sectors, but this is inconsistent and lacks transparency.

From there, he proposed 7 preferential contents for press agencies. In which, applying a preferential tax rate of 10%, or possibly lower, for income from activities outside of political duties such as advertising and event organization.

At the same time, corporate income tax is exempted for sponsorships and aid to press agencies to create resources to support the implementation of political and communication tasks.

Clearly separate income from political propaganda activities that are exempt from tax and income from business activities that enjoy low tax incentives.

There are special support policies for local press agencies, especially in remote areas with difficult socio-economic conditions and low or very low financial autonomy.

Develop simple tax declarations, prioritize support for the press in determining taxable income, and apply incentives. Increase the application of information technology in tax declarations and settlements to reduce administrative burdens for the press.

Along with that, indirect support through measures such as forming a financial support fund from the state budget, socialization to partially finance press activities. Building a mechanism to collect taxes from Google, Facebook... using this revenue to support domestic press.

Reduce taxes so the press can do its job better

Agreeing with these comments, delegate Do Chi Nghia (Phu Yen) emphasized that the press is facing extremely difficult times, the lives and incomes of officials and reporters have decreased significantly, and the activities of agencies have many problems to solve.

Revenues are decreasing while tasks are increasing and especially information competition on social networks requires better quality of press information and more investment of effort.

He believes that this tax reduction is an opportunity and condition to support press agencies to better perform their tasks and that stronger policies are needed.

He proposed to reduce tax to 10% for all types of press, the state budget would not lose much but it would be a very important encouragement for the press. Especially when tax is reduced, it increases the value of information, increases the spiritual value so that journalists can work better and more enthusiastically.

Explaining later, Deputy Prime Minister and Minister of Finance Ho Duc Phoc said that if the National Assembly agrees, the tax rate for printed newspapers and other types of media will be 10%.

The drafting committee discussed with the Finance and Budget Committee to unify this content to help press agencies.

He made it clear that there are many forms of support for press agencies such as ordering, advertising, etc. For press agencies that are not yet autonomous, the State still provides normal funding.

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia works with key political press agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/3020480dccf043828964e896c43fbc72)

![[Photo] Close-up of old apartment building waiting to be renovated](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/bb2001a1b6fe478a8085a5fa20ef4761)

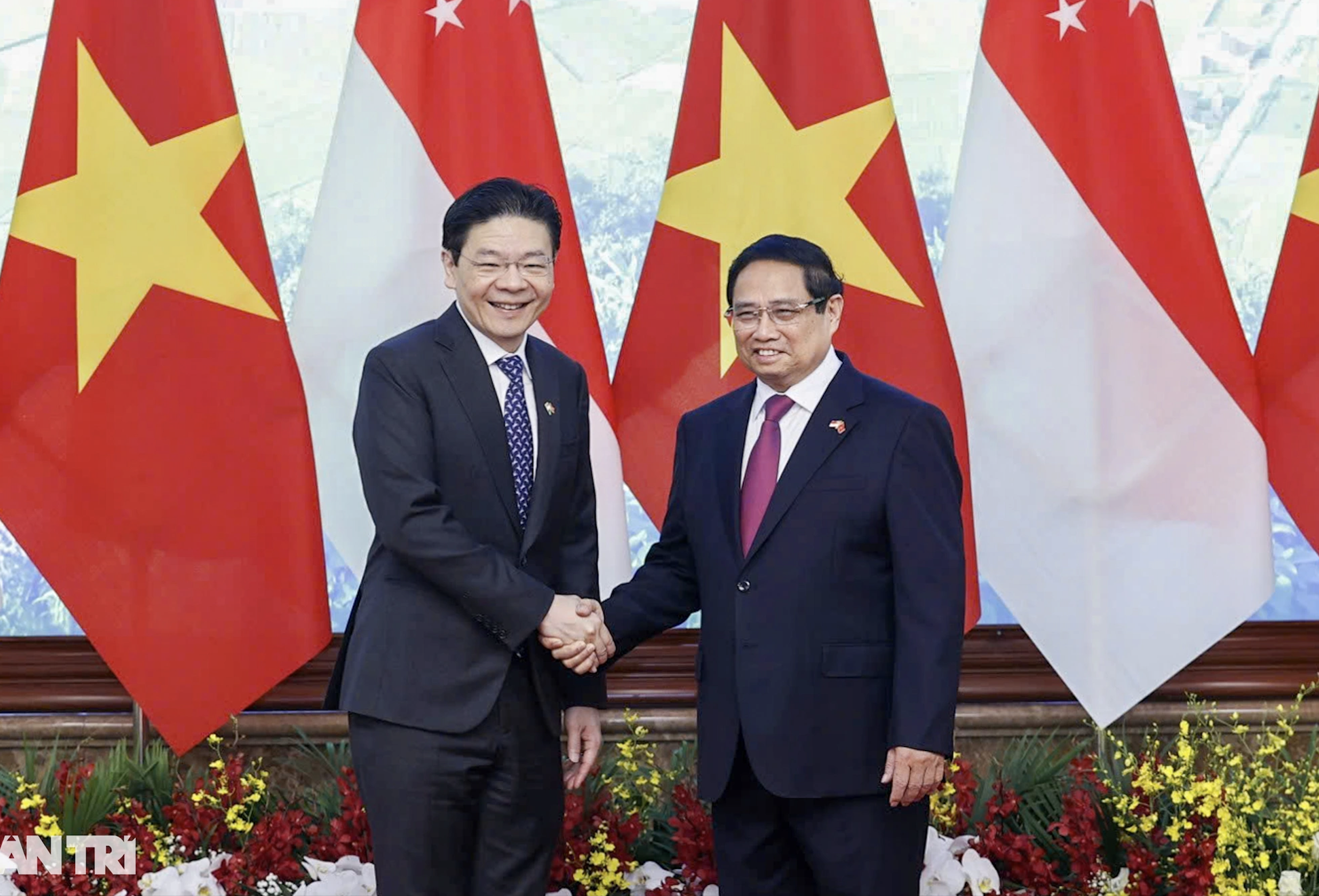

![[Photo] Welcoming ceremony for Prime Minister of the Republic of Singapore Lawrence Wong on an official visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/445d2e45d70047e6a32add912a5fde62)

Comment (0)