30% of households in Ho Chi Minh City and Hanoi have an income of over 30 million VND/month, but still find it difficult to buy a house, the dream of settling down is quite far away.

Surveys show that 30% of households in Ho Chi Minh City and Hanoi have an income of over 30 million VND/month, far exceeding that in rural areas and other provinces. However, the dream of settling down here is quite far away, with peak incomes having difficulty catching up with housing prices.

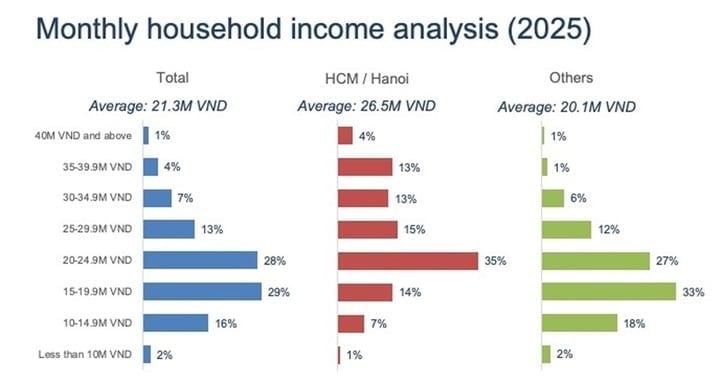

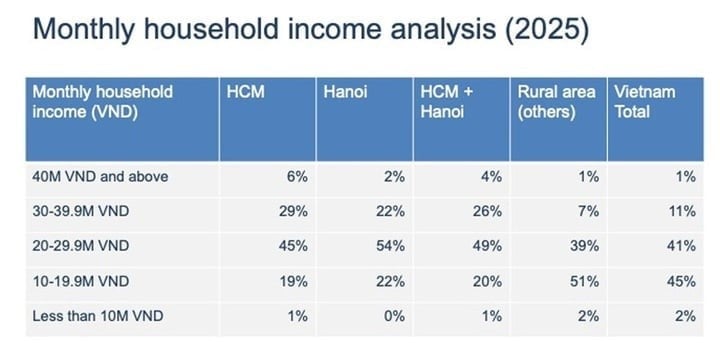

A survey by market research company Qandme released on February 25 showed that household income in Ho Chi Minh City and Hanoi is much higher than in other provinces and cities. The percentage of households with income of VND40 million or more in Ho Chi Minh City and Hanoi is 4%, while in other places it is 1%, and in rural areas it is 0.6%.

Income from 25 million VND/household or more accounts for 45%, while in other provinces and cities it is 20%. Income from 30 million VND/month or more accounts for 30%, while in other provinces and cities it is 8%.

The income gap between urban and rural areas is huge. Only 0.7% of households in Ho Chi Minh City and Hanoi have an income of less than VND10 million per month, compared to 2.2% in rural areas.

The data were collected through nationwide interviews, revealing clear disparities influenced by economic growth, employment opportunities and industrial concentration.

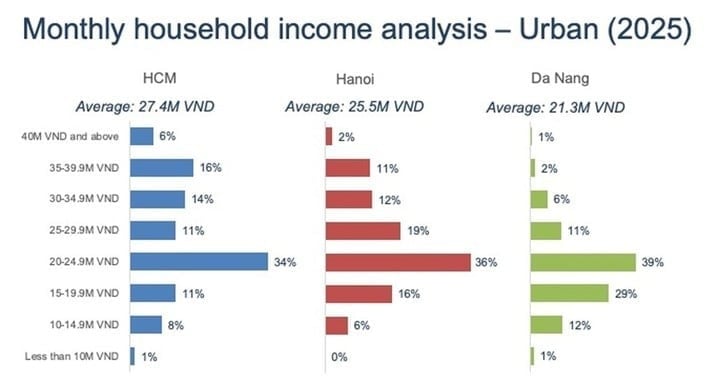

The income picture shows the rich-poor divide by region. Ho Chi Minh City has the highest income, followed by Hanoi and Da Nang. According to survey data, 15.5% of households in Ho Chi Minh City have an income of 35 to 39.9 million VND per month, compared to 11% in Hanoi and only 1.8% in Da Nang. In addition, 5.8% of households in Ho Chi Minh City have an income of 40 million VND or more, while the rate in Hanoi is 1.8% and in Da Nang is only 0.5%.

Although families in Ho Chi Minh City and Hanoi have the highest incomes in the country, life is not easy for those who do not own a home or are buying a home on installments. The dream of settling down and saving to buy a home is very difficult because house prices have increased at a dizzying rate over the past decade.

Currently in Hanoi, the "popular" price of an apartment is about 4 billion VND. Therefore, the richest 2% of households in Hanoi with 40 million VND/month, if they do not eat or spend anything, will need more than 8 years to be able to buy it.

According to Savills, the average household income in Hanoi is around VND250 million per year. Therefore, it would take about 16 years of not spending money to buy an apartment at a “popular” price.

In fact, costs in Ho Chi Minh City and Hanoi are often much higher than in other provinces and cities.

Suppose the household income is in the highest group and is 40 million VND/month. The savings rate may vary depending on each family's spending. Suppose the savings are high, with about 50% of income, or 20 million VND/month. They need nearly 17 years to be able to buy an apartment.

However, that does not take into account inflation with high depreciation rate and very fast increase in real estate price. Accumulating money to wait to buy a house, realizing the dream of settling down is difficult to do.

The usual solution is to take out a bank loan and pay it back in installments. But if you have to take out a bank loan, the interest rate will increase the cost of buying a house and extend the repayment period. The time can be up to several decades if there is no breakthrough in income.

For the group of households with the most common income in Ho Chi Minh City and Hanoi, which is from 20-24.9 million VND/month (accounting for 35% of the total number of households), the time to accumulate to be able to buy a house or take out a home loan will be double that of the first group, possibly up to 40-50 years.

The large income gap between urban and rural areas also occurs in many countries in the region and Asia.

In China, although the income of the richest group is higher, real estate prices in big cities like Beijing or Shanghai are also much more expensive than in Ho Chi Minh City and Hanoi. Therefore, the accumulation time to buy a house in these cities can be equivalent or even longer than in Hanoi and Ho Chi Minh City.

It can be seen that, despite being in the highest income group, home ownership in Hanoi and Ho Chi Minh City is still a big challenge for many households. The gap between income growth and real estate prices is creating a growing gap, requiring solutions from both the government and the market to help people access housing more reasonably.

Source: https://baolangson.vn/nhom-ho-gia-dinh-giau-nhat-ha-noi-nhin-an-tieu-8-nam-moi-mua-noi-nha-4-ty-5039391.html

![[Podcast] News on February 21, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/1/95e8ca51488d48cab89fa7526493031f)

Comment (0)