LIVE UPDATE TABLE OF GOLD PRICE TODAY 24/7 and EXCHANGE RATE TODAY 24/7

| 1. PNJ - Updated: 07/23/2023 22:30 - Time of website supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 56,000 | 57,100 |

| HCMC - SJC | 66,450 | 67,100 |

| Hanoi - PNJ | 56,000 | 57,100 |

| Hanoi - SJC | 66,450 | 67,100 |

| Da Nang - PNJ | 56,000 | 57,100 |

| Da Nang - SJC | 66,450 | 67,100 |

| Western Region - PNJ | 56,000 | 57,100 |

| Western Region - SJC | 66,500 | 67,100 |

| Jewelry gold price - PNJ rings (24K) | 56,000 | 57,000 |

| Jewelry Gold Price - 24K Jewelry | 55,800 | 56,600 |

| Jewelry Gold Price - 18K Jewelry | 41,200 | 42,600 |

| Jewelry Gold Price - 14K Jewelry | 31,860 | 33,260 |

| Jewelry Gold Price - 10K Jewelry | 22,300 | 23,700 |

The world gold price ended the last session of the week on the Kitco floor at 1,962.9 USD/ounce. The precious metal left the 2-month high recorded on the session of July 19. However, the price of this metal still increased by 0.4% over the past week. Meanwhile, the price of gold for futures in the US lost 0.2%, down to 1,966.60 USD/ounce.

Gold weakened after peaking above $2,000 an ounce on concerns about the US Federal Reserve’s higher interest rates. After approaching the $2,000 an ounce threshold earlier in the week, gold prices struggled and gradually fell due to profit-taking.

Investors are awaiting the Fed's interest rate meeting this week. There are many predictions that the Fed will raise interest rates by another 25 basis points this time and maintain it until the end of the year. Higher interest rates will negatively impact gold prices, but expectations that this monetary tightening policy will not last long will help the precious metal maintain its high level.

Meanwhile, the USD rose at a more steady pace after the Bank of Japan (BOJ) forecast that it would continue to maintain its aggressive monetary easing policy next week and saw no urgency in adjusting its interest rate control program.

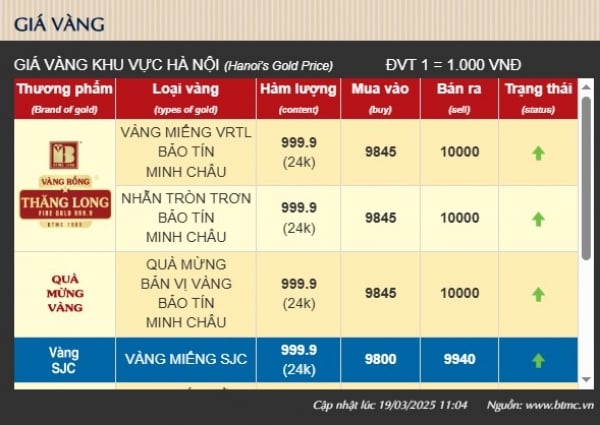

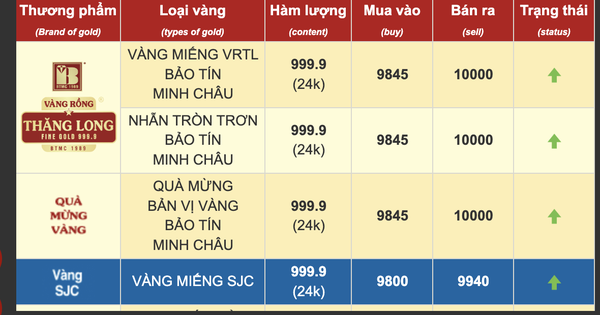

Domestic gold price in Hanoi market, Saigon Jewelry Company listed at 66.4 - 67.12 million VND/tael (buy - sell)

|

| Gold price today July 24, 2023: Gold price 'stuck' at an important level, hard to find traction, waiting for the Fed to decide on a direction. (Source: Kitco) |

Summary of SJC gold prices at major domestic trading brands at the closing time of last weekend (July 23):

Saigon Jewelry Company listed the price of SJC gold at 66.4 - 67.1 million VND/tael.

Doji Group currently lists the price of SJC gold at: 66.5 - 67.2 million VND/tael.

PNJ system listed at: 66.45 - 67.1 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 66.52 - 67.12 million VND/tael; Rong Thang Long gold brand is traded at 56.21 - 57.06 million VND/tael; jewelry gold price is traded at 55.55 - 56.75 million VND/tael.

Converted according to the USD price at Vietcombank on July 15, 1 USD = 23,810 VND, the world gold price is equivalent to 56.09 million VND/tael, 11.11 million VND/tael lower than the selling price of SJC gold.

Gold struggles to find traction

The latest Kitco News weekly gold survey shows that retail investors expect the precious metal to return to the impressive $2,000 an ounce mark, even as the Fed is almost certain to raise interest rates by 25 basis points next week. Meanwhile, market analysts, while optimistic, are also more cautious.

Sean Lusk, co-director of commercial hedging at Walsh Trading, said he remains bullish on gold because the Fed cannot control inflationary pressures, as supply issues will dominate the commodity market.

“Gold prices could fall $50 next week if the Fed maintains its hawkish stance after the rate hike,” he said.

According to Mr. James Stanley, market strategist at StoneX, precious metal prices will increase this week, before the Fed meeting.

The expert affirmed: "The consumer price index (CPI) has been adjusted well, but core inflation is still quite high. Therefore, I think that gold prices are likely to reverse around mid-week after the Fed's interest rate decision."

This week, 19 Wall Street analysts participated in Kitco’s gold survey. Eight analysts, or 42 percent, said gold would rise. Eight analysts, or 42 percent, said the precious metal would trade sideways, and three analysts, or 16 percent, predicted gold would fall.

Meanwhile, 369 votes were cast in Main Street’s online poll, with 221 respondents, or 60 percent, expecting gold to rise this week. Another 95, or 26 percent, said the precious metal would fall, and 53, or 14 percent, were neutral.

The Fed’s monetary policy meeting (July 25-26) will be the most prominent event influencing the gold market. Some analysts believe that the bank’s interest rate hike and hawkish tone will support the USD and put pressure on gold.

“The strength of the US dollar last week has made it difficult for gold to find any traction. In addition, the upcoming Fed meeting is almost certain to announce a 0.25% interest rate hike,” said Gary Wagner, founder of TheGoldForecast.com.

While the yellow metal faces some fundamental risks next week, some analysts remain optimistic as the commodity has managed to hold key technical support above $1,950 an ounce.

The precious metal could gain upside momentum as prices hold above $1,964.4 an ounce, said Michael Moor, creator of Moor Analytics.

Source

![[Photo] Prime Minister receives a number of businesses investing in Ba Ria-Vung Tau province](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/8e3ffa0322b24c07950a173380f0d1ba)

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

![[Photo] President Luong Cuong receives Ambassador of the Dominican Republic Jaime Francisco Rodriguez](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/12c7d14ff988439eaa905c56303b4683)

Comment (0)