Investment Comments

Stock Tien Phong (TPS): Muong is still in a medium-term uptrend, investors can take advantage of this break to look for profit opportunities in the market.

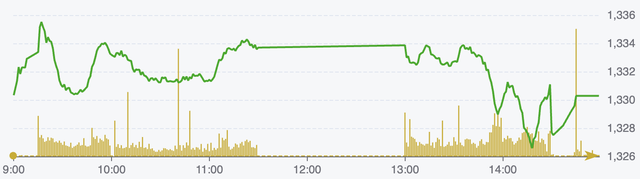

In case the market continues to increase in the next session, the index may head towards 1,340 points, the short-term support of VN-index is around 1,312 (+/-) points.

- VN-Index performance on March 10 (Source: FireAnt).

Asean Securities (Aseansc): The domestic stock market will continue its medium-term growth momentum in the coming time. However, the market has experienced a long period of growth without any significant adjustments, investors need to maintain a stable mentality in the face of fluctuations on the long-term growth path along with the country's "Dragon Decade".

Investors can consider continuing to disburse more strongly with large stocks with positive fundamentals and business prospects, always having cash ready to establish a solid position when necessary.

VPBank Securities (VPBankS): After a strong explosive session, the market has temporarily reduced its growth momentum and may encounter resistance at the 1,350 point area.

Therefore, investors should prepare for the scenario that the index may return to test the recent support zone at 1,315 - 1,320 points in the near future to create a more solid upward foundation.

Investment Recommendations

- MSN (Masan Group Corporation): Pending sale.

MSN announced its Q4/2024 results with net revenue reaching VND 22,702 billion (up 9% year-on-year) and profit after tax (after minority shareholders) reaching VND 691 billion (4 times higher than the same period).

Accumulated for the whole year of 2024, MSN's net revenue reached VND 83,178 billion (up 9% over the same period) and profit after tax (after minority shareholders) reached VND 1,999 billion (up 377% over the same period).

MSN's strong recovery in 2024 will mainly come from the growth of its retail consumer goods business and the successful transfer of HCStarck.

TCBS assesses MSN's business prospects in 2025 as positive thanks to the following key drivers: MCH continues its strategy of premiumizing its product lines and expanding its market share in international markets; WinCommerce plans to open 700-1,000 new stores and focus on improving efficiency at the point of sale; MSN focuses on reducing financial leverage to reduce debt pressure.

In addition, on March 3, 2025, Masan Consumer (a subsidiary of MSN) announced its plan to cancel trading on the UPCoM exchange and list on the HoSE exchange.

- SSI (SSI Securities Corporation): Pending sale.

In 2024, the Company recorded revenue of VND 8,529 billion (up 19% over the same period) and profit after tax of VND 2,835 billion (up 23.6%).

TCBS assesses that the prospects of the securities industry in general and the company in particular will grow positively thanks to: Low interest rate environment to promote economic growth; Expectations of upgrading the market to welcome new capital flows.

Accordingly, the two key business segments, proprietary trading (mostly fixed income products) and margin lending, will benefit.

TCBS recommends that investors should continue to hold SSI shares.

- GEX (Gelex Group Corporation): Waiting for sale.

The company has just announced its 2025 business plan with expected revenue of VND37,662 billion (up 11.5% year-on-year) and pre-tax profit of VND3,041 billion (down 15% year-on-year).

This is the company's record revenue ever. However, the planned profit has decreased because this year there is no longer any extraordinary income from divesting subsidiaries like in 2024.

In addition, the company plans to pay a 5% cash dividend and a 5% stock dividend.

TCBS assesses the growth potential in the company's core business segments such as construction materials, electrical equipment, and industrial parks as positive as the real estate market is showing signs of warming up and FDI capital flows are shifting to Vietnam. Investors should continue to hold this stock.

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

Comment (0)