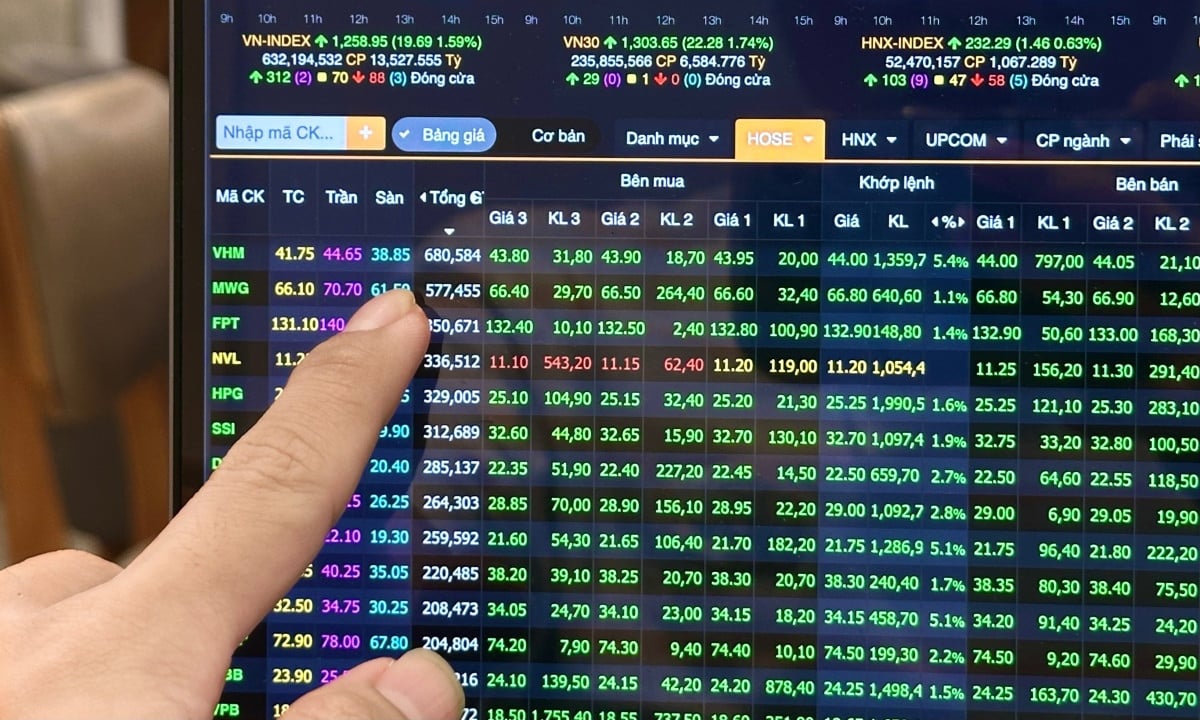

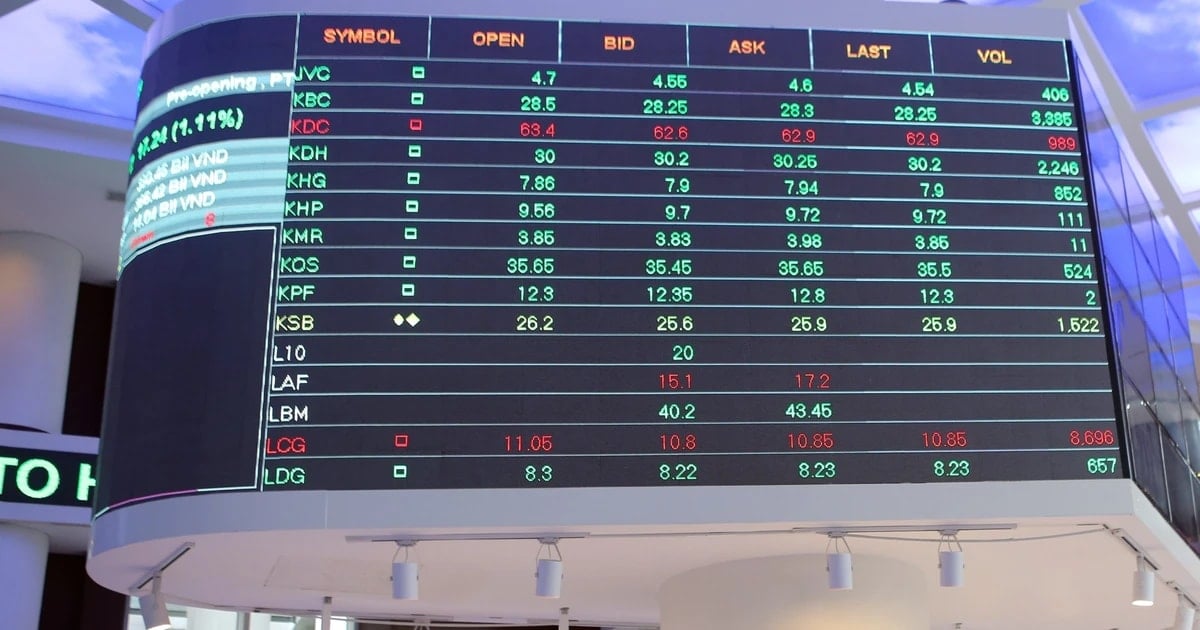

The HoSE index hovered around the reference price all morning with an amplitude of less than 5 points. Most of the trading time, the chart was green but the market was quiet. Liquidity at the end of the morning only reached nearly 3,900 billion VND. No stocks or industry groups led the market, investors only participated at a tentative and cautious level.

In the afternoon, VN-Index started to accelerate as more trading orders were poured into the system. The dominant demand helped the index regain the important psychological mark of 1,250 points at around 14:20. More active buying orders appeared, the market continued to accumulate in the ATC session.

At the end of the session, VN-Index closed at nearly 1,259 points, up nearly 19.7 points compared to yesterday. This is the strongest accumulation level since the session on August 16, bringing stocks back close to the price range at the beginning of last week.

The number of stocks increasing in price was overwhelming compared to the decrease, reaching 312 stocks and 88 stocks respectively. The most positive contributors were VHM, VCB, BID, TCB, VIC. The three groups of stocks leading the cash flow were also the sectors that contributed the most points to the general index, including real estate, securities and banking.

Today's real estate market is mostly green. The most prominent are VHM and PDR, which increased by 5.4% and 5.1%, respectively. In addition, many codes with good liquidity such as DIG, DXG, VRE, HDG, VIC, VCG... also accumulated about 2-4%.

Among the most cash-flow-attracting stocks in the real estate industry, NVL had mixed performance. This stock performed negatively in the second half of the morning, at times 4.9% lower than the reference price. However, in the afternoon, the return of demand supported the market price of NVL and closed the session at the reference price of VND11,200.

The above developments occurred after the Ho Chi Minh City Stock Exchange (HoSE) decided to put NVL shares on the warning list. The reason was that this company was 15 days late in publishing its audited semi-annual financial report compared to the prescribed deadline. Last week, HoSE also put this stock on the list of stocks that are not eligible for margin trading.

Novaland said that in the first 6 months of the year, the company implemented many plans and programs at the same time, such as restarting projects, completing and handing over products, and handing over certificates to residents. Therefore, transactions and the number of documents between the parent company and its subsidiaries increased, slowing down the process of completing financial reports. Novaland said it is working hard with the auditor to soon announce the information.

In the securities and banking group, all codes with liquidity of hundreds of billions increased in price. The most prominent were HCM, VCI, FTS, MBB, VPB, TCB...

Liquidity improved in the afternoon but the total only increased slightly compared to yesterday, reaching over 13,500 billion VND. The positive point is that foreign investors increased their net buying value, recording about 525 billion VND, with the focus on VHM and FPT.

TH (according to VnExpress)Source: https://baohaiduong.vn/chung-khoan-tang-manh-nhat-mot-thang-393331.html

Comment (0)