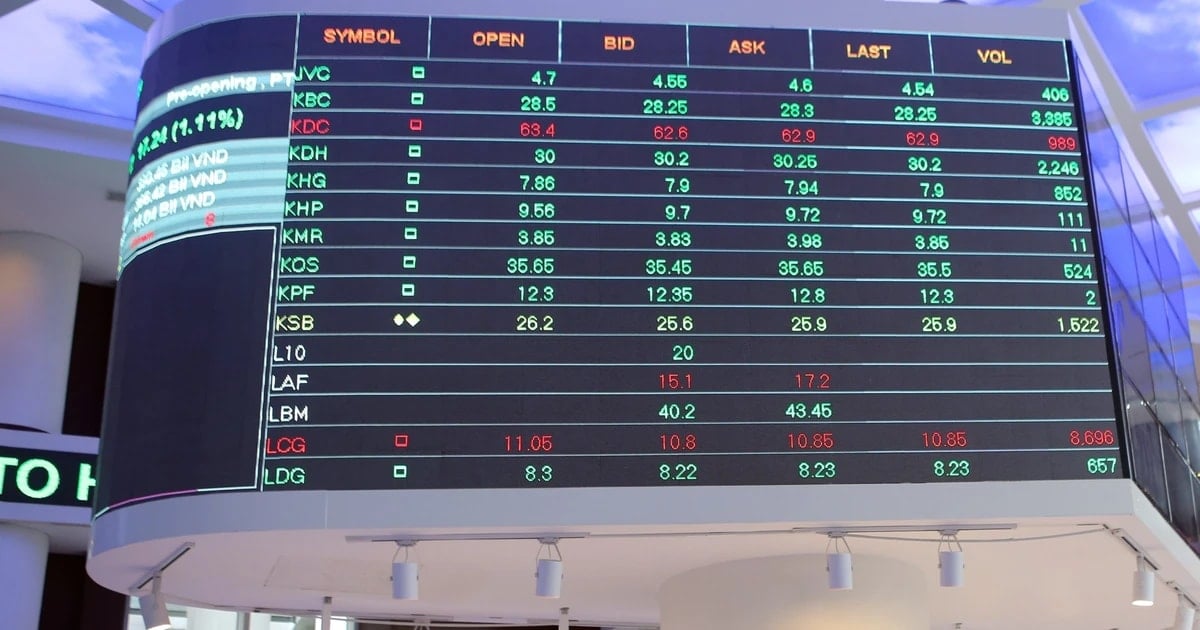

After the first few minutes of ATO moving sideways, the HoSE representative index was dyed red all day. In the first half of the morning, liquidity remained low like the previous session, preventing stocks from falling too far. After 11 o'clock, selling pressure increased, pushing the index closer to the 1,260 point mark.

Sell orders were pushed up continuously in the afternoon, making it difficult for the index to improve. After the ATC session, the VN-Index fell below 1,255 points, down more than 15 points compared to the previous session. This was the strongest correction of the market in the past 5 months.

On the HoSE floor, 353 stocks decreased, 5 times more than the 69 stocks that increased in price. Of which, the insurance, securities, retail and industrial groups had the strongest industry index declines.

However, due to their high proportion in market capitalization, banking stocks are the group with the largest presence in the top group that has the most negative impact on the VN-Index. In which, TCB leads, followed by CTG, VPB, MBB, ACB, LPB and HDB.

The market was also greatly affected by the VN30 basket when 24 stocks fell, causing the representative index to fall nearly 23 points, the strongest since the beginning of August. Red also spread to the Hanoi market and UPCoM.

During the session when VN-Index fell sharply, liquidity increased by nearly 3,000 billion to about 13,750 billion VND. However, this is still not a high number, equal to the average level of the past several months.

Foreign investors also stepped up the selling trend for the third consecutive session. Today, foreign investors net sold 734 billion VND, 7.6 times higher than the previous session. FPT continued to be the center of attention, along with CTG.

Mr. Pham Hoang An - Head of Analysis Department of Thanh Cong Securities (TCSC), said: "The market today decreased sharply, focusing on large stocks. The main reason may come from the fact that foreign funds had pulled down NAV (net asset value) at the end of last year and the market is now returning points."

Considering the current macro context, the continuously increasing exchange rate forces the State Bank to sell USD to stabilize. The estimated sales volume in December is nearly 3 billion USD. Selling foreign currency will narrow the money supply and the interest rate environment is at risk of increasing in the future. According to experts, the macro context is not good but the market at the end of 2024 will still increase strongly, especially in bank codes that funds hold a lot (CTG, STB...).

By 2025, the momentum to maintain performance will no longer be there, causing the buying momentum to slow down, combined with the fact that the DXY dollar strength index has just risen to the 109 zone, increasing the risk of the exchange rate continuing to rise in the future. This causes institutional investors to reduce their proportion, evidenced by the strong return of foreign investors to net selling in the last 3 sessions.

TH (according to VnExpress)Source: https://baohaiduong.vn/chung-khoan-giam-manh-nhat-5-thang-402168.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)