Many benefits in the PPP++ model of transport infrastructure investment of Deo Ca Group

On March 1, in Ho Chi Minh City, Deo Ca Group organized the Conference "Potential and opportunities for investing in transport infrastructure under the PPP++ model" to identify and discuss the potential and opportunities of transport investors through this model.

|

| Mr. Ho Minh Hoang - Chairman of the Board of Directors of Deo Ca Group Conference "Potential and opportunities for investment in transport infrastructure under the PPP++ model". |

According to the road network planning for the 2021-2030 period, the Government has set a target of having 5,000 km of expressways. This is a key task, with the drastic participation of the entire political system, many specific mechanisms have been issued, creating the most favorable conditions for project implementation.

Potential for investment in transport infrastructure

A representative of Deo Ca Group said that in order to encourage the participation of the private sector, the state budget supports PPP projects as seed capital, enterprises are given priority to invest, exploit services related to the project and borrow long-term credit capital with preferential interest rates. In addition, public investment projects can be concessioned for exploitation, localities study and implement mechanisms to collect revenue from exploiting land funds where the project passes through to invest effectively, increasing the value of the project.

In addition to roads, the Government is also paying attention to railway development. Decision 1769/QD-TTg sets a target of investing in 9 railway lines with a length of 2,362km by 2030. Land funds for railways are planned appropriately for urban and functional area development (TOD model) to create investment resources. Socialization of railway business and transportation services is promoted to attract economic sectors to participate in investment.

The Government's determination to complete 5,000km of highways by 2030 and the movements of implementing high-speed railways are huge job opportunities opening up for businesses developing transport infrastructure.

Commenting on the plan to realize the Government's goals of building transport infrastructure, Mr. Ho Nghia Dung - former Minister of Transport said that investing in transport infrastructure requires a huge amount of capital, no matter how strong the state is, it cannot "take" all of it through public investment. Therefore, the state has called on the private sector to participate in investment through the PPP method to develop public infrastructure and public services to serve the people.

“However, no matter how strong the private sector is, it cannot “single-handedly” cooperate with the state to build projects, but will play the role of “leader” to gather and call on other investors to participate in investment. The PPP++ model is a creation of Deo Ca to create strong enough resources to jointly implement public services. The “leader” unit must have sufficient financial and human capacity, brand name and especially management capacity to be able to attract other investors. Deo Ca is a unit that converges all the factors to gather and lead other investors to successfully implement projects,” said Mr. Ho Nghia Dung.

|

| Comparison of traditional PPP model and PPP++ model of Deo Ca Group. |

What opportunities are there for investors?

In 2024, Deo Ca Group plans to invest in and build 300km of highways and belt roads with a total investment of more than VND 82,000 billion from typical projects such as Huu Nghi - Chi Lang, Tan Phu - Bao Loc, Ho Chi Minh City - Chon Thanh, Ring Road 4, Ho Chi Minh City - Trung Luong - My Thuan (phase 2) expressways...

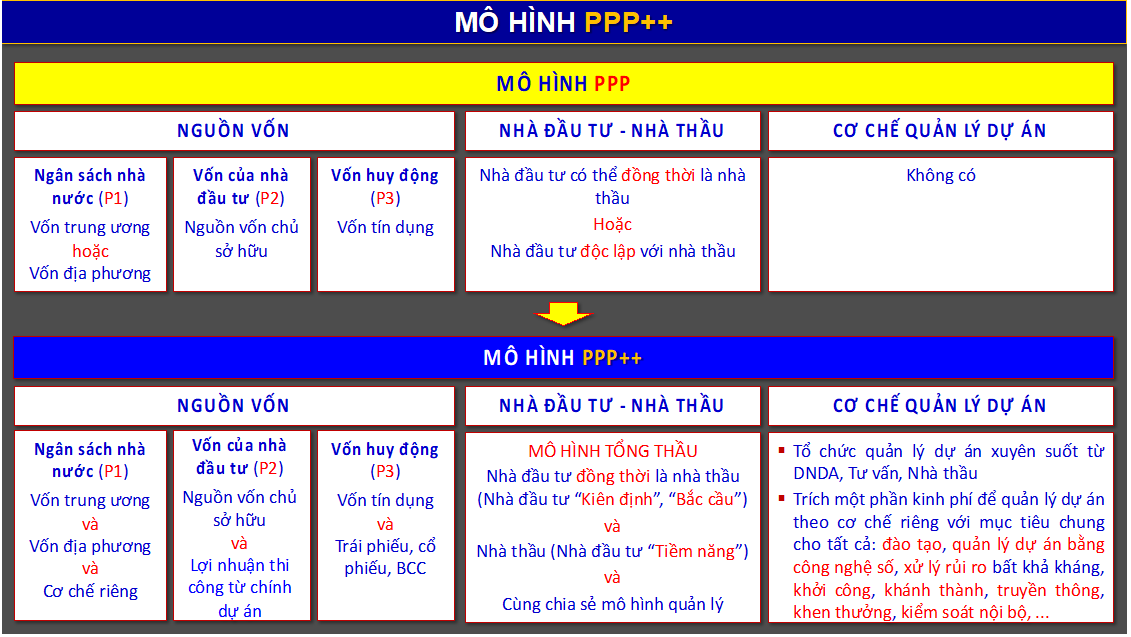

The PPP++ model is the solution that Deo Ca offers to mobilize capital for the project through diversifying mobilized capital sources to increase mobilization efficiency and minimize risks throughout the project implementation process.

The capital structure of projects implemented under the PPP++ method is more diversified than the basic PPP model. In addition to state budget capital, equity capital and credit capital, the capital structure under the PPP++ model includes construction profits from the project itself, bonds, stocks, BCC contracts, etc.

Competent and experienced contractors participate simultaneously as secondary investors, jointly implementing the project according to the general design-build (EC) or design-engineering-construction (EPC) model. This method will contribute to optimizing investment efficiency because the profits from the construction contractor are contributed back to the project investment capital. The benefits and responsibilities of the contractor are linked to the benefits and responsibilities of the investor, linked to the effectiveness of project implementation and operation.

As the leading investor, Deo Ca is responsible for organizing project preparation, bidding for project implementation, organizing project management as an investor, and working directly with State agencies (National Assembly, Government, ministries...).

“We not only solve immediate tasks to create products and create real values for society, but also participate in building policy institutions, fighting against shortcomings to improve, and making common laws for the whole society,” affirmed Mr. Ho Minh Hoang - Chairman of the Board of Directors of Deo Ca Group.

To mobilize other enterprises to participate in the project investment, Deo Ca has classified investors with different rights and obligations. Investors who "firmly" participate right from the project investment preparation stage, are directly involved in the project investment and enjoy the rights of investors according to regulations, have priority in choosing the scope of construction, and register the construction volume in accordance with the scope of participation and capacity.

The “bridge” investor participates from the project bidding stage, contributes capital through the leading investor, is entrusted with investment through a BCC contract with Deo Ca Group, enjoys benefits according to the agreement, and receives a volume corresponding to the investment participation rate in the project but with limits.

At the conference, Mr. Hoang Quang Trung - Chairman of the Board of Directors of Trung Thanh Investment and Construction Joint Stock Company said that Trung Thanh is currently one of the investors building a bridge for Deo Ca. Through the cooperation period, the company has seen that Deo Ca has developed rapidly, firmly, sustainably, and has distinct bright spots. To become "steadfast", "bridge" or "potential" investors, investors like us must also affirm our own capacity.

“We determined that to become a steadfast investor in the PPP++ model, we must steadfastly accompany to overcome difficulties, risks, and challenges, and at the same time meet the capacity in finance, management, human resources and professionalism. Currently, we are a bridge investor and will continue to demonstrate our capacity to become a steadfast investor in the future,” Mr. Trung shared.

“Potential” investors participate from the project implementation stage, contribute funds according to the project management mechanism as contractors, are considered to invest in future projects, are assigned construction volume appropriate to their capacity but have a smaller investment limit than the “bridge” investor group.

For partners, when accompanying Deo Ca Group to implement projects under the PPP++ model, investors and contractors are assigned the responsibilities and benefits of both roles.

Source

Comment (0)