(NLDO) – The psychological threshold of 1,300 points of VN-Index this time is not a worrying barrier, the market decline is an opportunity for investors to increase the proportion of stocks.

During the trading session on March 4, stock investors breathed a sigh of relief when the VN-Index continued to maintain the 1,300-point mark, despite strong fluctuations during the session. At one point, the VN-Index dropped sharply to 1,298 points, before cash flow entered the market, pulling the index back and closing at the session's highest level, reaching 1,311.91 points, up 2.54 points compared to the previous session.

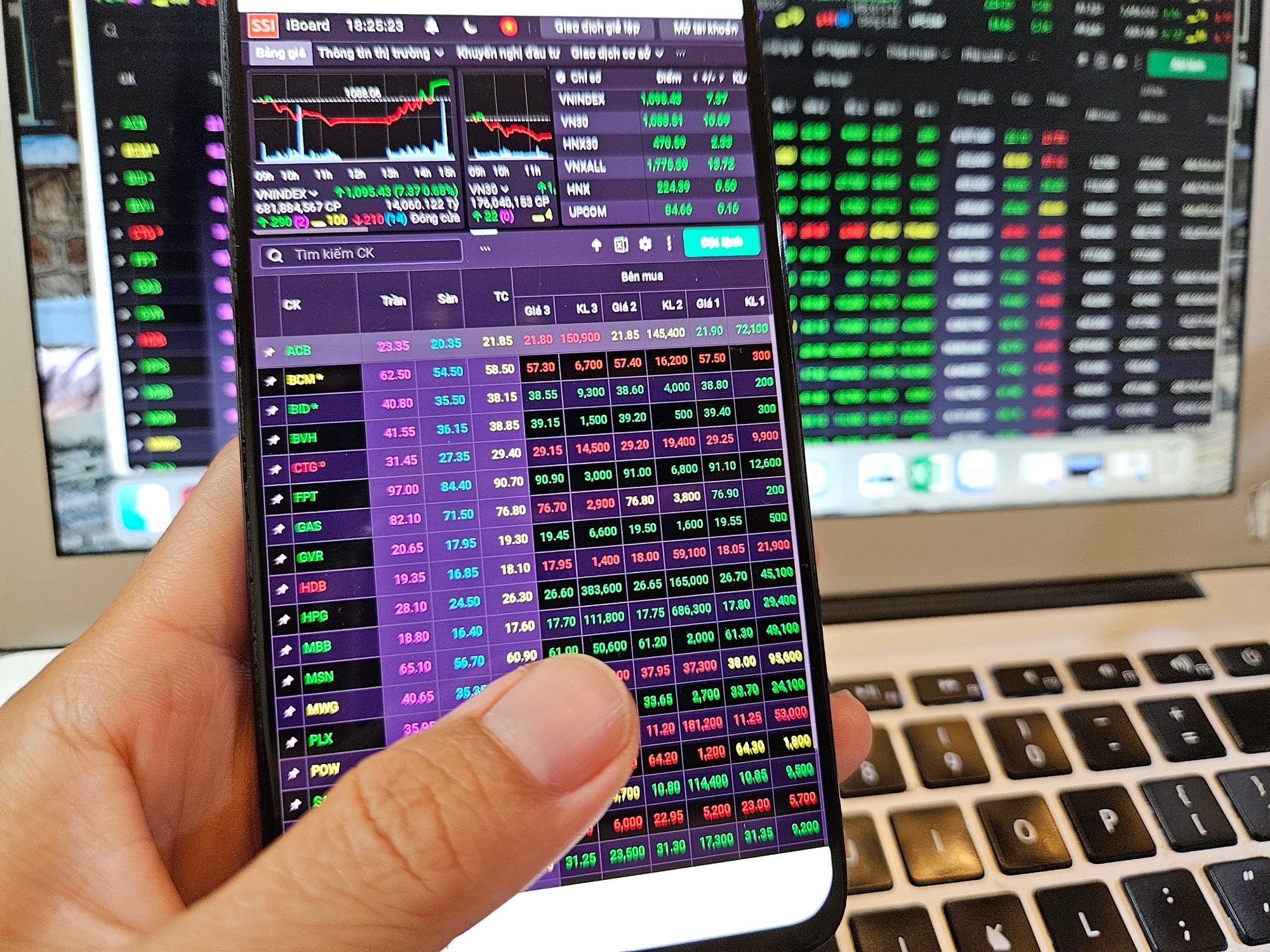

Market liquidity exploded when the trading value on the HOSE alone exceeded VND23,100 billion, significantly higher than the previous session. Stock groups that had a positive impact on the market included TCB, CTG, MBB, MSN, GVR, HVN...

Despite foreign investors net selling for 9 consecutive sessions, VN-Index still remained above the 1,300 point mark thanks to strong cash flow from individual investors and the self-trading sector of securities companies.

In its latest report, Dragon Capital said that the 1,300-point mark of the Vietnamese stock market this time has some differences, as it has maintained this mark for about a week. This is the third time the market has returned to this mark after important milestones in June 2022 and 2024.

"This reflects the excitement of investors, but also raises questions about the sustainability of the upward trend in the current context. Compared to previous times, the current Vietnamese economic context has many positive supporting factors," said the Dragon Capital expert.

According to this investment fund, the Government is pushing to reduce interest rates to stimulate growth. Currently, many banks have adjusted their deposit interest rates for all terms after the Prime Minister's telegram showed a loose monetary policy.

Stock market continues to thrive with soaring liquidity

Public investment – one of the main growth drivers – has been strongly implemented by the Government in key projects since the beginning of the year. 2025 is not only the completion date of key national infrastructure projects for the 2021-2025 period, but also plays a pivotal role for strategic projects for the 2026-2030 period, contributing to changing the country's economic position.

In addition, the KRX trading system is expected to be deployed in the second quarter of 2025, paving the way for the possibility of market upgrade in September of the same year. This could create momentum to attract foreign capital to return.

The VN-Index has remained above the 1,300-point mark for more than 5 days, with an average trading value on the HoSE reaching over VND18,000 billion per session. This is a positive signal, showing that cash flow is gradually returning to the market.

Dragon Capital experts commented: "With these factors, the psychological threshold of 1,300 points is not a worrying barrier. The policy foundation is being vigorously promoted, along with a strong commitment from the Government, helping business confidence recover significantly. This will be a favorable premise for the market's breakthrough in 2025 and the coming years."

Foreign investors net sold for the 9th consecutive session but VN-Index still held firm above the 1,300 point mark

Although global trade policies may cause short-term fluctuations, with a strong domestic economy, external factors are only temporary and do not change the market growth trend. Therefore, according to Dragon Capital, instead of being too cautious, investors should take advantage of these opportunities to increase their investment proportion appropriately.

Source: https://nld.com.vn/1300-diem-cua-vn-index-hien-nay-khac-truoc-nhu-the-nao-196250304152355129.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

Comment (0)