Nam Long (NLG) Shareholders' Meeting: Possibility of selling project capital, revenue in the first quarter of 2024 is 1,160 billion VND

Transferring capital components in projects is an annual activity of NLG to invite partners and have faster cash flow. Currently implemented projects are all owned by NLG with over 65%, so the possibility of selling capital is there.

This is the sharing of the Board of Directors of Nam Long Investment Corporation (stock code NLG) at the 2024 Shareholders' Meeting held today (April 20).

Nam Long plans to achieve sales of VND9,554 billion, net revenue of VND6,657 billion, double that of 2023, after-tax profit of VND821 billion, after-tax profit of parent company shareholders of VND506 billion, a slight increase of 5% compared to last year. Expected dividend is 5% / par value.

In case net profit is 30% higher than planned, this ratio will gradually increase and reach a maximum of 10% of par value. Depending on the business situation, the 2024 dividend can be advanced 50% in December 2024 and the remainder in 2025. The specific ratio will be decided at the 2025 Annual General Meeting of Shareholders.

|

In 2024, Nam Long continues to orient its development towards an integrated Real Estate Group model with core tasks in 3 main business segments, including:

Land development, housing projects and urban areas : the company continues to focus on implementing projects and component projects of integrated urban areas including Mizuki Park 26 hectares (Binh Chanh), Waterpoint phase 1 165 hectares (Ben Luc, Long An), Akari City 8.5 hectares (Binh Tan), EHome Southgate, Izumi City 170 hectares (Dong Nai), Nam Long Central Lake 43 hectares (Can Tho). At the same time, the Group also allocates a budget to continue creating clean land funds and developing new urban land funds in the long term.

Commercial Real Estate Development : Nam Long is promoting plans to develop city facilities in integrated urban areas. This year, some facilities in the integrated urban area Waterpoint will be deployed and put into operation such as EMASI Plus international bilingual school, San Ha convenience store (SanHa Food), Saigon-Waterpoint polyclinic, Wisdomland kindergarten, etc.

Investment and capital mobilization : the company focuses on improving capital mobilization capabilities and optimizing capital sources, maintaining a solid financial foundation. Maintaining long-term cooperation with long-term partners, expanding investment attraction opportunities from third parties in line with the Group's strategic goals.

|

Mr. Nguyen Xuan Quang, Chairman of Nam Long Board of Directors, shared at the congress that the company determined to only sell and focus on what the market needs, avoiding investing a lot of money but not being able to sell products, leading to high inventory.

"The challenge this year is dealing with inventory, overdue debt and customers liquidating contracts. All real estate companies, to varying degrees, face all these difficulties. When the market loses confidence, we must have confidence," said Mr. Quang.

Mr. Quang also said that the current low lending interest rate is an opportunity. Currently, the interest rate is lower than the pre-Covid-19 period, and can compete with other countries. For example, in developed countries such as Australia, the US, etc., real estate lending interest rates are at 7-8%.

According to the roadmap to 2030, Nam Long must complete 14 strategies. This year, the company focuses on 3 important strategies: Investment and investment management, overall finance (including capital mobilization), M&A and growth, according to Mr. Quang.

Nam Long's Board of Directors also submitted a proposal to issue 446,276 shares under the long-term incentive policy for senior leaders and managers (ESG program). The shares will be restricted from transfer for 1 year after issuance.

In addition, the Company also plans to purchase liability insurance for members of the Board of Directors in 2024 with a premium of USD 20,900, insurance limit of USD 10 million, term from July 31, 2024 - July 30, 2025.

On April 1, Nam Long had a new General Director, Mr. Lucas Ignatius Loh Jen Yuh.

It is known that the new General Director has strengths in strategic thinking and experience in the fields of investment and M&A, with more than 20 years of international management experience in the positions of Chairman, CEO, Investment Director and Investment Manager at large corporations such as Capitaland, Hopson, Temasek Holding... in the Singapore and Chinese markets.

In 2023, Nam Long delivered exactly 1,609 products, recording a record high delivery revenue of VND 7,033 billion. Profit after tax was VND 484 billion, reaching 82% of the yearly plan. During the year, the company also successfully issued VND 500 billion in bonds to OCB.

Discussion at the Congress

What is the unrecorded backlog value by the end of 2023? What is the value in 2024-2025?

Backlog at NLG is understood as pre-sales revenue, about 8,000 billion VND from 2023. Of which 6,000 billion VND can be recorded as revenue for handover this year, the rest will be recorded scatteredly in 2025-2026.

However, the actual handover progress depends on the efforts of both parties, the buyer and the seller. This year, the market is difficult, so accompanying customers is important. In some cases, NLG cannot force customers to receive handover on schedule, but the policy is to accompany customers by supporting negotiations with banks to extend payment schedules.

Business results Q1/2024?

The first quarter of this year saw a delay in handover related to the Can Tho project due to waiting for land valuation to be recorded. Currently, the handover has been completed and is awaiting recording.

Estimated first quarter revenue reached 1,160 billion VND, higher than the same period last year. This is a good sign this year.

Legal updates on projects up to now? When was the Paragon and Izumi projects recorded?

The Izumi project is located in Long Hung Urban Area, Dong Nai - this is a component project with 4 other investors. The Government has established a steering committee to remove difficulties for the overall project. The Government, the Ministry of Construction and the People's Committee of Dong Nai province are adjusting the planning, it is expected that from December 2024 to the first quarter of 2025, NLG's project will be approved for 1/500 planning.

The Paragon project is part of the Dai Phuoc project of investor DIC Corp (stock code DIG), which has been extended until 2027. NLG will soon submit a new plan for the Paragon project.

In the period 2024 - 2026, NLG can bring 15,000 products to the market.

What projects does the 2024 business plan come from?

NLG's 2024 revenue plan will come from Akari phase 2, Southgate (over 2,000 billion VND).

NLG's current land fund of 681 hectares is enough for development until 2030.

When will Can Tho project complete its financial obligations?

For the Can Tho project, by the end of 2023, more than 300 billion VND had been paid for land use, and towers 1 and 2 had started construction. In the near future, the Company will complete the remaining part after deducting compensation to be able to record revenue this year.

How does the company solve infrastructure problems at the Mizuki project?

The total area of the Mizuki project is 28 hectares, divided into two development phases. This project is located in a rather weak area of District 7 and phase 1 was developed from 2018 - 2019, so the handling of the foundation connection and the infrastructure structure is not synchronous, leading to a deviation.

Since 2023, we have been working on solutions to each problem. We have thoroughly dealt with it and learned from it, and the incident of phase 1 will not be repeated.

Why is the revenue plan increased by 111%, but profit only increased by 5%?

Normally, profits come from three sources: consolidated handover revenue, handover revenue from non-consolidated projects (Mizuki), and capital sales. In 2023, profits will mainly come from handover revenue from non-consolidated projects (Mizuki).

This year, the planned profit comes from consolidated delivery revenue. The planned revenue increased dramatically, but if compared to the delivery revenue, it is the same as last year.

What are the company's plans to divest capital this year?

Transferring capital components in projects is an annual activity of NLG to invite partners and have faster cash flow. Currently implemented projects are all owned by NLG with over 65%, so the possibility of selling capital is there. In the next 3 years, the Company can mobilize capital from selling capital plus selling non-core assets of about 6,000 billion VND. The sale depends on market conditions and negotiations.

Does NLG have plans to IPO its subsidiaries?

Whether or not to list is relatively open, depending on the market and the development of the two subsidiaries. We established Nam Long Land to focus on developing urban projects, while Nam Long Commercial provides asset management services and commercial real estate. Specifically, the IPO plan and where the value lies depends on the market reaction and the development steps of these two units.

Criteria for expanding NLG's land fund?

NLG's land fund expansion is carried out in stages, such as this year focusing on the affordable segment and moving towards developing integrated urban areas with minimal internal facilities.

Source

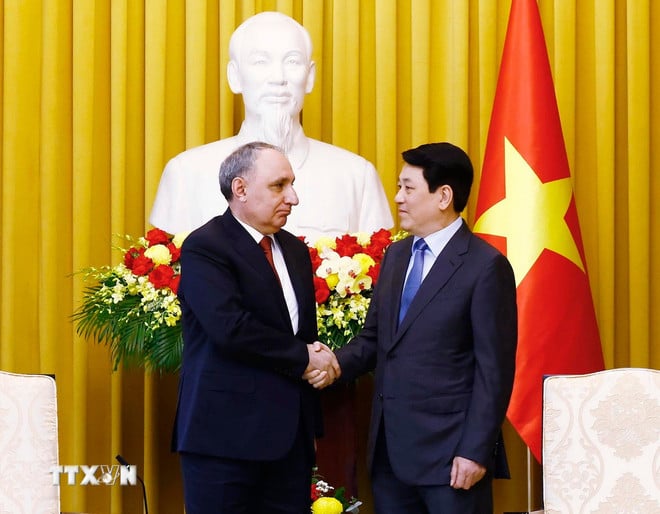

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/a9ac668e1a3744bca692bde02494f808)

![[Photo] Overcoming the sun to remove temporary and dilapidated houses for poor households](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/824ba71165cc4f8fb6a3903ca0323e5d)

![[Photo] Prime Minister Pham Minh Chinh attends conference on ensuring security and order in the Northwest and surrounding areas](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/933ce5c8b72e4663bd6c6cd8be908f23)

![[Photo] Prime Minister Pham Minh Chinh dialogues with Vietnamese youth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/7fd8b4735134417cbaf5be67ee9f88b1)

![[Photo] The flavors of Southern Vietnamese traditional cakes](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/b220c9f405b945d798738ea0a94b29b8)

![[Photo] Vietnam team's strength guaranteed for match against Laos](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/1e739f7af040492a9ffcb09c35a0810b)

Comment (0)