Race to "welcome the storm"

ASML's sales to China have surged in the past two months as mainland semiconductor makers race to buy foundry equipment before the United States or the Netherlands impose new export restrictions.

The world's largest chip foundry equipment maker's latest quarterly results nearly doubled the previous quarter, with sales to China of $2.44 billion, accounting for 46% of total revenue for the same period.

In the April-June quarter, the mainland accounted for 24% of ASML's total revenue, behind Taiwan and South Korea.

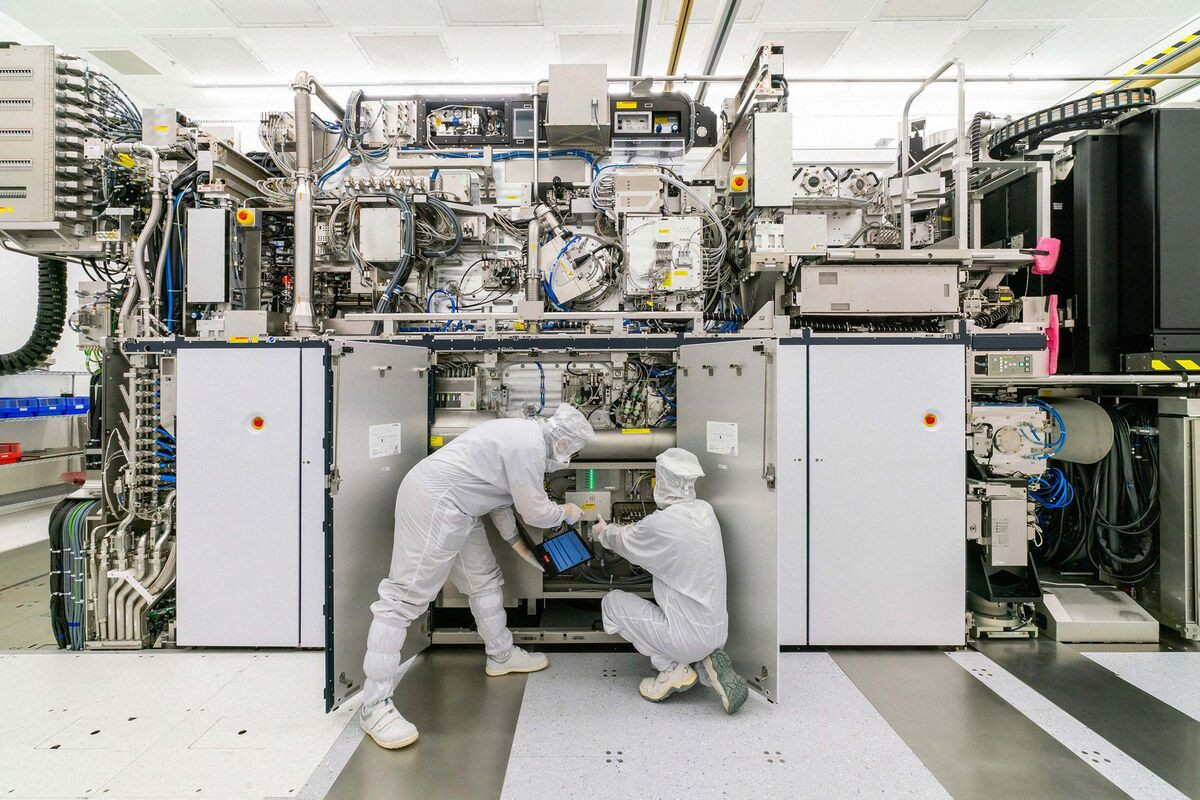

Photo: Nikkei Asia

“The shipments this quarter are based on orders from 2022 and even the year before,” ASML Chief Financial Officer Roger Dassen said on October 18, noting that the shipments were fully compliant with current regulations.

ASML's advanced lithography machines are widely used by global chipmakers such as Intel, Samsung and TSMC, as well as SMIC and ChangXin Memory Technologies.

Earlier this week, the US Commerce Department began tightening export controls on semiconductors and artificial intelligence (AI) chips to curb China’s ambitions for semiconductor self-sufficiency. The updated rules are expected to have a negative impact on chipmakers such as Nvidia, ASML, and TSMC.

In June 2023, the Netherlands imposed restrictions on ASML exporting certain types of deep ultraviolet (DUV) lithography systems to China. Lithography is a key part of the chip manufacturing process, in which chip designs are printed onto semiconductor wafers.

DUV machines are not the company’s most advanced tools, but they can still help Beijing advance its semiconductor manufacturing technology. Most notably, SMIC has just helped Huawei restore some of its 5G mobile chip production capacity on a 7-nanometer process based on DUV lithography.

Uncertain future

The latest regulations could impact shipments of ASML’s 1980Di DUV lithography machines to China, industry analysts and executives say. These machines are widely used to produce 28-nanometer chips, suitable for a wide range of microcontrollers, image sensors, display drivers, and more. Other DUV lithography systems such as the 2000i and more advanced tools are already subject to the Netherlands’ own export controls to China, which came into effect in September.

“This will definitely impact China’s mature 28nm chip expansion plan and create more uncertainties ahead for the country’s semiconductor industry,” said Donnie Teng, an analyst at Nomura Securities.

Dylan Patel, chief analyst at semiconductor research firm Semianalysis, said the US is imposing a “de minimis rule” that states that tools with US content and certain capabilities cannot be shipped to China without a license. Patel said this means the regulations could go beyond the Dutch, given that 1980Di contains US technology.

“The restrictions around 1980Di will be a major issue for the Chinese semiconductor industry as it is mandatory for all 28nm nodes,” Patel said.

In response, ASML said it “needs to carefully assess any potential impacts” due to the breadth and complexity of the new regulations. However, the Dutch company does not expect the updated rules to have a significant impact on its financial outlook for 2023.

How the US patched the 'loophole' in its policy of embargoing Chinese semiconductors

Reuters quoted a US official as saying that the country will take necessary steps to prevent manufacturers from "circumventing the law" in exporting semiconductors to Beijing.

TSMC finds a way to stay out of the US-China semiconductor war

TSMC is applying for a permanent license to ship US chip equipment to its manufacturing facility in Nanjing, China.

New 'hot spot' on the US-China semiconductor technology front

A freely available semiconductor technology widely used in China is becoming the next 'flashpoint' in the battle between the world's two largest economies.

Source

Comment (0)