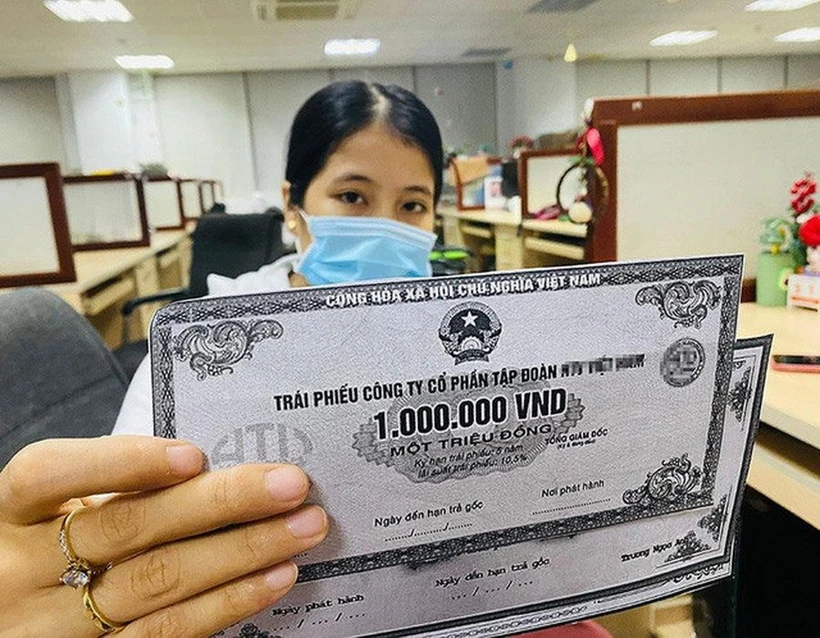

According to the Deputy Minister of Finance, the corporate bond market has stabilized, investor sentiment is more stable, and issuing businesses and investors have returned to the market.

To achieve the high growth target this year and the 2026-2030 period, unblocking the capital market is considered a particularly important solution to reduce the pressure on capital supply for the banking system. In particular, the corporate bond market, as a channel for supplying medium and long-term capital for the economy, is expected to recover strongly after the recent restructuring period.

Recovering from a slump

According to statistics from credit rating agency FiinRatings, in 2024, Vietnam's corporate bond market will have a strong recovery after the restructuring period in 2023, reaching a scale of VND 1.26 million billion, equivalent to 11.2% of the total domestic budget (GDP).

The total value of corporate bond issuance during the year reached VND443,700 billion, up 26.8% over the previous year. Issuance activities were most active in the third and fourth quarters of 2024, reflecting the increased capital needs of businesses in the context of economic recovery.

Notably, the problem bond ratio (including late payment and restructuring) decreased to 3.5%, significantly lower than the 15.3% level in 2023, showing that the financial capacity of issuers is gradually improving.

According to Deputy Minister of Finance Nguyen Duc Chi, the recent recovery of the corporate bond market is a positive signal for Vietnam's capital market. The market has adjusted and adapted better to meet new development requirements.

“Currently, the corporate bond market has stabilized, investor sentiment is more stable, and issuers and investors have returned to the market. This shows that new regulations have been more clearly defined, creating a premise for the corporate bond market in 2025 and the following years,” said Deputy Minister Nguyen Duc Chi.

In fact, the corporate bond market has recovered significantly after a series of corrective actions from the management agency. In particular, the private corporate bond trading system was put into operation at the Hanoi Stock Exchange (July 2023).

In addition, Decree 08/2023/ND-CP (amending, supplementing and suspending the implementation of a number of articles in the Decrees regulating the offering and trading of individual corporate bonds in the domestic market and the offering of corporate bonds to the international market) and the amended Securities Law (2024) effective from January 1, 2025 also continue to enhance transparency and efficiency as well as strengthen supervision and strict handling of violations in the bond market.

Sharing at the recent Vietnam Bond and Credit Forum, Mr. Nguyen Tu Anh, Director of the Center for Economic Information, Analysis and Forecast (Central Economic Committee), said that the Vietnamese corporate bond market has just gone through a period of great ups and downs and the positive point is that the legal framework for corporate bonds has been significantly improved.

Notably, the new Securities Law, which took effect from the beginning of 2025, has better fulfilled its role in protecting investors’ interests with higher requirements for information verification, credit rating, etc., thereby enhancing the reliability of corporate bonds and reducing risks for investors. This is an important foundation for the market to develop healthily and sustainably.

For individual issuers, the new regulations also require credit ratings, bank guarantees or collateral. These will help strengthen investors’ confidence in this market.

Even the real estate business sector, although the pressure on maturing bonds is still high, has also seen more positive developments.

According to Mr. Duong Duc Hieu, Director and Senior Analyst of Vietnam Investment Credit Rating Joint Stock Company (VIS Rating), the refinancing risk for real estate bonds tends to decrease, thanks to the fact that investors are gradually regaining access to new financial sources. This comes from two main sources: bank credit and new bond issuance activities in 2025. The recovery is mainly driven by changes in the legal framework and new regulations issued under the amended Securities Law.

Separation of investment activities of banks

Despite many positive developments, the Vietnamese bond market is still considered to have not developed to its full potential and position, nor has it been able to promote long-term capital channels for businesses. One of the biggest shortcomings of this market today is the imbalance in the issuance structure, when banks still dominate.

According to FiinRatings data, in 2024, the credit institution group will continue to maintain its leading role with a proportion of 69% of the total issuance value, a sharp increase compared to the rate of 56% in the previous year. This is followed by the real estate group with 19% and the manufacturing industry with only 3%.

In January 2025, data from the Vietnam Bond Market Association recorded 4 public issuances with a total value of VND5,554 billion. The entire issuance volume belonged to the banking and securities sectors; of which, securities accounted for only VND300 billion.

This shows a serious imbalance when the bond market, which is expected to ease the burden on the credit system, is actually a channel for banks to borrow and then lend to businesses. Meanwhile, manufacturing businesses with large capital needs are the group issuing the fewest bonds at present.

According to Associate Professor, Dr. Nguyen Huu Huan, a finance-banking expert, the cause of this situation comes from both businesses and other objective factors. Vietnamese businesses are mainly small and medium-sized enterprises, with weak management capacity, leading to very limited opportunities to access the capital market.

“When small and medium-sized enterprises have difficulty accessing the bond market, they have to borrow capital from banks at high interest rates. Instead of letting enterprises directly mobilize capital from investors, banks use the bond market to mobilize medium and long-term capital and then lend it to enterprises. This leads to the risk of creating a group monopoly and maintaining high interest rates in the financial market," Associate Professor, Dr. Nguyen Huu Huan said.

The “distortion” in the issuance structure still needs more time for the market to self-regulate and solutions from management agencies. However, increasing transparency in issuance and trading; at the same time, encouraging businesses to use bonds as a long-term capital mobilization channel will be an immediate solution to promote a healthier market development.

To ensure a more stable and healthy market development, Mr. Nguyen Tu Anh, Director of the Center for Economic Information, Analysis and Forecast, said that in the medium and long term, it is necessary to consider perfecting the legal system for investment banking activities. Separating investment banks and commercial banks is an important factor in limiting the risk of risks from the capital market spreading to the currency market. This is a necessary step to ensure the stability of the financial system, especially in the context of the economy moving towards a stronger development phase.

In particular, in the period 2025-2030, the trend of large public investments in key projects will create huge capital needs, requiring contractors to be able to mobilize significant financial resources. With the policy of encouraging domestic enterprises, regardless of whether they are state-owned or private, to participate in these projects, it will open up important opportunities to restore the corporate bond market.

“This is a great opportunity to restore the corporate bond market. I think it is necessary to consider building a policy to help businesses that win bids for projects to be able to mobilize capital right on the corporate bond market. This will both reduce pressure on the State budget and reduce the burden on the banking system when it has to provide medium and long-term capital for the economy; thereby promoting sustainable economic growth," Mr. Nguyen Tu Anh proposed.

In addition, to achieve the target of a market size of 20% of GDP by 2025 as set by the Government, the corporate bond market still has many bottlenecks to be resolved. In particular, perfecting the legal framework; information transparency; applying credit rating more widely; having a strategy to attract more institutional investors to participate... will be important issues to promote the sustainable development of this market in the coming time./.

Source

Comment (0)