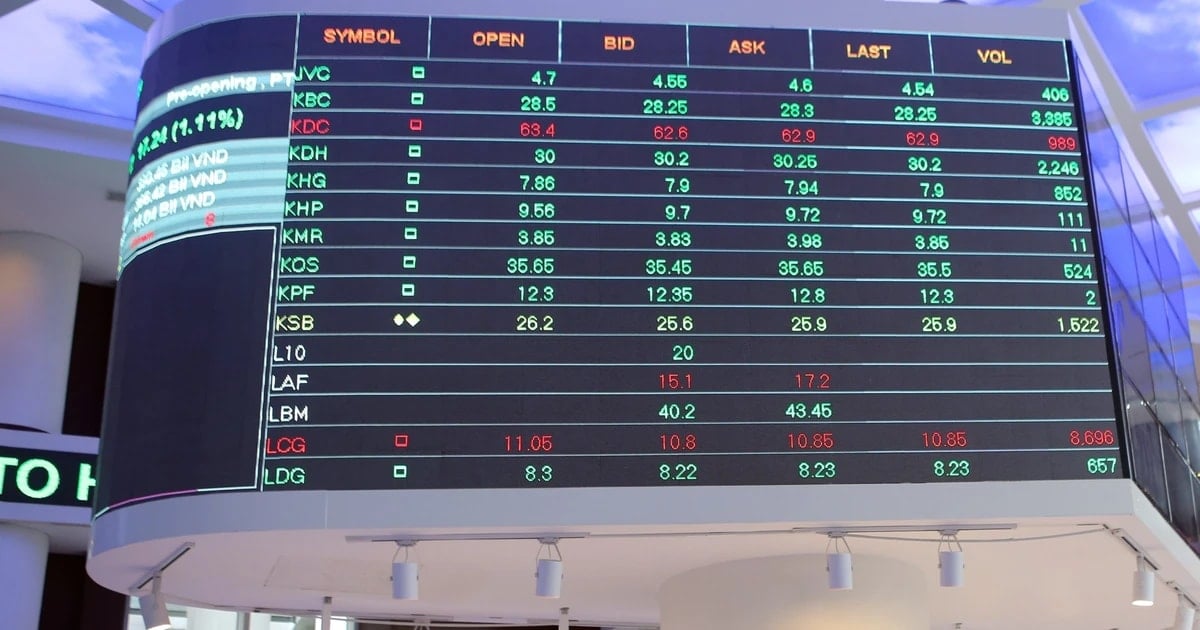

VN-Index fluctuated very narrowly today, only around 4 points compared to the reference. At the opening, the index increased slightly but demand appeared sporadically. In less than an hour, the index fell to red and then fluctuated between the two colors. Buyers and sellers struggled back and forth without recording which side had absolute dominance or which group of stocks led the market. Liquidity also fell sharply compared to the same period yesterday.

Stocks traded below reference before the lunch break and in the early afternoon. Demand improved from 1:15 p.m., helping the HoSE index maintain its green color and rise to a peak of nearly 1,249 points. This was also the only highlight of the session that "lulled" investors to sleep. Afterwards, the index dropped as demand gradually withdrew and cash flow into the market weakened significantly.

VN-Index closed the day at nearly 1,245.8 points, accumulating more than 1 point compared to yesterday.

The market clearly showed disagreement when there were 187 stocks increasing, not too far from the 168 stocks decreasing. Even the performance of each stock showed that this was a gloomy trading session when the fluctuation range of each stock code did not exceed the reference.

By industry, the telecommunications, tourism - entertainment, automobile and chemical groups have the best performance but mainly thanks to some key codes of the industry. Meanwhile, cash flow-attracting, large-cap stocks such as real estate, banking or securities show a negative trend and deep differentiation.

HoSE liquidity was 4,900 billion lower than the previous session. Total trading value reached only nearly 11,000 billion VND, the second lowest level in nearly two months. Foreign investors extended their net selling streak to the 9th session. Today they net sold more than 850 billion VND, focusing on MSN and VHM.

Overall, the cash flow into the market was small throughout the session, clearly showing the cautious and exploratory sentiment of investors. This is understandable as today is the US presidential election day and stocks have been in a long period of stagnant movements, lacking the driving force from pillar stocks.

In yesterday's market review, Saigon - Hanoi Securities (SHS) said that in the short term, the VN-Index is under correction pressure from large-cap stocks, especially the banking group. Meanwhile, mid-cap stocks have been under correction pressure before, so they have now been quite balanced, gradually recovering and diverging.

The lack of a clear trend was also recorded on the HNX and UPCoM exchanges. Both closed above the reference price, but the number of stocks increasing and decreasing was not too different and there was no market leader.

TH (according to VnExpress)Source: https://baohaiduong.vn/thanh-khoan-chung-khoan-giam-manh-397315.html

Comment (0)