Continuing the move to attract money through the issuance of treasury bills, on September 27, the State Bank of Vietnam (SBV) announced the results of the open market auction. Accordingly, this agency continued to offer 28-day treasury bills under the interest rate bidding mechanism. As a result, 9/12 participating members won the bid with a total volume of VND20,000 billion, interest rate of 0.65%, higher than the session on September 26 at 0.58%.

On the channel of pledging valuable papers, there were no new transactions and the circulation remained at 0. In total, the State Bank withdrew VND 20,000 billion from the system in the trading session on September 27. With a term of 28 days, this amount will be pumped back into the system by the State Bank on October 25, 2023.

Previously, in the last 4 consecutive sessions of September 21, 22, 25 and 26, the State Bank successfully bid a total of VND 50,000 billion worth of 28-day bills and did not conduct any transactions in the open market; thereby withdrawing the corresponding amount of money from the banking system.

Thus, in the last 5 trading sessions, the State Bank has withdrawn a total of nearly 70,000 billion VND from the banking system through the treasury bill channel.

The number of participating members is quite large, about 11-17 members and the winning rate is increasing with 8-9 members in the most recent sessions, on September 25 and September 26, and there were 9 members winning the bid with interest rates of 0.58% and 0.49% respectively.

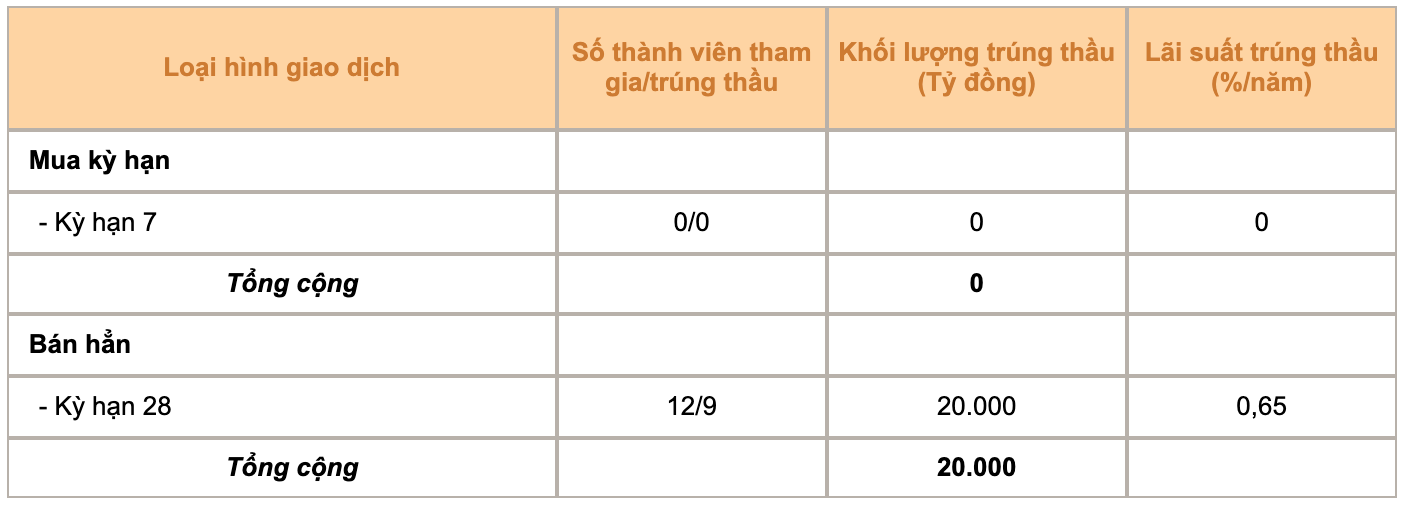

Open market auction results on September 27 (Source: SBV).

Commenting on this move, Maybank Securities (MBKE) commented that the State Bank's consideration of withdrawing money from the current system is a measure to reduce pressure on the exchange rate, bringing it back to the target level (approximately 3% for this year). In August and September, the exchange rate increased rapidly and showed signs of exceeding the target level (over 3%).

According to Maybank, this is a carefully calculated move based on observing the liquidity of the system (which is currently in excess) and a wise move (there is no need to use the foreign exchange selling tool like last year). Note that in 2022, the SBV sold 25 billion USD from foreign exchange reserves. The early sale caused the SBV to "run out of bullets" early, reducing the ability to intervene flexibly later.

At the same time, the low winning interest rate shows that there is still a lot of excess liquidity in the banking system. The reason the market has seen is that credit growth has been slow until mid-September, only 5.7% compared to the target of 14-15% this year.

MayBank observes and believes that the State Bank is carefully calculating the amount of money withdrawn through treasury bills to ensure that the amount is sufficient to achieve the goals of increasing interest rates in the interbank market, thereby reducing pressure on exchange rates; not causing disruptions in liquidity for the entire economy; and ensuring that the real interest rate of the economy (lending interest rate) will continue to decrease.

Regarding exchange rate developments, after a few days of cooling down, on September 26, the USD/VND exchange rate returned to a high level. Accordingly, the State Bank listed the central exchange rate at 24,084 VND/USD, an increase of 8 VND compared to the previous day. The USD price at commercial banks increased by 90 VND, to 24,270 VND/USD for buying and 24,610 VND/USD for selling. Compared to the beginning of the year, the USD price on the market has increased by more than 3% .

Source

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

![[Photo] Prime Minister receives a number of businesses investing in Ba Ria-Vung Tau province](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/8e3ffa0322b24c07950a173380f0d1ba)

![[Photo] President Luong Cuong receives Ambassador of the Dominican Republic Jaime Francisco Rodriguez](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/12c7d14ff988439eaa905c56303b4683)

Comment (0)