Each share of PGBank is being traded at more than 17,000 VND - Photo: PGB

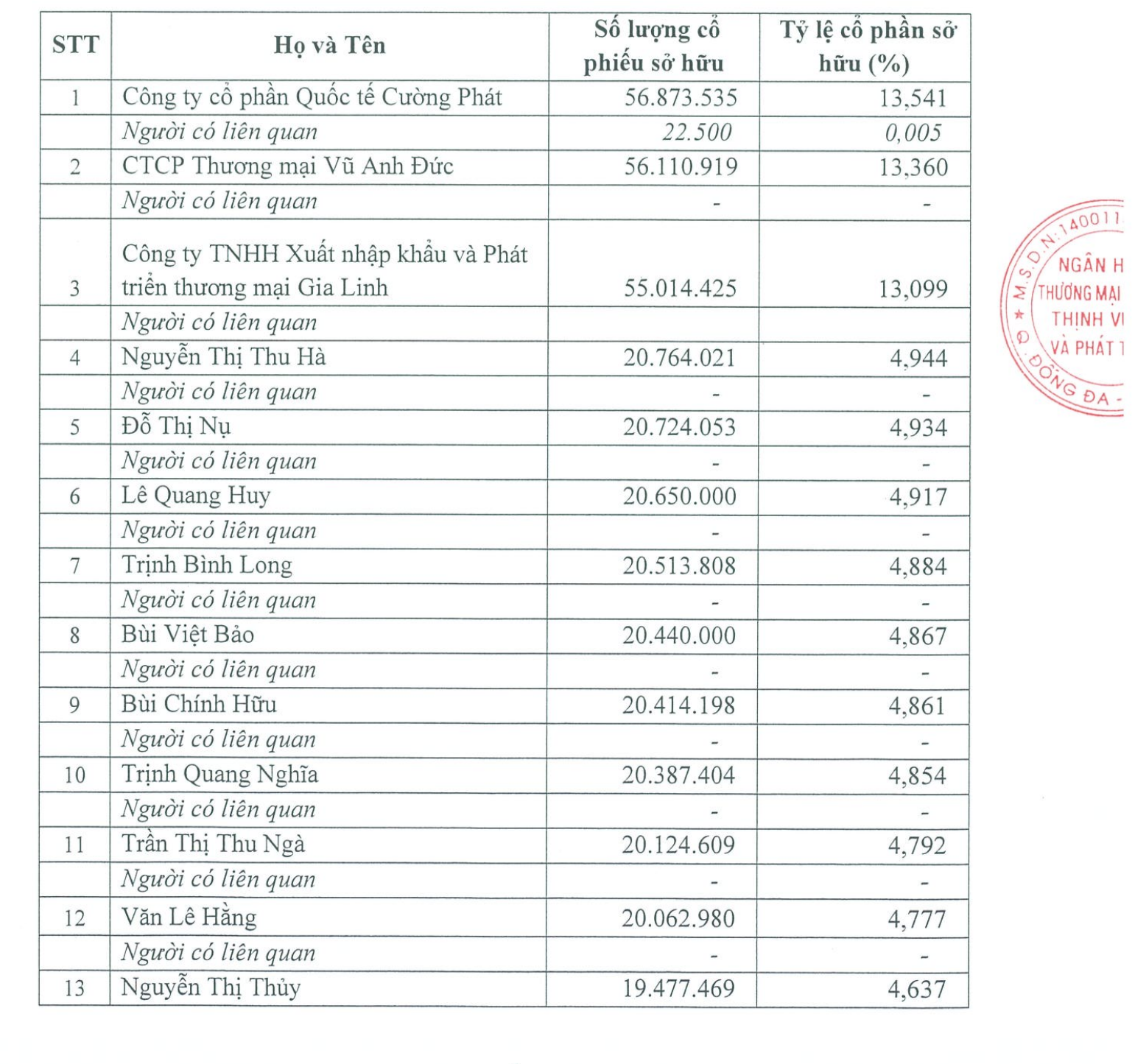

Prosperity and Development Joint Stock Commercial Bank (PGBank) recently announced the list of shareholders owning more than 1% of PGBank's charter capital and related parties.

A long list of individual shareholders holding nearly 5% of PGBank's capital

According to this first public list, PGBank has 16 shareholders, including 3 organizations and the rest are individuals owning 1% or more of charter capital.

Of which, 3 institutional shareholders include Cuong Phat International Joint Stock Company with more than 56.87 million shares, equivalent to 13.54% ownership of GPBank's charter capital.

Next is Vu Anh Duc Trading Joint Stock Company, which owns more than 56.11 million shares, equivalent to 13.36% of capital. Meanwhile, Gia Linh Import-Export and Trade Development Company Limited holds more than 55 million shares, accounting for 13.099%.

In addition to the 3 strategic shareholders holding 40% of charter capital that appeared in PGBank's management report, this latest announcement shows the identities of 13 "nearly major" shareholders with a ratio of almost 5%.

Many individual shareholders hold nearly 5% of GPBank's charter capital.

Specifically, Ms. Nguyen Thi Thu Ha holds 4.944% of capital, Ms. Do Thi Nu (4.934%), Mr. Le Quang Huy (4.917%), Mr. Trinh Binh Long (4.884%), Mr. Bui Viet Bao (4.867%), Mr. Bui Chinh Huu (4.861%), Mr. Trinh Quang Nghia (4.854%), Ms. Tran Thi Thu Nga (4.792%), Mr. Van Le Hang (4.777%), Ms. Nguyen Thi Thuy (4.637%), Mr. Ta Van Manh (4.536%), Ms. Vu Thi An Ninh (3.388%) and Mr. Dinh Thanh Nghiep (1.025%).

In total, 16 shareholders and related parties own more than 97% of PGBank's charter capital.

Notably, senior leaders of this bank such as Mr. Pham Manh Thang - Chairman, or Mr. Dao Phong Truc Dai - Vice Chairman, are not on the above list.

Similarly, Mr. Le Van Phu or Mr. Nguyen Trong Chien - deputy general director - also do not hold capital in PGBank.

Previously, the minutes from PGBank also showed a difference from most banks: a very concentrated stock structure when this year's General Meeting of Shareholders had only 20 shareholders attending, representing more than 288.4 million voting shares, equivalent to 68.67% of the total number of voting shares.

Many banks have a fairly concentrated stock structure.

According to regulations, an individual shareholder cannot own more than 5% of the charter capital of a credit institution. As shown in the above list of shareholders of GPBank, most only own 4.6 - 4.9% of the charter capital.

Previously, when investors wanted to learn about the shareholder structure of a listed organization, including banks, they would often have to search from annual reports or management reports.

However, these reports usually only disclose the ownership ratio of the largest shareholders, the ownership ratio of board members, executive board and those related to the leadership.

Individual shareholders owning less than 5%, or even 4.99%, are not required to disclose.

However, according to the amended Law on Credit Institutions 2024, effective from July 1, 2024, banks must publicly disclose information on shareholders owning 1% or more of charter capital.

At banks, shareholder lists in many places also show a fairly concentrated share ownership ratio.

Like OCB, 17 domestic individuals and enterprises also hold more than 60% of shares of this private bank.

Or at VPBank, 13 individual shareholders and 4 institutional shareholders own a total of nearly 5.1 billion shares, equivalent to 64.2% of VPBank's charter capital.

Another notable point in the revised Law on Credit Institutions is the reduction of the ownership ratio limit for institutional shareholders (including shares that such shareholders indirectly own) from 15% to 10%; for shareholders and related persons, the limit is reduced from 20% to 15%.

From July 1, 2024, shareholders and related persons owning shares exceeding the ceiling according to new regulations will still be maintained but will not be allowed to increase, except in the case of receiving dividends in shares.

In the public list of some banks, including PGBank, there are 3 institutional shareholders all holding more than 10% of capital.

Source: https://tuoitre.vn/lo-dien-16-ong-chu-chinh-cua-pgbank-co-cau-so-huu-rat-khac-biet-20240922204033079.htm

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

Comment (0)