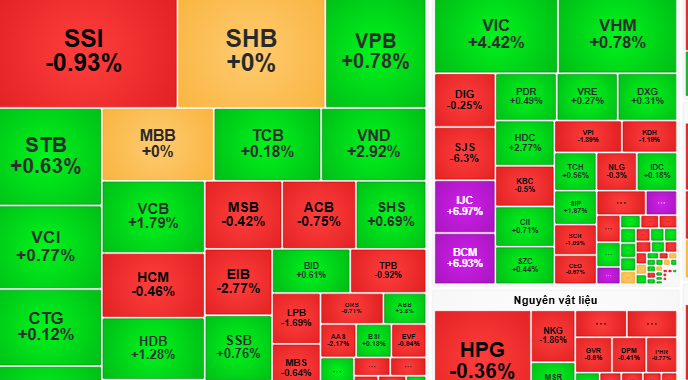

(NLDO) - At the end of the session on March 10, although the VN-Index increased by 4.23 points, closing at 1,330 points, liquidity decreased, showing that money flowing into stocks was limited.

Stock trading is likely to be volatile and the market will be adjusted in the session of March 11.

Vietnamese stocks continued to be green when entering the trading session on March 10. The VN-Index at times approached 1,356 points thanks to the strong cash flow attracted by banking, securities, real estate stocks and Vingroup stocks (VIC, VHM). However, the market quickly cooled down and a dispute between supply and demand for stocks appeared.

Entering the session, although profit-taking pressure increased and foreign investors reversed and sold stocks heavily, the market still made efforts to maintain green and support the score at the end of the trading session.

Dragon Capital Securities Company (VDSC) commented that the divergence continued with stocks increasing and decreasing in price. The VIC and VHM stocks traded actively and the banking and real estate groups continued to have green, contributing to stabilizing the market.

According to VSDC, it is likely that stock trading will be volatile and the market will correct in the next session. Investors should avoid falling into an overbought state, and consider taking short-term profits on stocks that have increased rapidly to the resistance zone, taking advantage of the fluctuations of each session to buy stocks with positive developments.

Meanwhile, VCBS Securities Company said that the increase mainly came from large-cap stocks, the market tends to fluctuate greatly with many fluctuations. Therefore, investors can sell to take partial profits with stocks with supply force, and shift disbursement to stocks showing signs of attracting cash flow.

Source: https://nld.com.vn/chung-khoan-ngay-mai-11-3-tien-van-chay-vao-co-phieu-se-than-trong-196250310171218311.htm

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

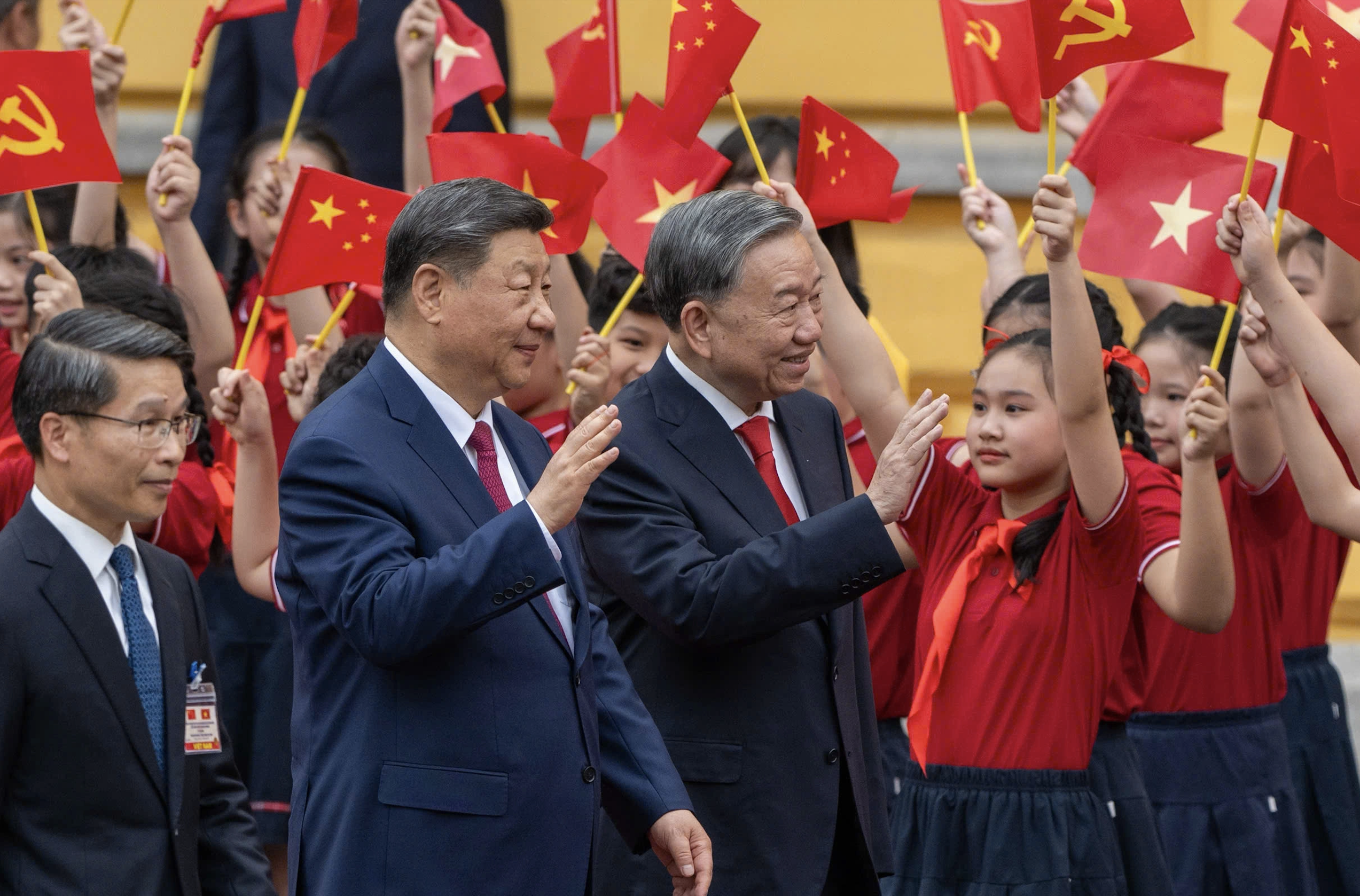

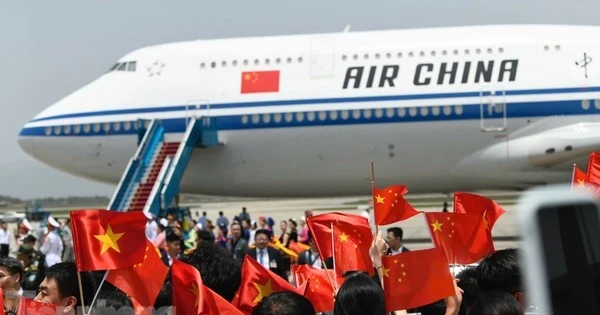

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] Hanoi people warmly welcome Chinese General Secretary and President Xi Jinping on his State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/d6ac6588b9324603b1c48a9df14d620c)

Comment (0)