Duc Giang Chemical Group Joint Stock Company (stock code: DGC) is chaired by Mr. Dao Huu Huyen as Chairman of the Board of Directors (BOD). Mr. Huyen's son, Mr. Dao Huu Duy Anh, is the General Director.

According to the new business registration update announced by the company, the legal representatives of this company are Mr. Huyen and Mr. Duy Anh.

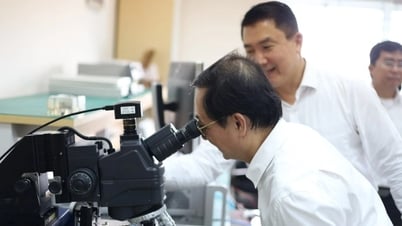

Mr. Dao Huu Huyen (left) and his son Dao Huu Duy Anh (right). Photo: DGC, NDH.

The chairman and CEO's family also holds a large amount of shares. The management report for the first half of 2024 said that Mr. Huyen owns 18.38% of the capital, Mr. Duy Anh owns 3.01% of the capital. Many relatives of the chairman also hold shares in this enterprise. In total, Mr. Huyen and related people own 40.76% of Duc Giang's capital.

According to DGC's market price of VND115,900/share, Mr. Huyen's assets are worth about VND8,089 billion and Mr. Duy Anh's are worth VND1,325 billion. In total, Mr. Huyen and his son have assets worth about VND9,414 billion.

With the same management style of "father chairman, son general director", TNG Investment and Trading Joint Stock Company (stock code: TNG) was recently fined by the Department of Planning and Investment of Thai Nguyen province for violating the provisions of the Enterprise Law. The company was forced to dismiss Mr. Nguyen Duc Manh from the position of General Director.

After this company was fined, the General Director of City Auto Joint Stock Company (stock code: CTF) also submitted a resignation letter after one month in office. City Auto also has a structure of "father as chairman, son as general director".

Returning to the story of Duc Giang Chemical Group, this enterprise was formerly a state-owned company under the General Department of Chemicals of Vietnam, established in 1963. In 2004, the enterprise converted its operating model to a joint stock company and in 2000 transferred its stock listing to the Ho Chi Minh City Stock Exchange (HoSE).

Duc Giang Chemicals operates in the production of yellow phosphorus, phosphoric acid, fertilizers, minerals... The group's business results were quite outstanding in 2022, with a record after-tax profit of VND 6,036 billion, exceeding the annual plan by 72%. Net revenue reached VND 14,444 billion, exceeding the annual plan by 12%.

In 2023, the market is not favorable, especially yellow phosphorus products due to domestic and foreign competition, prices are falling rapidly, demand is lower than every year. On the contrary, other products such as fertilizers, animal feed additives have stable prices, output tends to increase, helping the company's sales and profits not decrease much.

This year, the company's net revenue reached over VND9,748 billion, down 32%, and after-tax profit was over VND3,241 billion, down 46%. The company achieved 88% of its revenue plan and exceeded its profit plan by 8%.

In the first 9 months of 2024, the company earned a profit of VND 2,322 billion, down 7% over the same period last year. The amount of idle money is quite large, more than VND 11,366 billion as of September 30, accounting for 70% of total assets.

The company has short-term financial debt of more than 791 billion VND, no long-term debt. Accumulated profit after tax up to September 30 is more than 7,597 billion VND, on charter capital of 3,797 billion VND.

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] The Prime Ministers of Vietnam and Thailand witnessed the signing ceremony of cooperation and exchange of documents.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/935407e225f640f9ac97b85d3359c1a5)

Comment (0)