DNVN - The US dollar on March 11, 2025 recorded a decline against the Japanese Yen and the Swiss Franc in the trading session on Monday, as the market continued to face tariff tensions and concerns about the growth rate of the US economy.

USD exchange rate on the world market

The Dollar Index (DXY), a tool that measures the strength of the USD against a basket of six major currencies including EUR, JPY, GBP, CAD, SEK, CHF, is currently at 103.85 - up 0.01 points compared to the trading session on March 10, 2025.

Investors are closely watching trade tensions after US President Donald Trump decided to impose tariffs on major partners, but also delayed some tariffs for a month to consider the impact on the US economy.

The greenback weakened 0.76% to 146.91 yen, after hitting a session low of 146.625, its lowest since early October. Against the Swiss franc, the dollar fell 0.06% to 0.879, its lowest since early December.

The dollar fell 0.03 percent against the euro to $1.083350. The single currency, however, hovered around a four-month high as investors awaited news on the euro zone’s ability to boost spending. Last week, the euro posted its biggest gain in 16 years.

European Union finance ministers are meeting to discuss defense financing options. European nations are stepping up military spending and continuing support for Ukraine after Trump's decision to freeze U.S. military aid to Kyiv raised concerns about Washington's commitment to its regional allies.

“Most of the time, the FX market revolves around the US dollar: whether it’s getting stronger or weaker,” said Eugene Epstein, head of trading and structured products for North America at Moneycorp. “But right now, Europe is emerging with its own separate narrative, with the euro rising on expectations of government spending and the possibility that the European Central Bank may be more dovish than originally planned.”

Data from LSEG shows investors are pricing in 75 basis points of interest rate cuts from the US Federal Reserve this year, with the first cut expected in June. Markets are now focused on US inflation data due on Wednesday.

In currency futures, investors cut their net long dollar positions to $15.3 billion, down from a nine-year high of $35.2 billion in January.

“When I look closely at the signals, I see a tendency for the Trump administration to want a weaker dollar, even if this is not officially stated,” Epstein stressed.

Latest data showed that basic wages in Japan rose 3.1% in January after recording a 2.6% increase in December. This was also the strongest increase since 1992. However, the highest inflation in two years has reduced workers' real income.

The Bank of Japan is expected to keep interest rates unchanged at its March 18-19 policy meeting, although several officials have said they need to assess the sustainability of wage growth following the January rate hike.

Fluctuations in other currencies

The Norwegian crown rose sharply against the dollar and the euro, hitting its highest level against the dollar since October at 10.7585 crowns to the dollar, after higher-than-expected inflation data cast doubt on the central bank's plans to cut interest rates in March.

In China, the yuan weakened on Monday after data over the weekend showed consumer prices fell at their fastest pace in 13 months in February.

Meanwhile, the Canadian dollar fell 0.33% against the USD, to 1.4415 CAD/USD. Former Bank of Canada Governor Mark Carney won the leadership election of the Liberal Party of Canada on Sunday, paving the way for policy confrontations with the Trump administration, especially on the issue of trade tariffs.

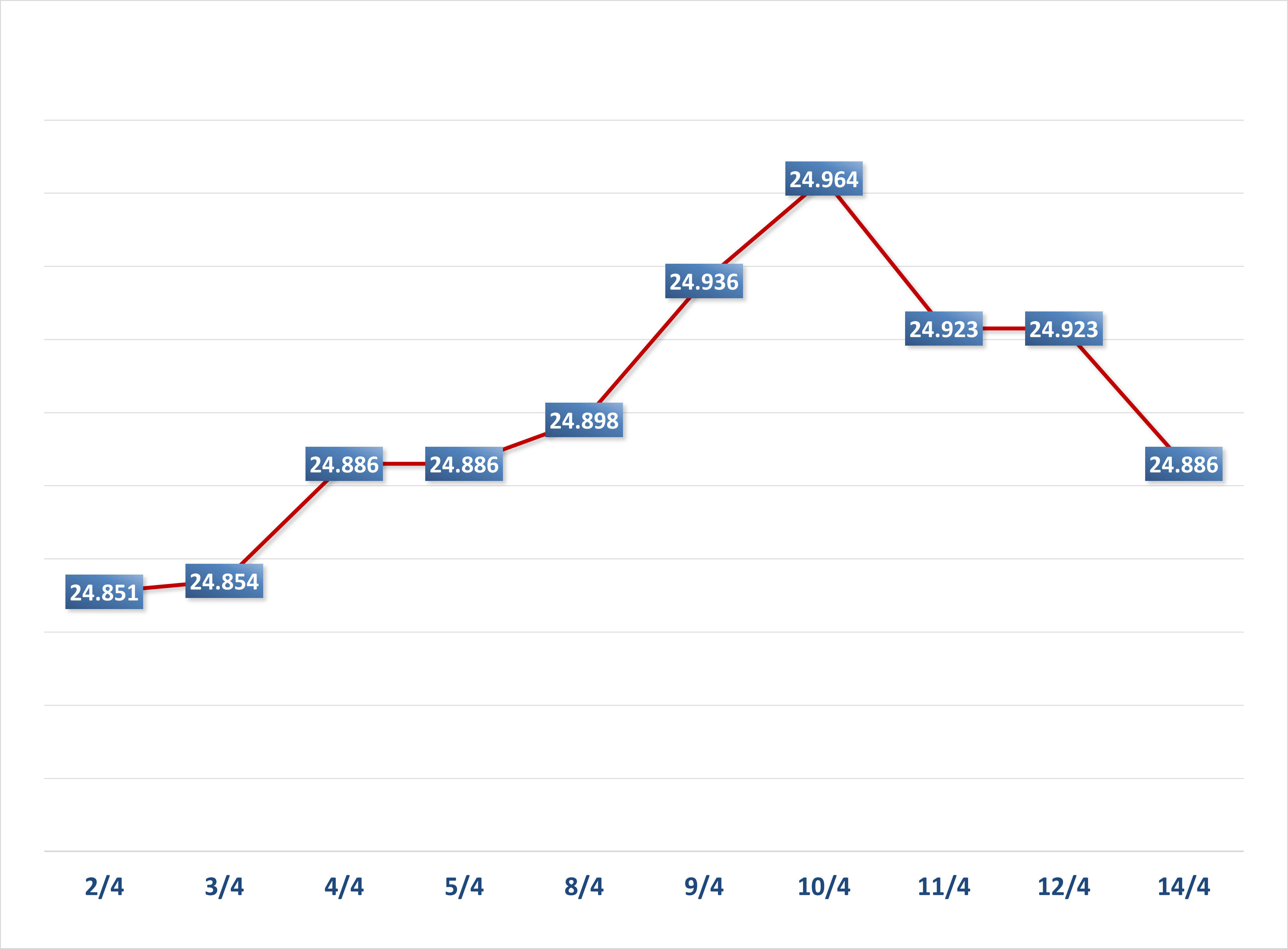

Domestic USD exchange rate

In the domestic market, at the beginning of the trading session on March 11, the State Bank of Vietnam adjusted the central exchange rate of VND against USD by 24 VND, reaching 24,754 VND.

The reference exchange rate at the State Bank of Vietnam also increased slightly, with the current buying and selling rates being 23,567 VND - 25,941 VND.

Specifically, at Vietcombank, the listed USD exchange rate is at 25,310 - 25,700 VND/USD, up 10 VND in both directions compared to the previous session.

- LPBank and OceanBank currently have the lowest USD cash purchase price: 25,222 VND/USD

- LPBank and OceanBank have the lowest USD transfer purchase price: 25,232 VND/USD

- HSBC Bank listed the highest USD cash purchase price: 25,400 VND/USD

- VietinBank has the highest USD transfer purchase price: 25,697 VND/USD

On the selling side:

- LPBank and OceanBank have the lowest USD cash selling price: 25,483 VND/USD

- HSBC Bank has the lowest USD transfer price: 25,630 VND/USD

- Saigonbank listed the highest USD cash selling price: 25,800 VND/USD

- SCB Bank has the highest USD transfer price: 25,750 VND/USD

The Euro exchange rate at the State Bank of Vietnam increased slightly, currently reaching 25,552 VND - 28,241 VND (buy - sell).

The Japanese Yen exchange rate also recorded a slight increase, currently trading at 160 VND - 176 VND.

Viet Anh (t/h)

Source: https://doanhnghiepvn.vn/kinh-te/gia-ngoai-te-ngay-11-3-2025-usd-tang-nhe/20250311084010064

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

Comment (0)