Leaders of some banks believe that credit demand is still weak, so increasing deposit interest rates cannot yet have an impact on increasing lending interest rates.

For individuals, short-term loan interest rates are around 6.5-6.8%/year, medium and long-term loans have interest rates around 9.1-9.3%/year. For businesses, short-term loan interest rates are from 6%/year, medium and long-term loans are from 9%/year.

In addition, many banks are implementing preferential interest rate credit packages for both individual and corporate customers. Depending on each customer and specific credit package, short-term loan interest rates can be from 4.5%/year, medium and long-term from 6%/year.

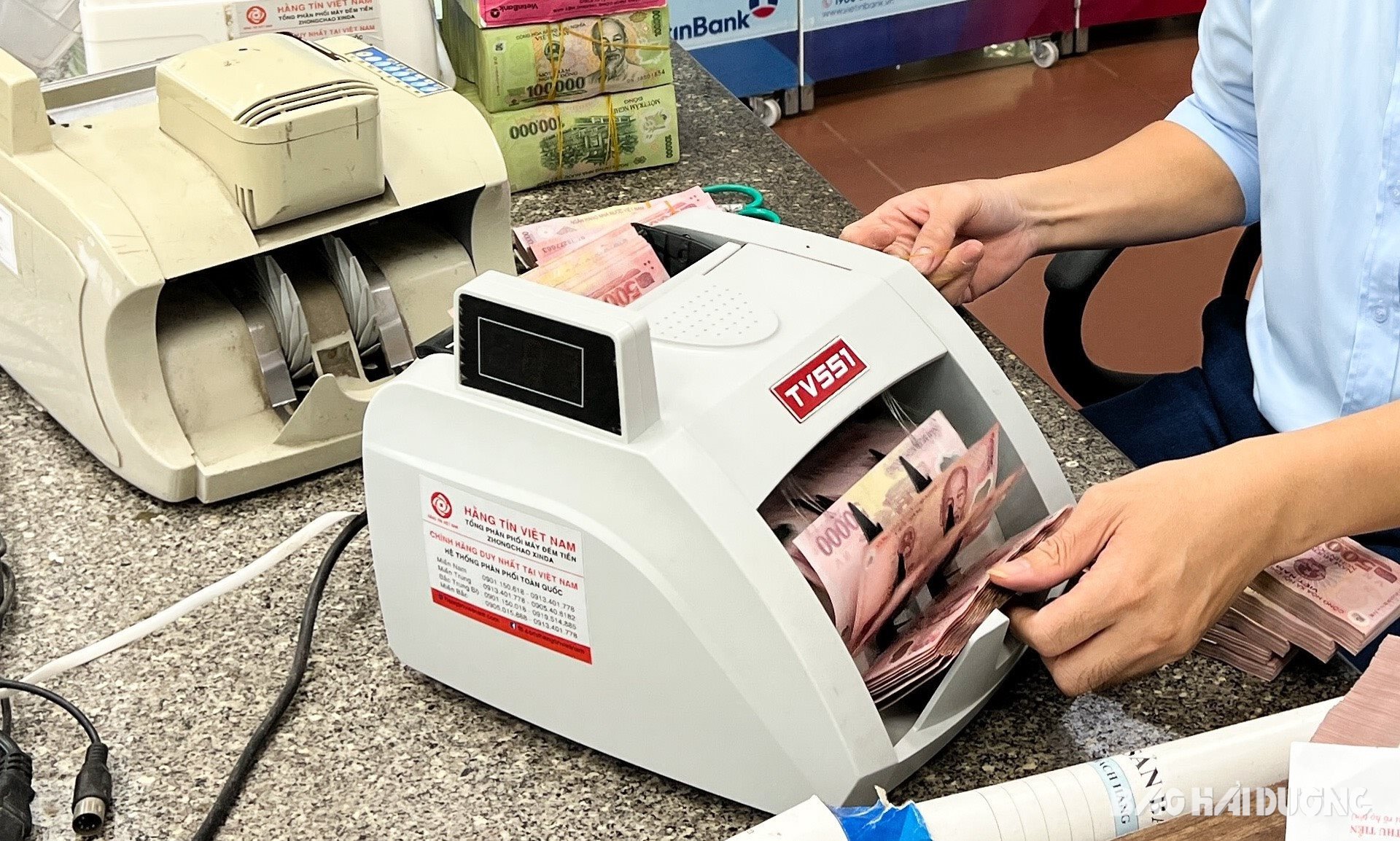

Regarding deposit interest rates, a survey at branches in Hai Duong of some banks such as the Big 4 group (Agribank, VietinBank, BIDV, Vietcombank), and some joint stock commercial banks without state capital such as Sacombank, Bac A, SCB, showed that deposit interest rates directly deposited at the counter recorded an average increase of 0.1-0.5%/year for many terms, mainly from 12 months or less; online savings interest rates were 0.1-0.15%/year higher than at the counter.

For banks without state capital, the current mobilization interest rate fluctuates at 1.9-2.8%/year for terms under 6 months, 2.9-3.8%/year for terms of 6 months, 3.7-4.7%/year for terms of 12 months, and 3.9-5%/year for terms of 24 months.

Among the surveyed banks, Sacombank is the bank with the highest deposit interest rate.

The Big 4 group has interest rates of 1.9-2%/year for terms under 6 months, 3%/year for terms of 6 months, 4.7%/year for terms of 12 months and 24 months.

The above-mentioned deposit interest rates have mostly been adjusted upward since the beginning of May 2024, after more than a year of continuous decline. In the context of prolonged low deposit interest rates, there are signs of residential deposits shifting away from banks, while credit has shown signs of increasing again. Some banking experts believe that the increase in deposit interest rates is for banks to "absorb" cash flow to ensure capital balance. However, the increase in deposit interest rates from now until the end of the year is not expected to be high.

According to data compiled by the State Bank of Vietnam, by the end of April 2024, the total outstanding bank credit in the province was VND 134,115 billion, up 0.1% compared to the end of 2023, up 0.5% compared to the end of March 2024. This is the first month since the beginning of 2024 that bank credit in Hai Duong has grown positively. In particular, outstanding short-term loans increased by 0.4% compared to the end of 2023, up 0.2% compared to the end of March 2024, showing that people and businesses have increased bank loans to supplement working capital to develop production and business.

Total mobilized capital is VND 198,735 billion, up 1.6% compared to the end of 2023, up 0.2% compared to the end of March 2024.

Source

Comment (0)