Domestic gold price

Domestic gold bar prices continue to decline. Currently, gold brands are buying at VND88.5 million/tael and selling at VND90.5 million/tael.

Bao Tin Minh Chau and Phu Quy SJC gold are being bought at 300,000 VND higher than other brands.

Similarly, the price of gold rings of various brands was also adjusted down slightly. Specifically, the price of SJC 9999 gold rings was listed at VND88.5 million/tael for buying and VND90.4 million/tael for selling, down VND400,000 for buying and down VND700,000 for selling.

DOJI in Hanoi and Ho Chi Minh City markets adjusted the buying price down by 400,000 VND and the selling price down by 700,000 VND to 88.5 million VND/tael and 90.5 million VND/tael, respectively.

The listed buying and selling prices of PNJ brand gold rings are VND 89.8 million/tael and VND 90.5 million/tael, a decrease of VND 500,000 in buying price and VND 700,000 in selling price.

Bao Tin Minh Chau listed the price of plain round gold rings at 90.1 million VND/tael for buying and 91.3 million VND/tael for selling, down 50,000 VND for buying and 400,000 VND for selling.

Phu Quy SJC is buying gold rings at 89.7 million VND/tael and selling at 91.2 million VND/tael, down 300,000 VND in both directions compared to early this morning.

Update gold price details

| 1. DOJI - Updated: 03/01/2025 04:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 88,500 ▼400K | 90,500 ▼700K |

| AVPL/SJC HCM | 88,500 ▼400K | 90,500 ▼700K |

| AVPL/SJC DN | 88,500 ▼400K | 90,500 ▼700K |

| Raw material 9999 - HN | 90,000 ▼100K | 90,400 ▼200K |

| Raw material 999 - HN | 89,900 ▼100K | 90,300 ▼200K |

| AVPL/SJC Can Tho | 88,500 ▼400K | 90,500 ▼700K |

| 2. PNJ - Updated: 03/01/2025 04:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 89,800 ▼500K | 90,500 ▼700K |

| HCMC - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Hanoi - PNJ | 89,800 ▼500K | 90,500 ▼700K |

| Hanoi - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Da Nang - PNJ | 89,800 ▼500K | 90,500 ▼700K |

| Da Nang - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Western Region - PNJ | 89,800 ▼500K | 90,500 ▼700K |

| Western Region - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Jewelry gold price - PNJ | 89,800 ▼500K | 90,500 ▼700K |

| Jewelry gold price - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Jewelry gold price - Southeast | PNJ | 89,800 ▼500K |

| Jewelry gold price - SJC | 88,500 ▼400K | 90,500 ▼700K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 89,800 ▼500K |

| Jewelry gold price - Jewelry gold 999.9 | 88,000 ▼600K | 90,500 ▼600K |

| Jewelry gold price - Jewelry gold 999 | 87,910 ▼600K | 90,410 ▼600K |

| Jewelry gold price - Jewelry gold 99 | 87,200 ▼590K | 89,700 ▼590K |

| Jewelry gold price - 916 gold (22K) | 80,500 ▼550K | 83,000 ▼550K |

| Jewelry gold price - 750 gold (18K) | 65,530 ▼450K | 68,030 ▼450K |

| Jewelry gold price - 680 gold (16.3K) | 59,190 ▼410K | 61,690 ▼410K |

| Jewelry gold price - 650 gold (15.6K) | 56,480 ▼390K | 58,980 ▼390K |

| Jewelry gold price - 610 gold (14.6K) | 52,860 ▼360K | 55,360 ▼360K |

| Jewelry gold price - 585 gold (14K) | 50,590 ▼350K | 53,090 ▼350K |

| Jewelry gold price - 416 gold (10K) | 35,300 ▼250K | 37,800 ▼250K |

| Jewelry gold price - 375 gold (9K) | 31,590 ▼220K | 34,090 ▼220K |

| Jewelry gold price - 333 gold (8K) | 27,520 ▼190K | 30,020 ▼190K |

| 3. AJC - Updated: 03/01/2025 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| Jewelry 99.99 | 8,910 ▼20K | 9,120 ▼40K |

| 99.9 Jewelry | 8,900 ▼20K | 9,110 ▼40K |

| NL 99.99 | 8,910 ▼20K | |

| Round ring not sealed in blister T.Binh | 8,900 ▼20K | |

| Round, 3A, Yellow T.Bình | 9,000 ▼20K | 9,130 ▼40K |

| Round, 3A, Yellow N.An | 9,000 ▼20K | 9,130 ▼40K |

| Round, 3A, Yellow Street, Hanoi | 9,000 ▼20K | 9,130 ▼40K |

| SJC Thai Binh pieces | 8,850 ▼70K | 9,050 ▼70K |

| SJC Nghe An pieces | 8,850 ▼70K | 9,050 ▼70K |

| SJC Hanoi Piece | 8,850 ▼70K | 9,050 ▼70K |

World gold price drops sharply

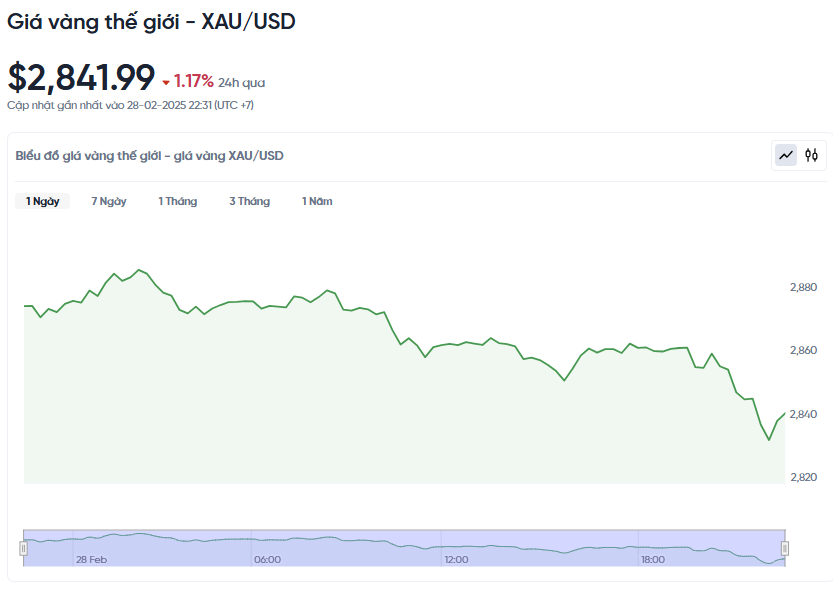

As of 4:00 a.m. on March 1 (Vietnam time), the world gold price was listed at 2,841.99 USD/ounce, down 33.7 USD/ounce compared to the beginning of the previous trading session.

Gold prices fell to their lowest in more than two weeks on Thursday, hurt by a rebound in the U.S. dollar. As the U.S. Dollar Index rose 0.7%, gold, which is priced in dollars, became more expensive for holders of other currencies, denting demand.

According to Alex Ebkarian, CEO of Allegiance Gold, the direction of gold prices remains clear. Short-term fluctuations and profit-taking are just a normal part of the gold price cycle and do not have much impact on the long-term trend.

Investors are now focused on the U.S. personal consumption expenditure (PCE) index, due for release on Friday. According to a Reuters poll, analysts expect the PCE to remain at 0.3%. TD Securities head of commodity strategy Bart Melek warned that if the PCE data misses forecasts significantly, the market could react negatively on concerns that the Federal Reserve will delay its rate cut.

The market now expects the Fed to cut rates at least twice this year, with a total of about 55 basis points of easing in 2025. Investors are also watching speeches by Fed officials for clues on upcoming monetary policy.

In addition, the international trade situation is also attracting attention. US President Donald Trump has just confirmed that the plan to impose tariffs on imports from Mexico and Canada will take effect on March 4 as scheduled. This decision could impact many markets, including gold.

Gold price trend forecast for the next 24 hours

According to Mr. Ebkarian, gold prices have the prospect of surpassing $3,000/ounce in the next 30 to 60 days, depending on the market's reaction to the tariff policy.

The PCE index – one of the Fed’s most important inflation measures – has a big impact on gold prices. If the index rises 2.5% year-over-year, down from 2.6% in December, it would indicate that inflation is cooling. At that time, the possibility of the Fed keeping or cutting interest rates will be higher, weakening the USD and gold prices may rise sharply again.

Conversely, if the PCE is higher than expected (above 2.5%), this indicates that inflation is still persistent. At that time, the FED may continue to maintain high interest rates or even tighten monetary policy. This will increase the opportunity cost of holding gold, pushing up the USD price and bond yields, putting downward pressure on gold prices.

In the April gold futures market, gold still has the short-term advantage, but the upside momentum on the daily chart has stalled. Buyers are aiming to hold prices above $2,974 an ounce, which is a key resistance level, while sellers are trying to push prices below the $2,800 an ounce support level. The outcome of upcoming economic and policy factors will determine the direction of gold prices in the near term.

Source: https://baoquangnam.vn/gia-vang-1-3-2025-vang-trong-nuoc-va-the-gioi-giam-thap-nhat-2-tuan-qua-3149712.html

Comment (0)