Strong buying pressure took place in the metal market, with prices of many commodities increasing amid concerns about the possibility of a disruption in the global supply chain.

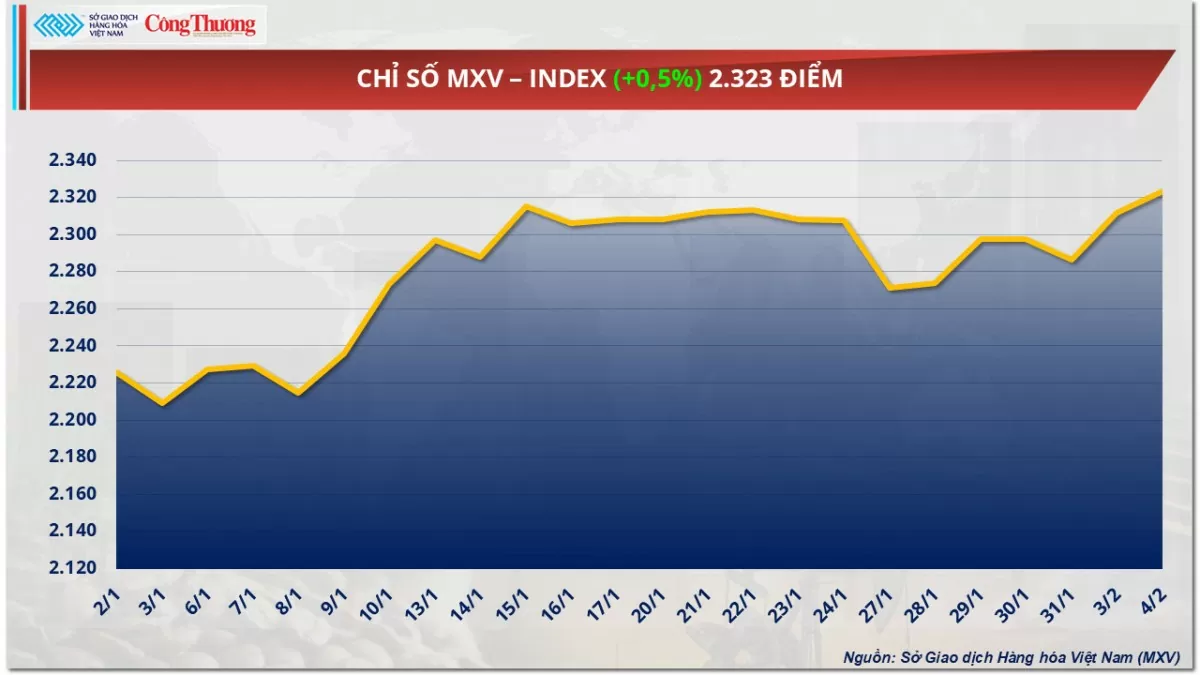

The Vietnam Commodity Exchange (MXV) said that at the close of trading yesterday (February 4), overwhelming buying pressure pushed the MXV-Index up 0.5% to a 7-month high of 2,323 points. Notably, green covered the entire metal price chart. In addition, the agricultural market also recorded a positive session, notably, soybean prices extended their increase to the second session and surpassed the peak set in October last year.

|

| MXV-Index |

Concerns over global supply disruptions send metal prices soaring

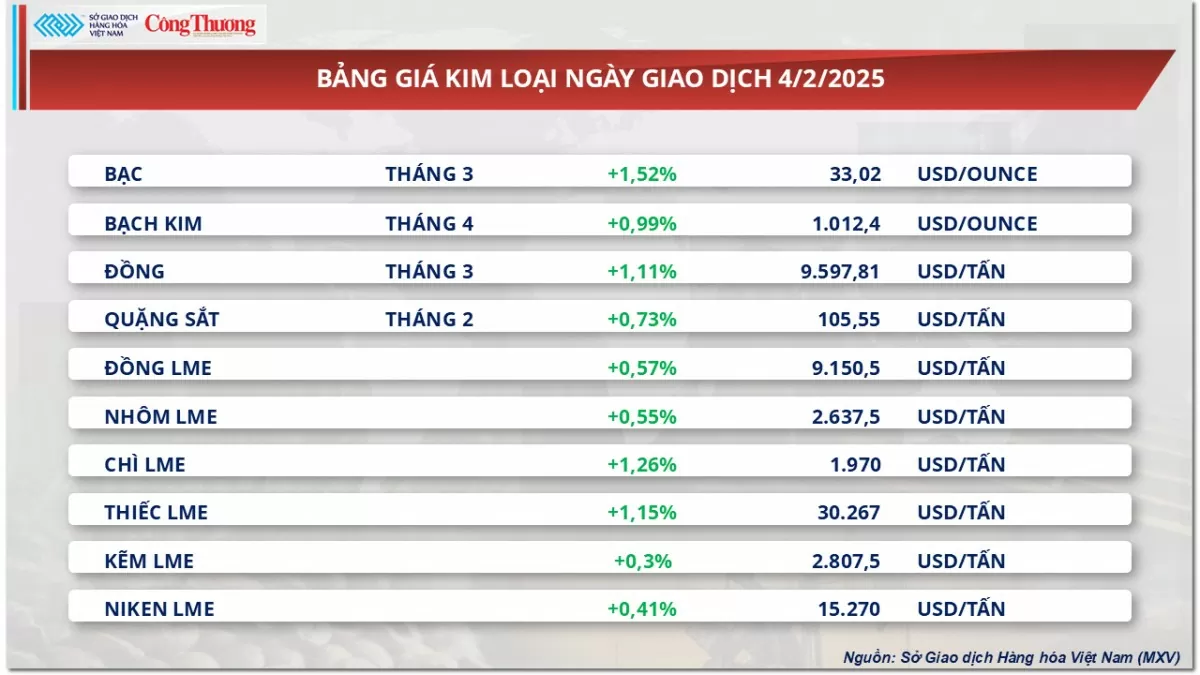

At the end of yesterday's trading session, strong buying pressure occurred in the metal market, with prices of all commodities increasing amid growing concerns about the possibility of disruption of the global supply chain. The current political situation shows the possibility of US-China trade tensions escalating.

In the precious metals market, silver prices rose sharply by 1.52%, reaching $33.02/ounce - the highest level since late October 2024, while platinum also increased significantly by nearly 1% to $1,012/ounce.

|

| Metal price list |

On February 3, US President Donald Trump unexpectedly postponed the imposition of tariffs on Mexican and Canadian goods just hours before the decision was due to take effect. However, the market still faces many potential risks as the tense trade relationship between Washington and Beijing shows signs of escalating due to the two sides not reaching a consensus.

China has officially announced that it will take appropriate countermeasures to the Trump administration's tariff move, raising concerns about a prolonged trade war. With the global economic environment showing no signs of cooling down, investors continue to increase capital flows into safe-haven assets, especially precious metals.

In addition, the extension of the US tariffs on Canada and Mexico has weakened the US dollar slightly, making dollar-denominated commodities such as metals more attractive to importers using other currencies, stimulating buying and adding momentum to the price increase of industrial and precious metals.

For the base metals group, the upward momentum continued to be maintained when COMEX copper prices recorded an increase of 1.11%, equivalent to 4.35 USD/pound (9,597 USD/ton), while iron ore reversed to recover 0.73%, at 105.5 USD/ton.

A January Reuters poll found that experts are forecasting higher average prices for copper, zinc and tin this year than in 2024. COMEX copper, in particular, is getting some support from expectations that China will roll out new economic stimulus measures to boost domestic demand. However, market experts have warned that the outlook for the macro-sensitive metal could come under pressure if the US does indeed raise its 10% import tariffs on Chinese goods.

Meanwhile, concerns about supply disruptions were the main reason for iron ore prices to regain momentum yesterday. Rio Tinto - one of the world's largest iron ore miners - is struggling as tropical cyclones Taliah and Vince have disrupted exports in Western Australia. This is a surprise for Chinese steel mills, which did not stock up on Australian raw materials before the Lunar New Year holiday. This disruption has pushed iron ore prices up.

Soybean prices close at highest level since early October 2024

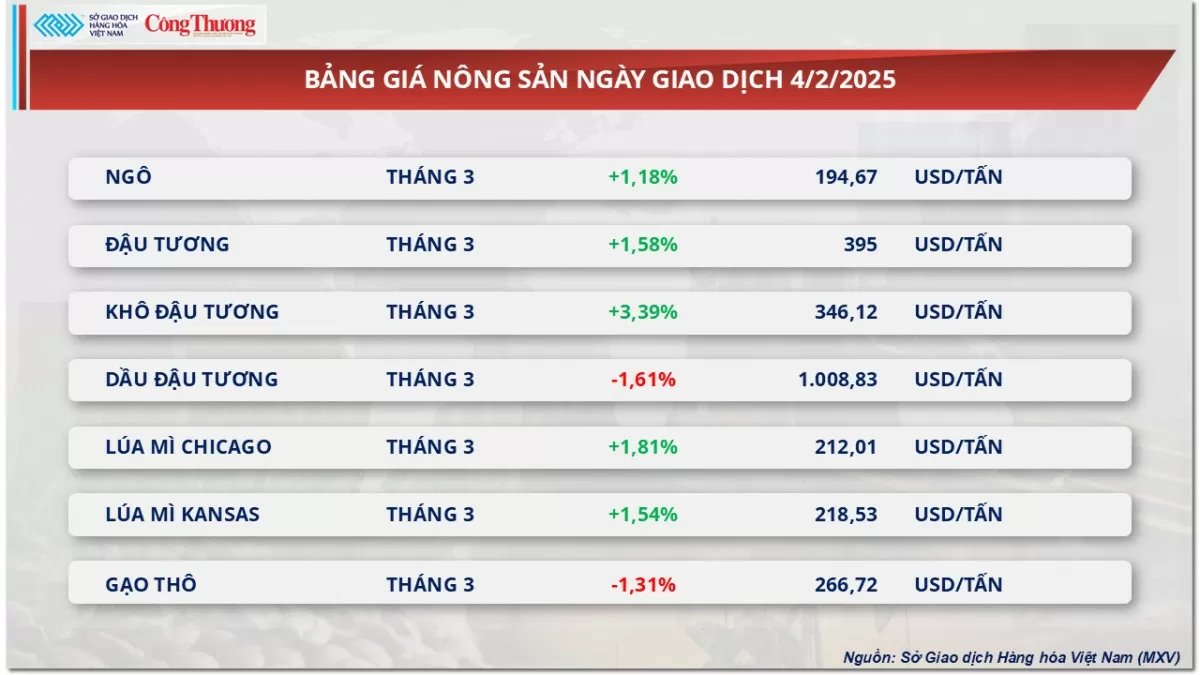

According to MXV, the agricultural market continued to improve in yesterday's trading session, notably, soybean prices extended their increase into the second session, increasing by 1.5%. Despite slight selling pressure at the opening, prices quickly recovered and closed at their highest level since early October. The market continued to monitor and evaluate the tariffs of the US and China, after the US postponed tariffs on Canada and Mexico.

|

| Agricultural product price list |

US President Donald Trump has postponed tariffs on Mexico, while continuing to impose a 10% tariff on all imports from China this week. In response, Beijing has retaliated by announcing tariffs on US energy goods, which will begin next week. The retaliatory tariffs do not include agricultural products, allaying concerns that US soybean exports to China will be immediately affected by the trade conflict between the two countries. In addition, analysts say Beijing's response is measured and there is still room for negotiation. This is a factor that boosted buying interest in soybeans yesterday.

In South America, the weather continues to be less positive. In Argentina, although there has been some rain recently, it has not been enough to improve crop quality. Experts say that the country's main production areas need more rain to maintain their yield potential for the current crop year. Meanwhile, in Brazil, high humidity is significantly hindering harvest activities. According to the latest report from consulting firm AgRural, Brazil's soybean harvest progress for the 2024-25 crop year is only 9% complete, up 5% from last week but still significantly lower than the 16% level at the same time last year.

In particular, in the state of Mato Grosso - Brazil's leading producing region, IMEA data shows that the harvest progress is only 12.2%, much lower than the five-year average of 25.5%. These unfavorable weather conditions in South America contributed to the price increase in yesterday's trading session.

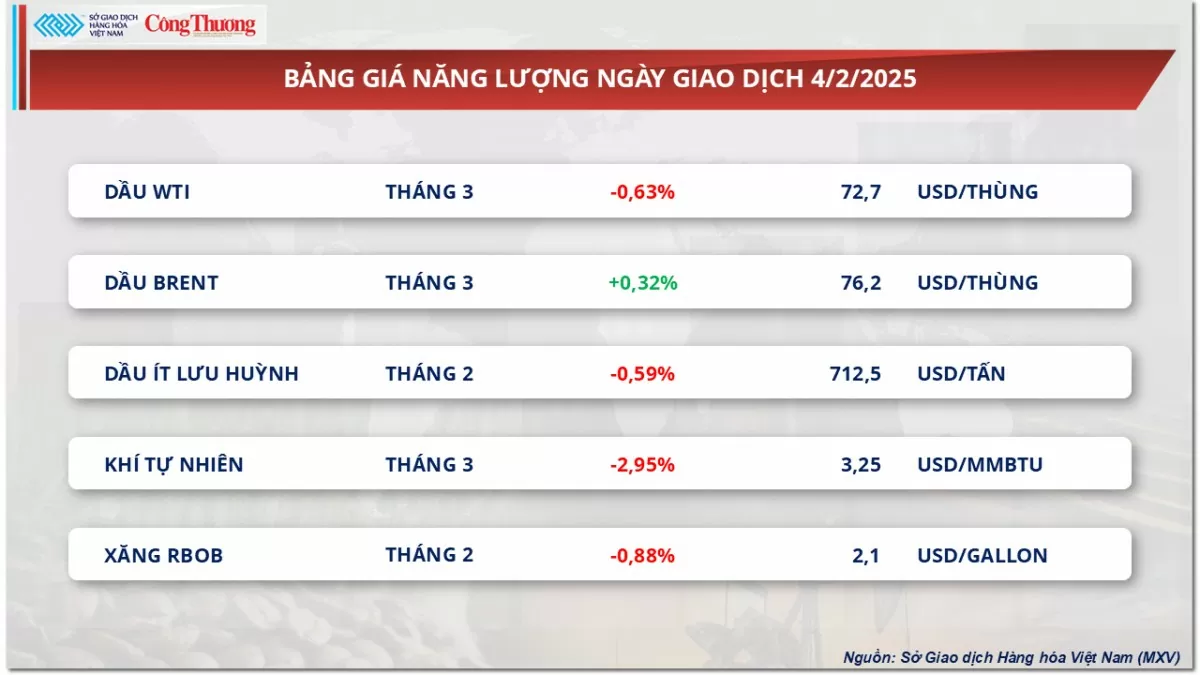

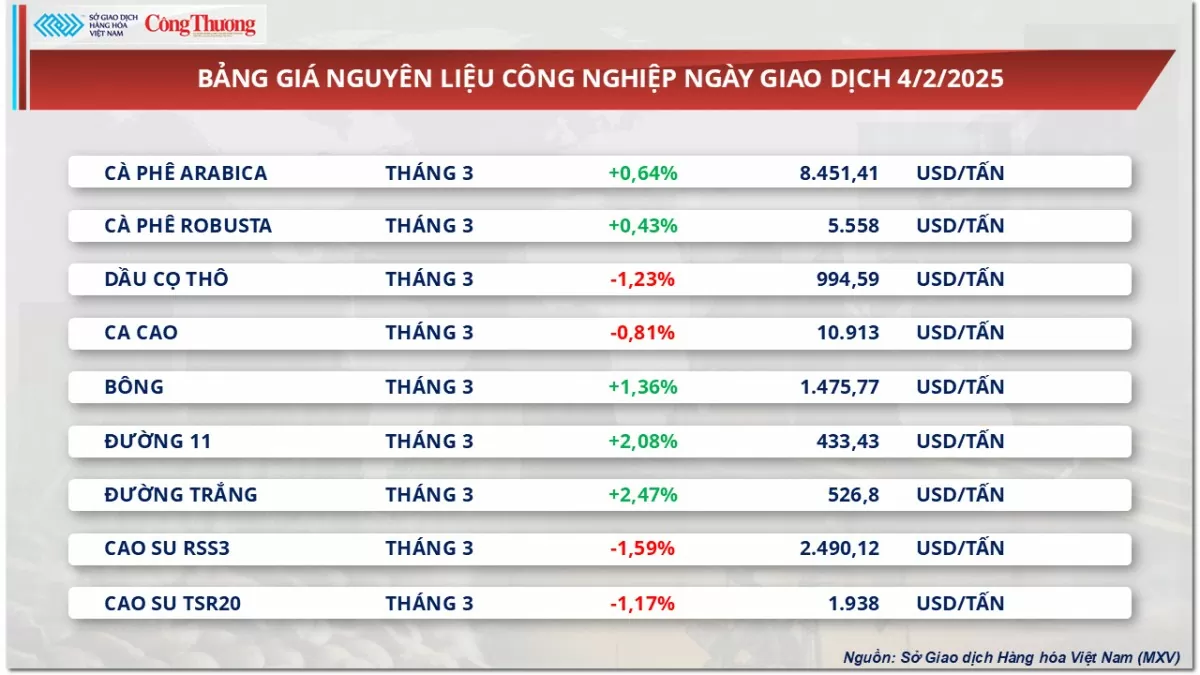

Prices of some other goods

|

| Energy price list |

|

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-ngay-52-gia-kim-loai-dong-loat-tang-372291.html

Comment (0)