On February 28, 2025, the Government issued Decree No. 44/2025/ND-CP on labor management, wages, remuneration, and bonuses in state-owned enterprises.

Accordingly, the Decree regulates the management of labor, wages, remuneration and bonuses in state-owned enterprises, including:

- Enterprises in which the State holds 100% of the charter capital as prescribed in Clause 2, Article 88 of the Law on Enterprises.

- Enterprises in which the State holds more than 50% of charter capital or total voting shares as prescribed in Clause 3, Article 88 of the Law on Enterprises.

Subjects of application of the Decree:

- Employees working under labor contracts; employees who are officers, professional soldiers, workers, defense officials, officers, non-commissioned officers, police workers, and people working in secretarial work.

- General Director, Director, Deputy General Director, Deputy Director, Chief Accountant (hereinafter referred to as the Executive Board).

- Chairman and members of the Board of Members or Chairman of the company, Chairman and members of the Board of Directors, excluding independent members of the Board of Directors (hereinafter referred to as Board Members).

- Head of the Board of Supervisors, Supervisors, members of the Board of Supervisors (hereinafter referred to as Supervisors).

- Representative of state capital invested in enterprises and representative agency of owners according to the provisions of the Law on management and use of state capital invested in production and business at enterprises.

- Agencies, organizations and individuals related to the implementation of the provisions of this Decree.

The principles of labor management, salary, remuneration and bonuses in enterprises are determined in connection with tasks, labor productivity and production and business efficiency.

Accordingly, the Decree clearly stipulates the principles of labor management, wages, remuneration, and bonuses in enterprises, which are determined in connection with tasks, labor productivity, and production and business efficiency, in accordance with the industry and nature of the enterprise's operations, aiming to ensure the wage level in the market; implementing an appropriate wage mechanism for enterprises to attract and encourage high-tech human resources in high-tech fields prioritized for development by the State.

Pursuant to the provisions of this Decree, the law on labor, employment, the Charter of operations and strategies, production and business plans, enterprises decide on the recruitment and use of labor, develop salary scales, payrolls, labor norms, determine salary funds, bonuses and pay salaries and bonuses to employees according to positions or jobs, ensure appropriate salary and bonus payment, without limiting the maximum level for experts, talented people, people with high professional and technical qualifications, and making many contributions to the enterprise.

Method of determining the Salary Fund of employees and the Executive Board

Separate the salaries and remuneration of Board members and Supervisors from the salaries of the Executive Board. The salary fund of employees and the Executive Board is determined according to the following methods:

1. Determine the salary fund through the average salary level according to Section 2 and Section 4, Chapter III of this Decree.

2. Determine the salary fund through the stable salary unit price according to Section 3 and Section 4, Chapter III of the Decree. This method is only applicable to enterprises that have been in operation for at least the expected period of applying the stable salary unit price according to the provisions of Clause 1, Article 12 of this Decree.

Depending on the tasks, nature of the industry, and conditions of production and business activities, enterprises decide to choose one of the two methods of determining the salary fund mentioned above.

Enterprises with many different fields of production and business activities and can separate labor and financial indicators to calculate labor productivity and production and business efficiency corresponding to each field of activity can choose the appropriate method from the above two methods to determine the salary fund corresponding to each field of activity.

For enterprises that choose the method of determining the salary fund through the stable salary unit price, they must maintain that salary fund determination method throughout the period of applying the selected stable salary unit price (except in cases where the impact of objective factors or the enterprise changes its business strategy, functions, tasks, or organizational structure that greatly affects the production and business activities of the enterprise) and must report to the owner's representative agency together with the stable salary unit price before implementation.

Regarding salary distribution, according to the Decree, Employees and the Executive Board are paid according to the salary regulations issued by the enterprise, in which: Employees' salaries are paid according to their position or job, linked to labor productivity and the contribution of each person to the production and business results of the enterprise; The salaries of the Executive Board are paid according to their position, position and production and business results, in which the salary of the General Director and Director (except in cases where the General Director and Director are hired to work under a labor contract) must not exceed 10 times the average salary of employees.

When developing a salary payment regulation, the enterprise must consult with the organization representing employees at the facility, organize dialogue at the workplace according to the provisions of labor law, report to the owner's representative agency for inspection, supervision and public disclosure at the enterprise before implementation.

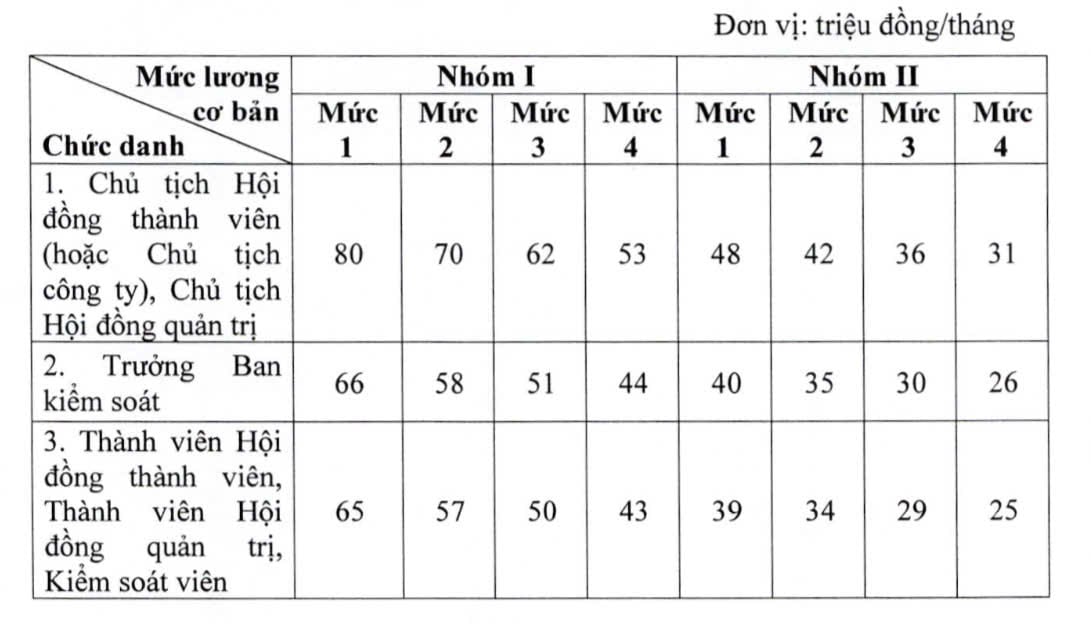

According to the Decree, the basic salary of Board Members and full-time Supervisors is prescribed as follows:

The subjects and conditions for applying levels 1, 2, 3 and 4 of groups I and II shall comply with the provisions in the Appendix issued with Decree No. 44/2025/ND-CP.

Every year, the enterprise, based on the planned production and business targets, determines the basic salary to determine the planned salary level of each Board Member and Supervisor.

The Decree takes effect from April 15, 2025. The regimes prescribed in this Decree shall be implemented from January 1, 2025.

Please see the full text of Decree 44/2025/ND-CP in the attached file:

Source: https://moha.gov.vn/tintuc/Pages/danh-sach-tin-noi-bat.aspx?ItemID=56950

Comment (0)