Closing the first trading session of the week, the price of Arabica coffee for March 2025 contract increased by 2.47% and the price of Robusta coffee for March 2025 contract increased by 0.37% compared to the reference.

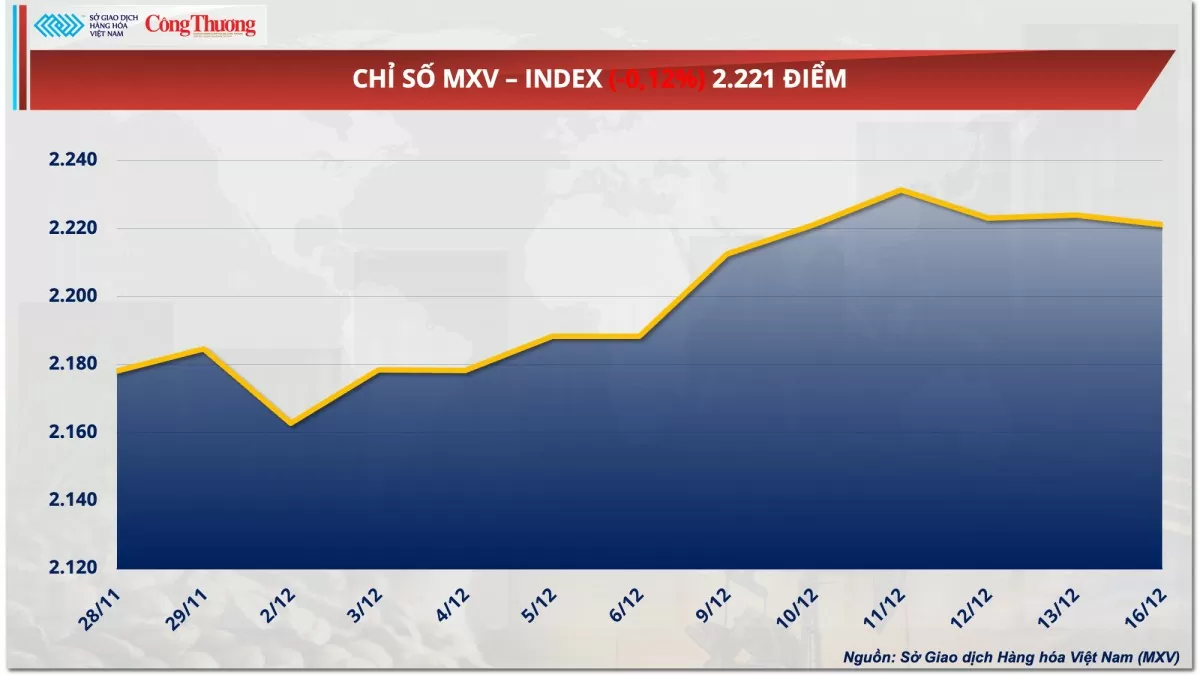

The Vietnam Commodity Exchange (MXV) said that red returned to dominate the world raw material price list yesterday (December 16). The group of industrial materials attracted attention when it went against the general trend of the whole market. Notably, cocoa prices continued to break out and climb to a historical peak amid concerns about supply shortages. Meanwhile, the metal market was relatively quiet in the first trading session of the week. Closing, the MXV-Index decreased by 0.12% to 2,221 points.

|

| MXV-Index |

Cocoa prices continue to hit historic highs, coffee prices soar

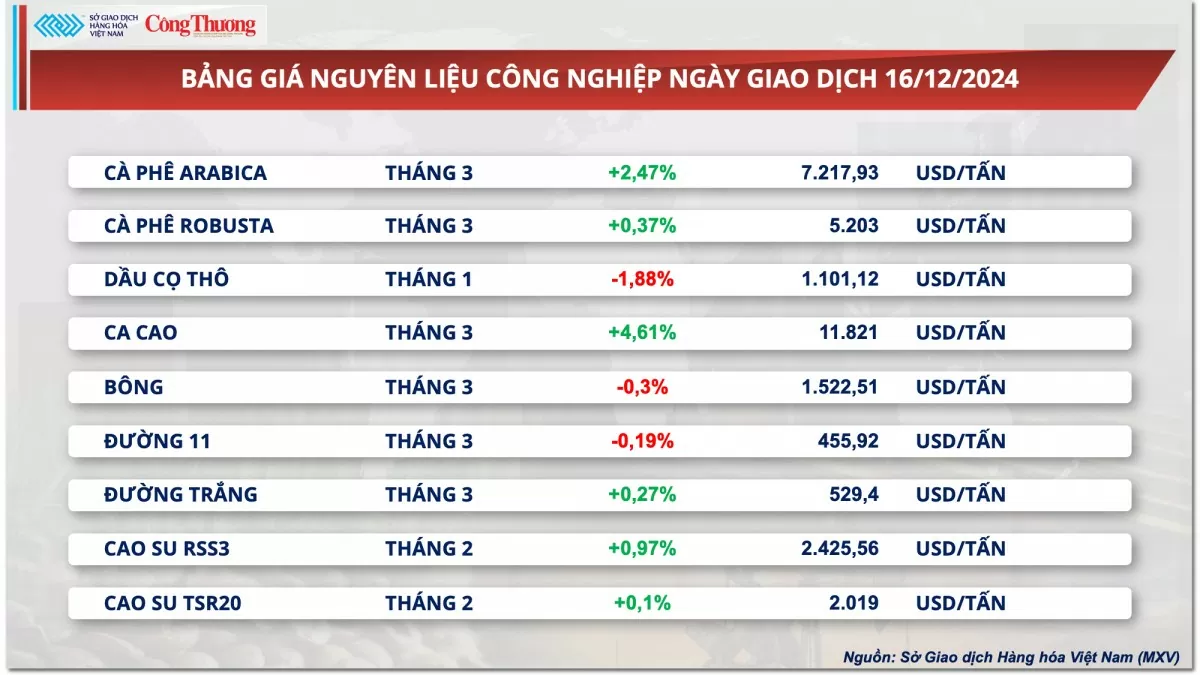

At the end of the first trading session of the week, the MXV-Index of the industrial materials group increased, going against the general trend of the whole market. The focus of the market was on cocoa when the price of this commodity returned to the historical peak set in April this year.

|

| Industrial raw material price list |

Specifically, cocoa prices on the Intercontinental Exchange (ICE-US) yesterday increased by 4.61%, re-establishing a historical peak. During the session, the price approached the $12,000/ton mark. Speculators continued to increase purchases due to concerns about supply shortages.

Cocoa exporters in Ivory Coast estimate that the volume of cocoa arriving in the country from October 1 to December 8 this year increased by 34% compared to the same period last year. However, this high increase is due to the fact that Ivory Coast's harvest and export volume are low and have decreased sharply in 2023. Compared to 2022, the amount of cocoa imported is about 12% lower. Currently, dry weather in Ivory Coast is raising concerns that this will affect upcoming productivity and production.

Cooperatives had previously said that most of the main harvest had been completed by November and the shortage was expected to last until February or March. Meanwhile, multinational exporters are concerned that they may not be able to meet orders due to shortages in supplies from farmers in the coming months.

Besides cocoa, coffee prices also recorded good increases yesterday, especially Arabica coffee. Accordingly, Arabica coffee prices for March 2025 contracts increased by 2.47% and Robusta coffee prices for March 2025 contracts increased by 0.37% compared to the reference. Below-average rainfall in Brazil's main coffee growing region has raised concerns about supply in Brazil amid mixed fundamental information.

The Meteorological Agency Somar reported that Minas Gerais, Brazil’s largest Arabica coffee-growing state, received just 35.2 mm of rain last week, just 65% of the historical average. This means Brazil’s main coffee-growing region has been experiencing consistently low rainfall since April, which could negatively impact the development of the 2025-2026 crop, leading to a negative supply outlook.

In the domestic market, coffee prices in the Central Highlands and Southeast this morning (December 17) were recorded at 123,500 - 125,200 VND/kg, unchanged from December 16. However, compared to the same period last year, coffee prices have now doubled.

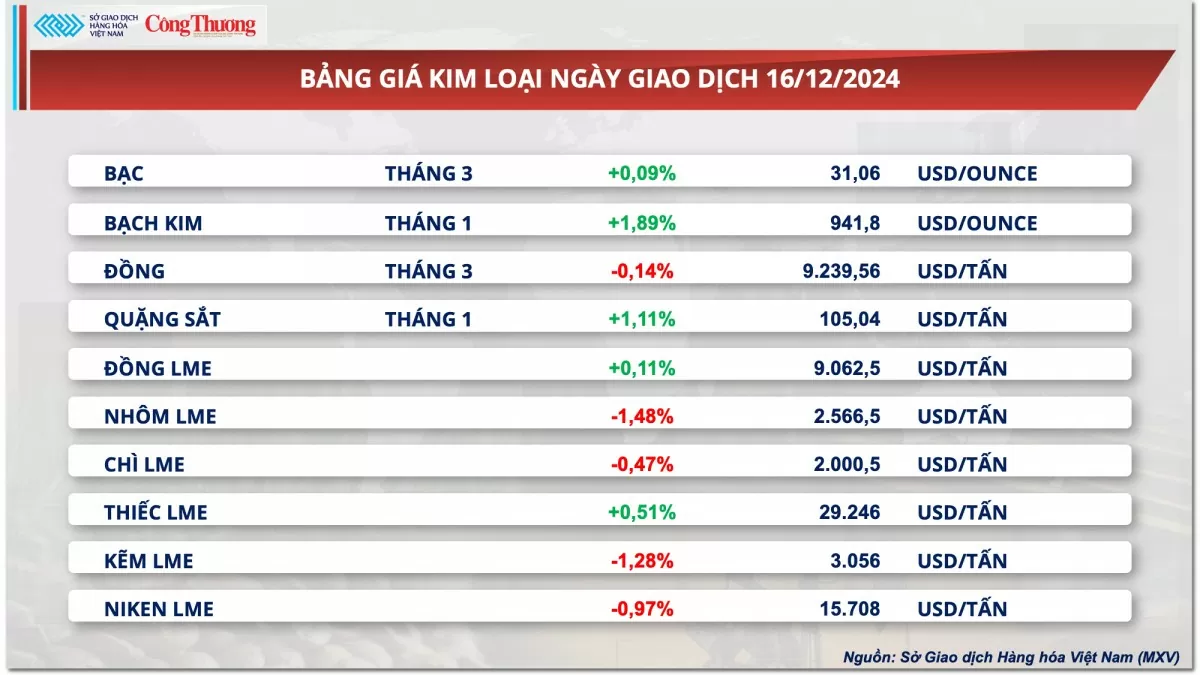

Metal market is divided.

According to MXV, at the end of the first trading session of the week, the metal market was clearly differentiated with 5 items increasing in price and 5 items decreasing in price. However, all items recorded low fluctuations, changing no more than 2%. For precious metals, platinum price recovered with an increase of 1.89% to 941.8 USD/ounce. Silver price inched up 0.09% to over 31 USD/ounce.

|

| Metal price list |

Precious metals are considered safe havens when the economy is in turmoil. As a result, investors have shifted their money into this investment channel, supporting the prices of silver and platinum. In addition, adding to the supportive factor, Citigroup recently forecast that the demand for gold and silver will be strong until US interest rates remain stable. The prices of both metals are expected to continue to increase and peak in late 2025 to early 2026.

In base metals, COMEX copper fell 0.14% to $9,239 a tonne, marking its fourth straight session of decline. Copper prices are under pressure from concerns about sluggish consumption in China, especially after the country released negative economic data that worsened the outlook for copper demand.

Specifically, according to data released by the National Bureau of Statistics (NBS) of China yesterday, the country's retail sales unexpectedly slowed down in November, despite the recent stimulus packages of the Chinese government. In November, China's retail sales increased by only 3% compared to the same period last year, this figure is significantly lower than the forecast of 4.6% and the increase of 4.8% in October. This is also the lowest level in the past 3 months.

Separately, NBS data showed that real estate investment in the country fell 10.4 percent in the first 11 months of the year, a sharper decline than the 10.3 percent decline in the 10-month period. Meanwhile, fixed asset investment rose just 3.3 percent, 0.2 percentage points lower than forecast and the lowest since December last year.

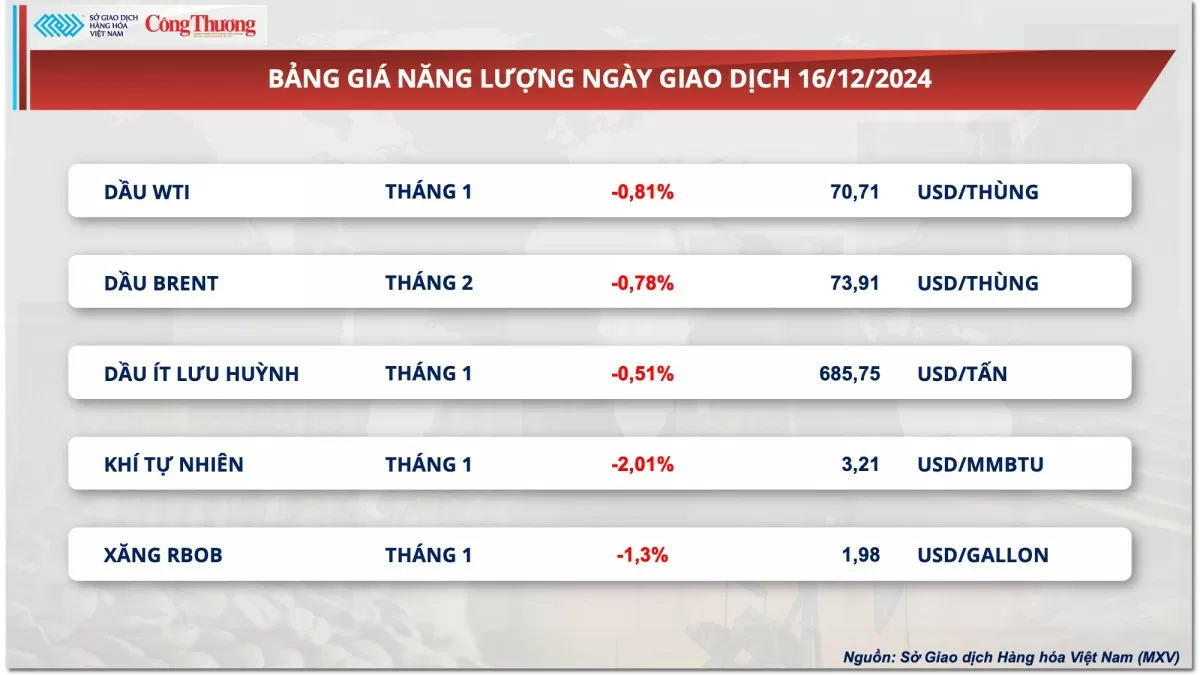

Prices of some other goods

|

| Energy price list |

|

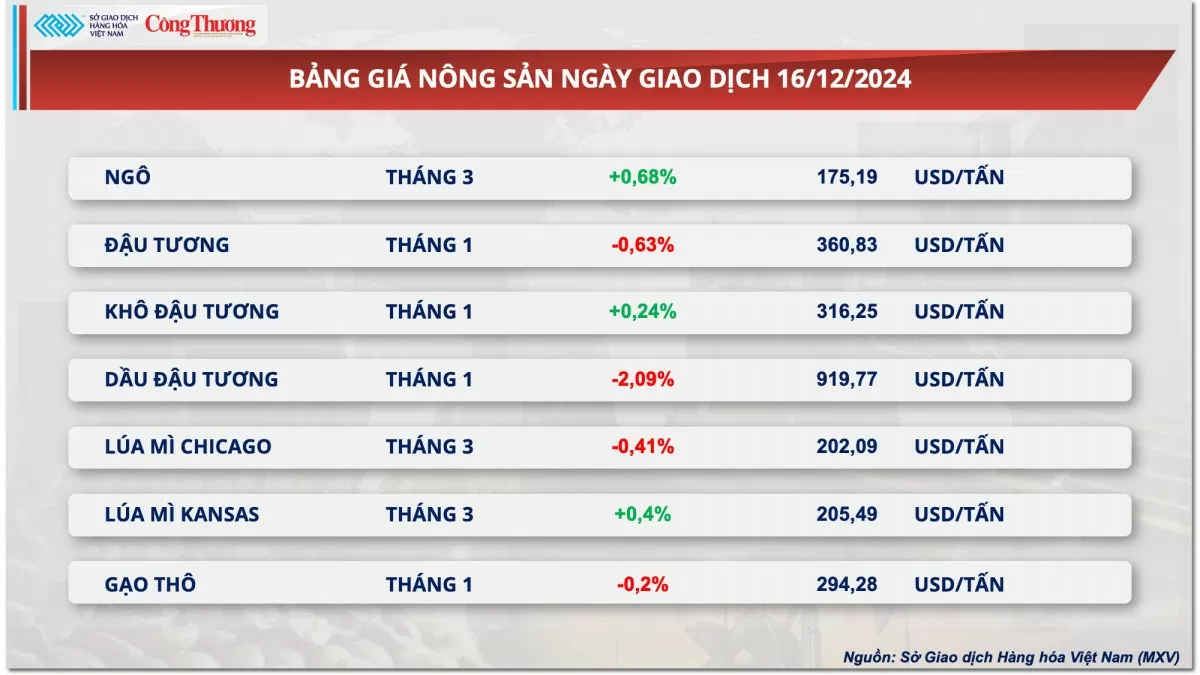

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-1712-gia-ca-phe-arabica-tang-247-364616.html

Comment (0)