| Wheat prices - an indicator of agricultural market risks from political conflicts After corn, wheat prices also face the risk of sharp increases |

Climate change is making weather more unpredictable, putting many major manufacturing nations at a disadvantage. Can the US seize this opportunity to regain its former glory?

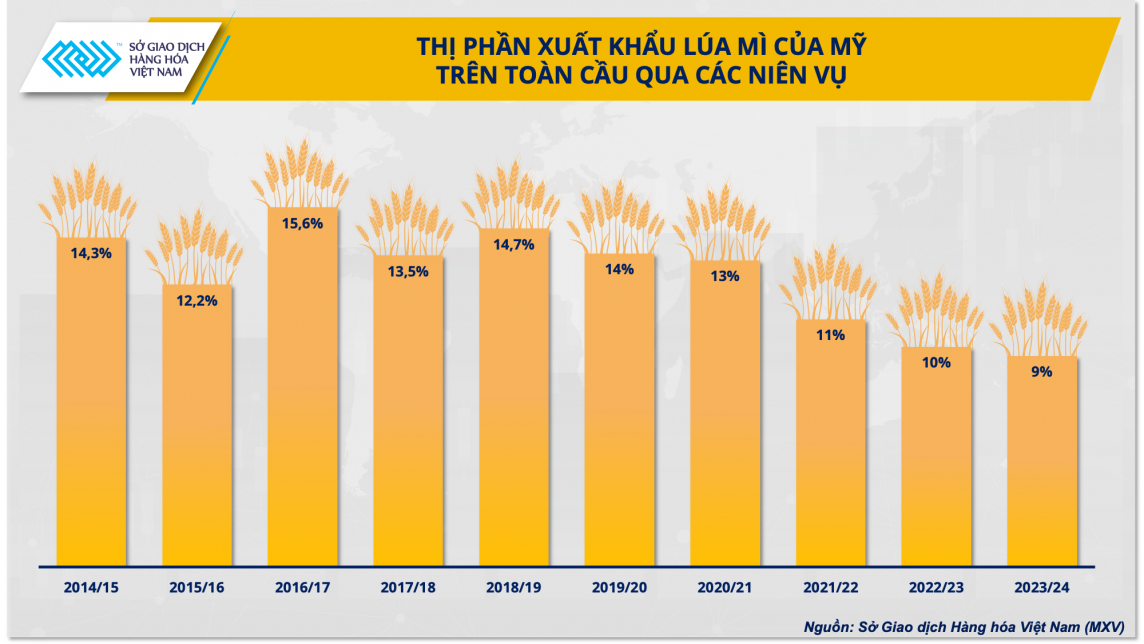

Market share continues to shrink

In recent years, the US wheat market share in the global market has been shrinking. Since the 2020-2021 crop year, US wheat exports have decreased for three consecutive crop years, signaling an alarming trend in demand.

According to the latest data from the US Department of Agriculture (USDA), US wheat exports in the 2023-2024 crop year will only reach 19.6 million tons, the lowest level since 1971. It can be said that in the eyes of importers around the world, the attractiveness of US wheat has decreased significantly.

|

| US wheat export market share globally by crop year |

Despite the volatile geopolitical situation in the world that poses challenges to food security in many countries, U.S. wheat remains a low-cost choice for many international traders. This can be attributed to a number of factors, including fierce competition from other producers with lower costs and geopolitical changes that have changed global trade flows.

As a result, U.S. wheat is losing market share to competitors in the Black Sea region and South America, which offer more competitive prices and lower transportation costs. This shift is not only a warning about long-term trends, but also poses a major challenge for U.S. farmers and exporters in maintaining and expanding their share of the international market.

Risk of damage in major producing countries

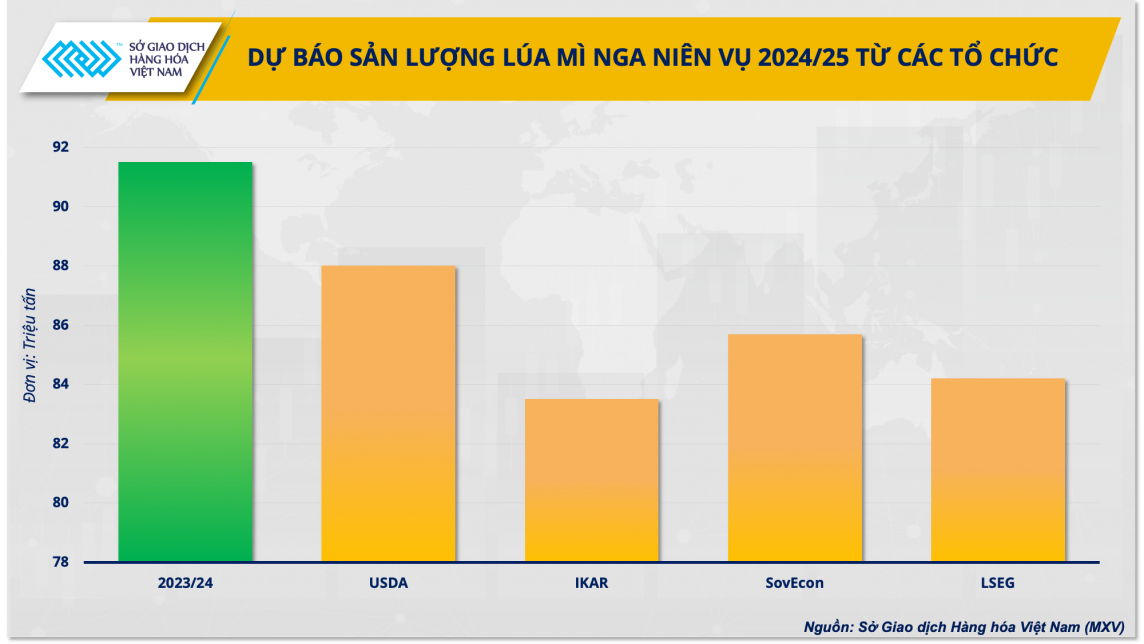

Global wheat supplies are already facing serious concerns amid increasingly heated geopolitical tensions in the Middle East and the Black Sea. Recent extreme weather in Russia, the world’s top wheat supplier, has especially drawn international attention.

Last week, eight major grain-growing regions in Russia declared a state of emergency after frost in early May caused severe damage to crops. In addition, southern Russia has had virtually no rain since April, causing soil moisture to drop significantly in major producing regions such as Krasnodar, Rostov and Stavropol. According to the Russian Ministry of Agriculture, the frost has affected about 1% of the country’s grain area this year, or about 900,000 hectares.

|

| Organizations' forecasts for Russia's 2024/25 wheat production |

The severe weather conditions in Russia will have a profound impact on the global wheat market, given its pivotal role in supplying many countries. In the current volatile environment, wheat importing countries need to diversify their supply sources and develop contingency strategies. This will not only help them mitigate risks but also ensure food security in the face of unpredictable geopolitical and climatic conditions.

|

| Mr. Pham Quang Anh - Director of Vietnam Commodity News Center |

“The shortage of wheat from Russia could create opportunities for other major wheat exporting countries such as the US, Canada and Australia. These countries can take advantage of the opportunity to increase production and expand the market share that Russia has lost due to the narrowing supply,” said Pham Quang Anh, director of the Vietnam Commodity News Center.

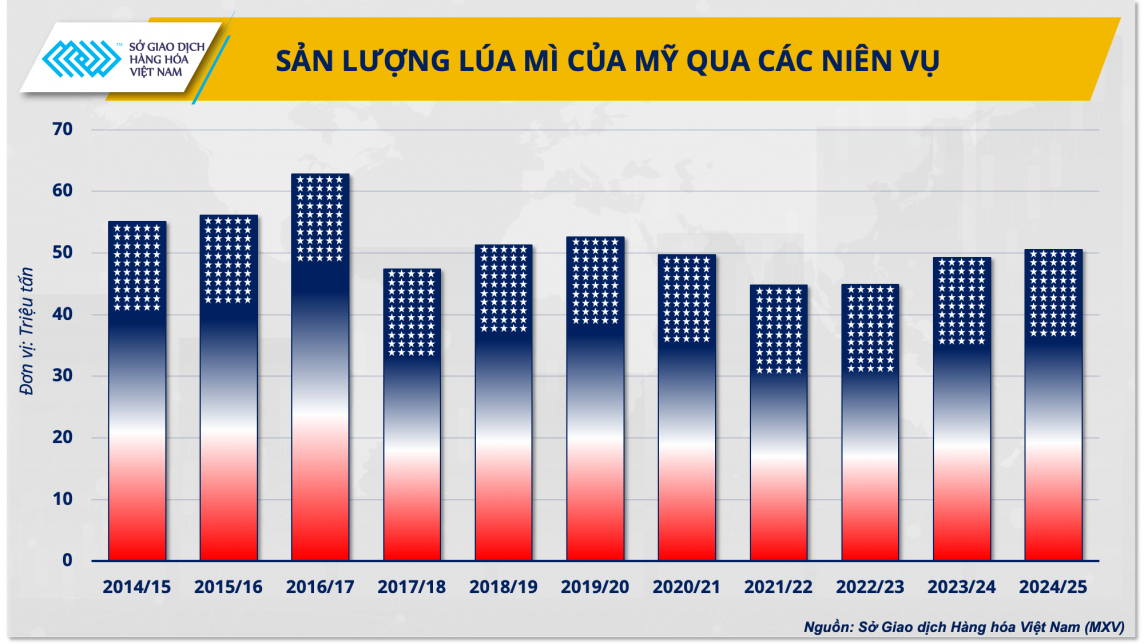

Opportunity for US wheat

With a positive supply forecast this year, the US may have a chance to regain its share of the global wheat market. In its May World Agricultural Supply and Demand report, the USDA forecasts US wheat production in 2024-25 to reach 50.56 million tonnes, up from 49.31 million tonnes in the current crop year. Exports are also expected to increase to 21.09 million tonnes next season, up from 19.60 million tonnes this year.

During their recent annual tour of Kansas, crop experts forecast the state’s wheat yield to reach 3.13 tons per hectare, the highest since 2021 and well above the 2018-2023 five-year average of 2.85 tons per hectare. In most areas surveyed, conditions were generally favorable despite some adverse weather. Wheat yields in northern Kansas were also expected to be at a three-year high, providing good supply prospects.

|

| US wheat production over crop years |

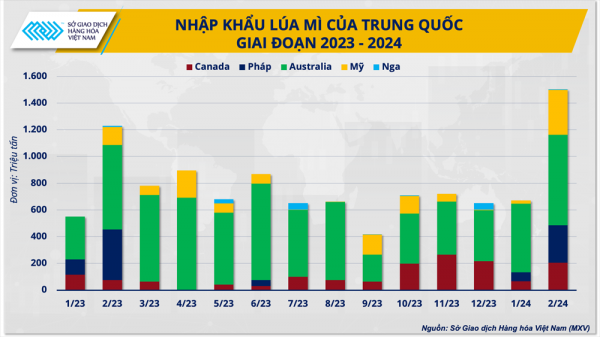

Last December, China placed a record-breaking order for soft red winter wheat (SRW) from the US. Although most of it was canceled due to the subsequent sharp decline in prices, this shows that the US remains one of the top choices when global supply tensions occur. Clearly, the US’s role in maintaining stable wheat supplies cannot be denied.

Mr. Pham Quang Anh commented: “ The volatility of the world geopolitical situation and the decline in production in Russia could disrupt the current global wheat export market share. The US could emerge this year as a reliable alternative source, and at the same time regain some of its previous market position.”

With increased yields and stable wheat quality, the US can meet the needs of the most demanding markets, thereby expanding market share and rebuilding the trust of international partners.

Source: https://congthuong.vn/co-hoi-cho-lua-mi-my-tim-lai-thi-phan-toan-cau-321635.html

Comment (0)