| Russia Exports Record Wheat: What’s Behind the Trade Move? Wheat Prices Rise to End Three-Session Losses |

However, risks to the global supply outlook remain…

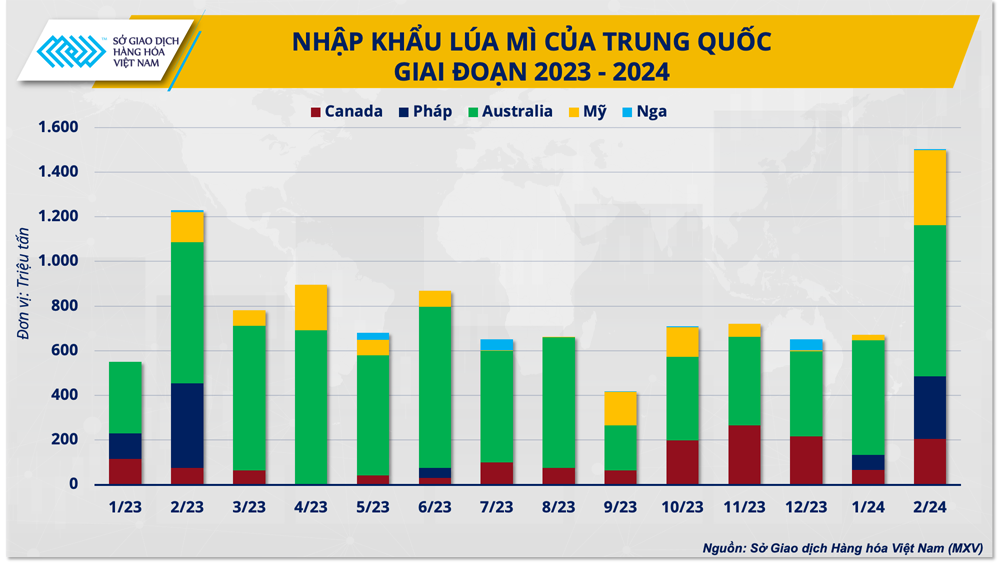

Wheat prices “follow” Chinese demand

China is a major player in the global wheat market, ranking first in production and also number one in imports. The country mainly buys wheat from major producers such as Australia, France, Canada and the United States.

|

| China's wheat imports in 2023 - 2024 |

It is therefore not surprising that China’s moves in the international trade market often influence wheat price trends. Late last year, the country unexpectedly placed a series of orders for US soft red winter wheat (SWR) due to heavy rains affecting its domestic crop. These orders are what are causing the current price slump.

However, China then continuously canceled previously purchased wheat orders from the US, totaling 504,000 tons, the largest volume recorded by the US Department of Agriculture (USDA) since 1999.

The world’s largest grain importer has also canceled a series of orders from other countries. According to FranceAgriMer, grain traders said China has canceled some purchases of French wheat. In addition, about 1 million tons of Australian wheat has also been canceled and delayed by Beijing.

Why is China canceling orders en masse?

China’s mass cancellation of wheat orders is clearly unusual. According to Mr. Pham Quang Anh, Director of the Vietnam Commodity News Center, there are three main reasons for this move.

|

| Mr. Pham Quang Anh, Director of Vietnam Commodity News Center |

First, there is a relatively abundant supply of wheat in the world today. Wheat exports from the Black Sea region are running smoothly, unlike two years ago. Ukraine’s shipping industry has also recovered and adapted after the end of the Black Sea agreement.

Meanwhile, cheap supplies from Russia have also flooded the market as the country is pushing to sell off its previous crop’s inventory to free up space for this year’s bumper harvest. This has made China’s supply choices much more diverse at present, no longer tied to a few specific countries as in the past.

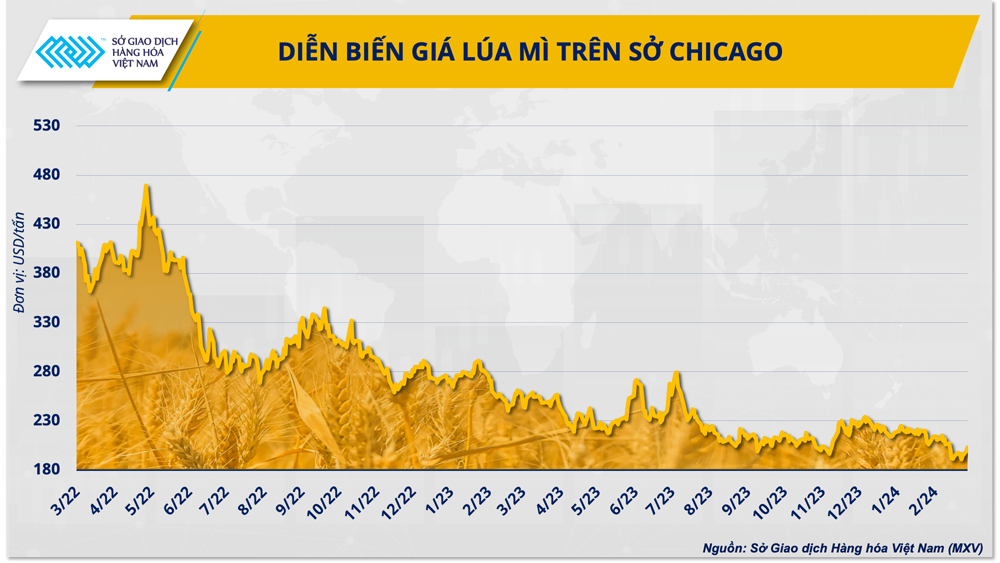

Second, wheat prices are falling sharply compared to last year. After peaking in 2022, wheat prices have fallen more than 60% from their peak. Since the beginning of 2024, wheat has continued to fall more than 14%, reaching its lowest level since August 2020. The sharp drop in prices has made contract compensation costs even lower than placing new orders at current low prices. This has prompted Chinese importers to cancel old orders purchased at high prices from the US, France and Australia.

|

| Wheat price developments over the past 2 years |

Third, China’s domestic supply is also high while demand is low. Although the country’s wheat crop suffered some damage from bad weather last year, overall production remains stable. In its March World Agricultural Supply and Demand Report (WASDE), USDA maintained its forecast for China’s 2024/25 wheat production at approximately 136.6 million tons. However, the ongoing difficulties in the pig industry have limited the demand for animal feed in the market and affected businesses’ decisions to import raw materials.

Temporary needs are no longer the deciding factor.

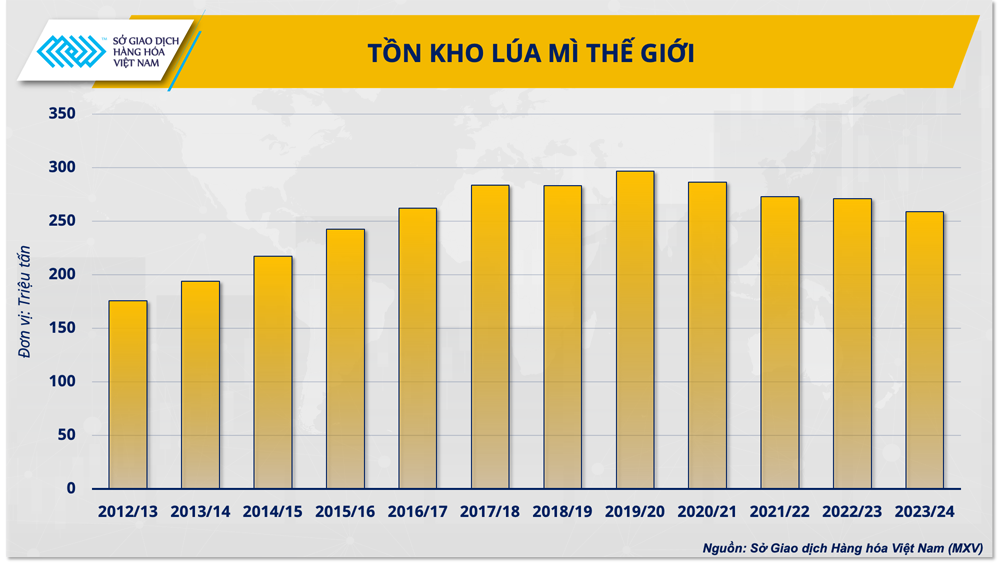

While China’s moves have dampened demand in the short term, the wheat market may still face supply risks going forward. In its March WASDE report, USDA lowered its estimate of global wheat ending stocks in 2023/24 to 258.83 million tonnes, a fourth consecutive annual decline and an eight-year low.

The agency also said that crops in the European Union had been affected after prolonged heavy rains during the planting period. In France, the EU's largest exporter, wheat quality was assessed to be much lower than the same period last year and the lowest since 2020.

|

| World wheat stocks |

In addition, the outlook for the US crop, which is set to be planted in the next month, is also not very optimistic for the world’s second-largest exporter. At the Agricultural Outlook Forum 2024, the USDA lowered its forecast for US wheat plantings this year to 46 million acres, down 5.2% from last year. Experts say the sharp drop in prices has prompted farmers to consider scaling back their crops and switching to more profitable crops.

In addition to global supply uncertainty, geopolitical risks could also be a scenario that could push prices higher. Late last week, Ukraine said Russia had launched airstrikes on its Black Sea port of Odessa, destroying several buildings and damaging businesses. If the situation persists, it could disrupt grain exports from one of Ukraine’s largest deep-water ports, potentially helping wheat recover.

“Overall, in the short term, wheat prices may still face pressure from China’s mass purchase cancellations. However, in the global context, the supply outlook still has many potential risks when geopolitical tensions erupt in important production areas, as well as policies to adjust production scale of important exporting countries,” Mr. Quang Anh assessed.

Source

Comment (0)