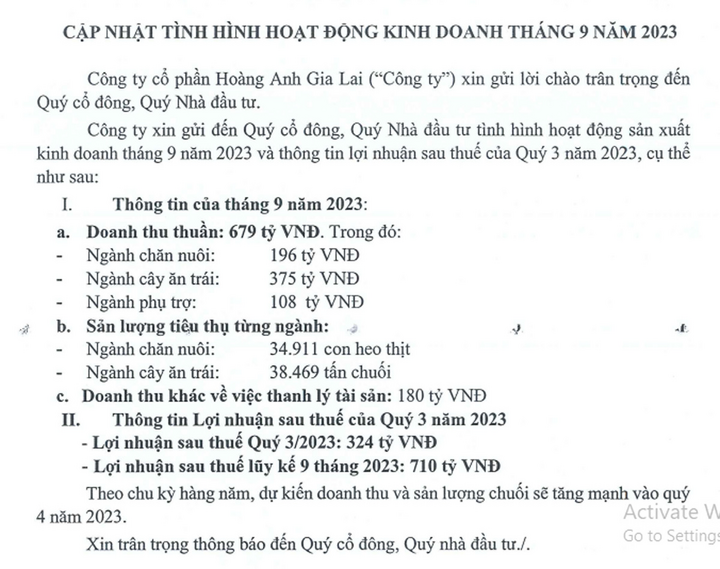

Hoang Anh Gia Lai Group (HAGL, code HAG) has just updated its business performance in the first 9 months of 2023. Accordingly, in the third quarter of 2023, HAGL's after-tax profit was VND 324 billion, a sharp increase of 3 times compared to the previous quarter thanks to the proceeds from asset liquidation worth VND 180 billion.

Specifically, in 9 months, HAGL recorded net revenue of 679 billion VND. Of which, the livestock industry brought in 196 billion VND, fruit trees were 375 billion VND. The supporting industry helped HAGL earn an additional 108 billion VND.

Notably, the revenue from asset liquidation of VND 180 billion helped the profit after tax in the first 9 months reach VND 710 billion (down 20% compared to the same period in 2022).

HAGL's asset sales are no longer rare in the past decade as Bau Duc's business restructures its debts.

For many years, Mr. Duc has been determined to clear all debts at the bank, including debts worth thousands of billions of VND at BIDV, which are expected to be resolved this year.

In his business history, Mr. Duc has sold many valuable assets. Those are HAGL Resort Quy Nhon and Da Lat more than a decade ago. In 2019, Mr. Duc sold the Hoang Anh Gia Lai Myanmar Center project to Thaco and officially withdrew from the real estate sector. This is a complex with office buildings, shopping malls and 5-star hotels.

In 2021, HAGL sold HAGL Agrico to Thaco. HAGL Agrico is an agricultural enterprise of Bau Duc and has a large land area.

On September 30, 2023, the Board of Directors passed a resolution to sell the property attached to the land, which is the HAGL hotel project in Pleiku city, Gia Lai province. This is the first 4-star hotel in the Central Highlands, operating since the end of 2005 with 117 bedrooms. Hoang Anh Gia Lai has held many annual general meetings of shareholders at this hotel.

HAGL sold the hotel to pay off part of its 2016 bond debt at the Bank for Investment and Development of Vietnam (BIDV). All proceeds from the sale of this non-profitable asset will be given priority to pay off the bond obligations at BIDV.

Hoang Anh Gia Lai recorded asset liquidation of 180 billion VND.

According to the 2023 semi-annual financial report, HAGL's outstanding bond debt at BIDV is VND5,271 billion. As of the end of September 2023, HAGL is late in paying VND2,870 billion in interest and late in paying VND1,157 billion in principal of the above bond lot. HAGL is expected to make payment in the fourth quarter of this year.

HAGL said the reason for the delay in payment was the expected source of money to collect debt from HAGL Agricultural Company - HAGL Agrico and liquidate some unprofitable assets of the company.

Despite selling many assets, HAGL still has many other debts. By mid-2023, HAGL will have VND8,085 billion left. HAGL plans to issue private shares worth more than a thousand billion VND to pay off bond principal and interest and to restructure debt at TPBank, while also adding working capital.

In recent years, HAGL has focused on a few crops and pig farming. The crop that Mr. Duc expects the most is durian, with a total of about 1,200 hectares with a large amount of fruiting by the end of next year. In 2023, HAGL will harvest about 80 hectares.

The chain segment has achieved much success with sales to China. However, the most anticipated segment is durian. HAGL still has 5,000 hectares of land and can grow more of this fruit.

Bau Duc is a famous businessman, once the richest man on the Vietnamese stock market in 2008-2009 with a wallet of thousands of billions of dong. HAGL shifted strongly to the agricultural sector, but then failed when the price of "white gold" rubber fell.

Bau Duc is a famous businessman who has made many contributions to Vietnamese football, but is also known for his many immortal statements that have caused a storm of public opinion and shock in the fields of business and football.

(Source: Vietnamnet)

Source

![[Photo] Prime Minister receives a number of businesses investing in Ba Ria-Vung Tau province](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/8e3ffa0322b24c07950a173380f0d1ba)

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

![[Photo] President Luong Cuong receives Ambassador of the Dominican Republic Jaime Francisco Rodriguez](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/12c7d14ff988439eaa905c56303b4683)

Comment (0)