USD exchange rate today (March 1): Early morning of March 1, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 30 VND, currently at 24,726 VND.

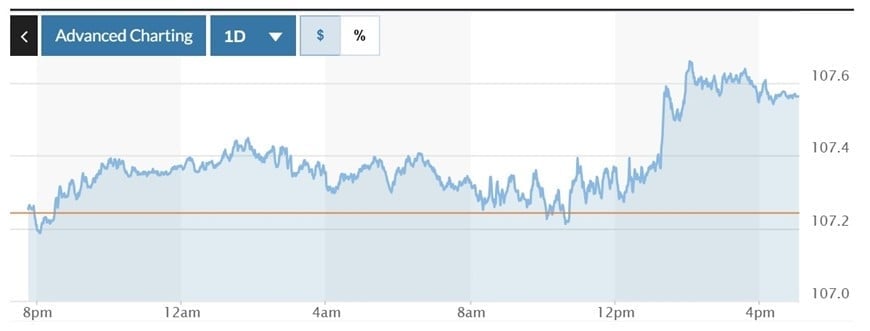

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.32% to 107.56.

USD exchange rate today in the world

The US dollar continued to gain, while the euro fell in the last trading session, after a meeting between Ukrainian President Volodymyr Zelensky and US President Donald Trump dashed hopes of any peace deal being reached soon in the Russia-Ukraine conflict.

It is known that Mr. Zelensky left the White House early after the meeting, without signing an agreement on the joint development of natural resources between Ukraine and the United States.

“The hope of a peace deal or ceasefire between Russia and Ukraine is probably not going to happen right now, which will bring volatility to the currency markets,” said Jack Mcintyre, portfolio manager at Brandywine Global in Philadelphia.

The euro fell after the meeting and closed down 0.29 percent at $1.0367, after falling to $1.0359, its lowest since Feb. 12. The common European currency has shown signs of stability after falling for months from a more than one-year high in September, partly due to hopes of a peace deal.

The US dollar initially fell slightly in trading, after inflation data largely matched investors' expectations, while consumer spending unexpectedly fell.

The Personal Consumption Expenditures (PCE) price index rose 0.3% in January, matching economists' expectations in a Reuters poll, after rising 0.3% in December. In the 12 months through January 2025, the PCE index rose 2.5%, after rising 2.6% in December. However, consumer spending, which accounts for more than two-thirds of US economic activity, fell 0.2% in January, after rising 0.8% in December. The DXY index then closed up 0.23% at 107.61.

The dollar gained about 0.9% for the week, but fell 0.8% in February, on track for its biggest monthly decline since September 2024.

Expectations that the Federal Reserve will cut interest rates by at least 25 basis points at its June meeting rose after the PCE data. Markets are pricing in a 79.1% chance of a rate cut, up from nearly 70% in the previous session, according to the CME FedWatch Tool.

Fed officials have recently expressed expectations that the central bank will keep interest rates on hold until there is more clarity on the impact of tariffs on inflation, as well as signs that the US economy is slowing.

The greenback fell nearly 4% from a more than two-year high hit in January earlier this week, on concerns about economic growth and inflation in the United States, as US President Donald Trump changed the deadline for imposing tariffs on Canada and Mexico.

On February 27, Mr. Trump said the proposed 25% tariff on goods from Mexico and Canada would take effect from March 4, along with an additional 10% tariff on Chinese imports.

The Canadian dollar fell 0.14% against the greenback in the last trading session, to CAD1.45; while the Mexican peso fell 0.3% against the USD, to CAD20.557.

Against the Japanese yen, the dollar rose 0.53 percent to 150.59, but has fallen nearly 3 percent for the month, as investors largely expect the Bank of Japan to raise interest rates this year.

The pound weakened 0.23% to $1.2568.

USD exchange rate today domestic

In the domestic market, at the beginning of the trading session on March 1, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD increased by 30 VND, currently at 24,726 VND.

* The reference exchange rate at the State Bank's transaction office increased slightly, currently at: 23,540 VND - 25,912 VND.

USD exchange rate at commercial banks buy and sell as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,340 VND | 25,730 VND |

Vietinbank | 25,220 VND | 25,800 VND |

BIDV | 25,375 VND | 25,735 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center increased slightly, currently at: 24,438 VND - 27,010 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 25,888 VND | 27,308 VND |

Vietinbank | 25,703 VND | 27,203 VND |

BIDV | 26,150 VND | 27,340 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office remains unchanged, currently at: 157 VND - 174 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 163.73 VND | 174.14 VND |

Vietinbank | 165.83 VND | 175.38 VND |

BIDV | 166.23 VND | 173.97 VND |

Source: https://baolangson.vn/ty-gia-usd-hom-nay-1-3-dong-usd-tiep-da-phuc-hoi-eur-giam-5039501.html

Comment (0)