Scams targeting QR codes.

Recently, QR code scams have seen a sharp increase worldwide and in Vietnam. Therefore, users need to be cautious before scanning QR codes, especially those posted or shared in public places, sent via social media, email, etc. Several banks in Vietnam have also warned about credit card scams using QR codes.

Specifically, after befriending victims on social media, scammers send QR codes for users to scan. These codes lead to fake bank websites. Users are then asked to enter their full name, citizen identification number (CCCD), account details, security code, or OTP, resulting in account hijacking. Meanwhile, at busy payment points such as cafes and restaurants, the scam involves pasting a fake QR code over the legitimate one. The scammer then pastes a fake QR code over the legitimate one, causing unsuspecting customers to lose money in seconds. To ensure customer safety, some cafes and restaurants only display the QR code at the cashier counter and constantly remind customers to be careful when scanning it.

Besides the issue of payment QR codes being tampered with, resulting in money being transferred to fraudsters' accounts, recently, malicious QR codes have also been easily spread through articles and images via various messaging applications, forums, and social media groups, especially in live broadcasts (livestreams). When readers or viewers scan the code, they are redirected to gambling advertising pages containing malware that can be installed on their phones…

The QR code scam recently busted by the Lam Dong Provincial Police is a case in point. Investigations revealed a group distributing flyers featuring images of attractive young women along with QR codes to entice users to scan them to access a website and download an application. However, the application contained malware designed to steal users' information and data.

In reality, QR codes are not malicious code used for direct attacks, but rather as an intermediary for transmitting content. Therefore, whether a user is attacked depends on how they handle the content after scanning the QR code. To avoid being scammed through this method, users need to be cautious before scanning QR codes, especially those posted or shared in public places, sent via social media, or email. Users also need to carefully identify and verify the account information of the person exchanging the QR code; and carefully examine the content of the website linked to the QR code.

Mr. Nguyen Duy Khiem (Department of Information Security, Ministry of Information and Communications) noted that QR codes have become increasingly popular everywhere, not only in Vietnam but also in many countries around the world. Payment methods using QR codes are becoming more familiar and widespread among Vietnamese users.

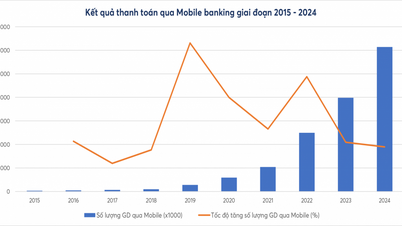

According to statistics from the Payment Department ( State Bank of Vietnam ), QR code payments have experienced strong growth in both quantity and value. In 2022, payments via QR code increased by over 225% in quantity and over 243% in value. In the first five months of 2023, payments via QR code scanning increased by 151.14% in quantity and 30.41% in value compared to the same period.

The Information Security Agency advises users to exercise caution before scanning QR codes, especially those posted or shared in public places, sent via social media, or email.

The Cybersecurity Department requests that agencies, units, and organizations providing QR codes pay attention to disseminating warnings to users and promptly provide solutions to verify transactions showing signs of irregularities; and regularly check the QR codes posted at the point of sale.

Misappropriating OTP codes and bank accounts.

The Payment Department of the State Bank of Vietnam has just issued document No. 4893/NHNN-TT to credit institutions, warning about scams aimed at stealing OTP codes and bank account information. According to the document, the scammers impersonate bank employees and call customers under the pretext of checking balances and transactions. When customers provide their name and the first six digits of their domestic debit card, the scammers ask them to read the remaining numbers on the card to confirm ownership.

The scammer then informs the customer that the bank will send a text message and asks them to read out 6 numbers. These are actually OTP codes for online payments, and if the customer follows the scammer's instructions, they will lose money from their card account.

The Payment Department also reported that fraudsters often create fake bank websites to receive and answer questions about bank services, aiming to collect personal information, transaction history, and account details. In addition, fraudsters send messages impersonating the bank's brand to customers, notifying them of unusual activity in their accounts and instructing them to verify information, change passwords, etc. From there, the fraudsters obtain customers' confidential information to steal money from their accounts.

Mr. Vu Minh Hieu, Head of Cybersecurity Department, Bkav Group, shared that in many cases, if customers provide confidential information for online banking services such as usernames, passwords, and OTP codes to fraudsters, their accounts can easily be compromised. According to Mr. Vu Ngoc Son, Director of Technology at the Vietnam National Cybersecurity Technology Company, to avoid losing bank accounts or having OTP codes stolen, users should absolutely not provide personal information such as login credentials or social media accounts.

"Users should not follow instructions from strangers that could inadvertently reveal personal information such as bank account details (account number, OTP code), citizen identification number, phone number, and residential address. This is how to protect themselves from online scams," Mr. Vu Ngoc Son emphasized.

Online scams increased by 64%.

According to the Vietnam Information Security Warning Portal, in 2022 there were approximately 13,000 cases of online fraud with two main types: fraud to steal personal information (accounting for 24.4%) and financial fraud (75.6%). Fraudulent theft of personal information also serves as a stepping stone to the development of financial fraud schemes. The ultimate goal is to defraud and seize assets, and the methods exploit the gullibility, lack of access to information, unemployment, low income, and greed of individuals. According to statistics from the Information Security Department (Ministry of Information and Communications), in the first six months of 2023, online fraud in Vietnam increased by 64% compared to the same period.

The Ministry of Public Security also announced that there are currently three main types of fraud: brand impersonation, account hijacking, and other combined forms. These three types of fraud are further categorized into 24 different scams, such as: "cheap travel package" scams; Deepfake and Deepvoice video call scams; "SIM blocking" scams due to unstandardized subscriber numbers; impersonating teachers or medical staff claiming relatives are in emergency care to trick people into transferring money; impersonating financial companies and banks, etc. These scams target the elderly, children, students, young people, workers, and office staff. According to the Ministry of Public Security, raising awareness and equipping individuals with basic knowledge and skills to ensure information security in cyberspace is a key factor in creating a safe Vietnamese cyberspace, contributing to the promotion of digital transformation and the sustainable development of the digital socio-economic infrastructure. This is a necessary and urgent task in the digital age: protecting information security for all those participating in online activities.

Source

![[Image] Ho Chi Minh City simultaneously commences construction and breaks ground on 4 key projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2026/01/15/1768472922847_image.jpeg)

Comment (0)