The rapid development of technology has led to increasingly high customer expectations for financial products. Today's digital banking experience is not limited to convenience, speed, and safety, but must also be suitable for each user profile.

Trendsetting Bank

Techcombank is still known as "Trendsetting Bank" thanks to its heavily invested technology platform, especially in digital experience.

A typical example, in 2016, this bank in the top most effective business in Vietnam implemented Zero Fee, creating an "earthquake" in the market when it exempted all fees for customers using Techcombank's digital banking services, even though at that time the service fees could reach thousands of billions of VND and were a major source of revenue for banks. After a while, a series of other banks also followed suit, and to date, almost all banks in Vietnam no longer charge fees.

Or in January 2024, Techcombank was the pioneer bank in Vietnam to implement "Automatic Profit" - paying high interest rates on idle money in payment accounts with the Automatic Profit feature enabled. The "revolution" created by Techcombank has attracted nearly 3 million more customers after more than a year of launching, helping to optimize benefits of nearly VND 80,000 billion of customers.

After more than a year, up to now, there have been a series of banks implementing interest payments on money in accounts similar to the "Automatic Profit" version of Techcombank in the early stages, but with different names, just like the way the "transaction fee-free era" in Vietnam was created from Techcombank's initiative.

However, customers always expect improvement, especially in experience. This has motivated Techcombank to launch version 2.0 of "Automatic Profit" after only 01 year and optimize the customer experience more completely thanks to convenient features, absolute seamlessness with a processing speed of only 1 second for all operations, payment on all channels without any restrictions.

"Automatic Profit" Sets a New Standard

"Automatic Profit" is a product of Techcombank but has attracted the rapid participation of many banks and the support of millions of customers, thereby establishing new standards for financial products, including:

Flexible use of the entire account balance 24/7 while the money is optimized for yield :

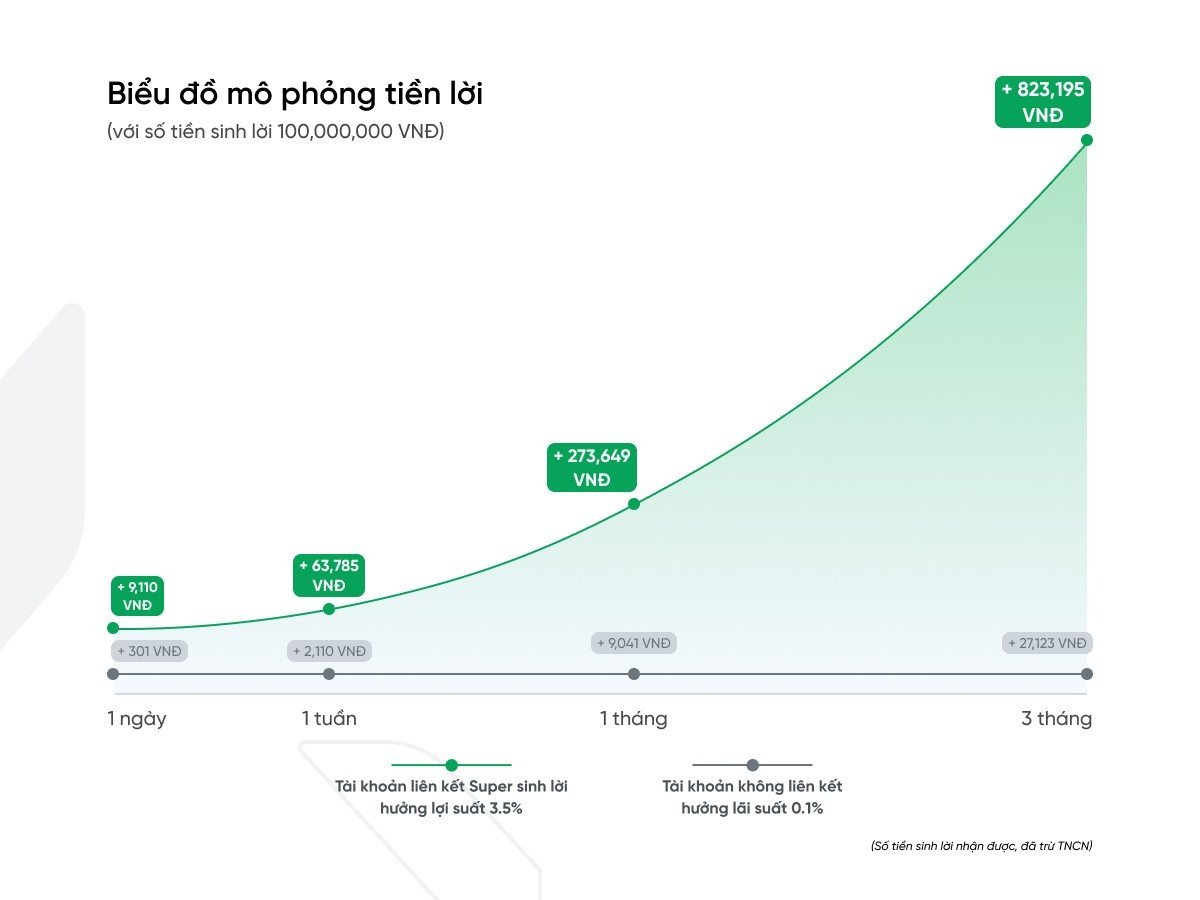

The special feature of Automatic Profit is its flexibility. With just 01 click, customers no longer have to worry about choosing what to optimize the yield for idle money, everything is automatically set up so that the account always reaches the highest yield, up to 4%/year. Unlike only allowing customers to use a part of the account balance in certain time frames, the newly launched Automatic Profit version 2.0 of Techcombank has helped customers flexibly use the entire account balance for all transactions such as payment, transfer or withdrawal 24/7 anytime, anywhere. The automatic transfer system ensures that spending needs are not interrupted. While the current version of some banks will only allow customers to use a part of the account balance in certain time frames. At the same time, instead of having to have an amount of 10 million VND or more for regular customers and over 100 million VND for priority customers to "make a profit", with "Automatic Profit" 2.0, the entire amount of money in the account has been optimized, eliminating all gaps in the threshold for making a profit. All idle money of customers is profitable, even for just 1 day.

Changing financial management habits: When customers tend to keep money in their accounts for longer, they will generate more yield from idle money. This encourages customers to keep money in their accounts instead of withdrawing it for unnecessary spending, because the higher the balance, the greater the profit. In addition, customers also avoid wasteful spending, thereby building a better financial habit.

Superior digital experience: With just one operation, customers can easily manage their profitable money right on the app, receive interest every day and track the profits generated. This also encourages customers to use more digital banking services, from checking balances, tracking profits, to making payment transactions. With the "Automatic Profit" version 2.0, Techcombank has continuously improved and has a breakthrough solution with a monthly interest payment mechanism that helps customers easily track the yield from idle money in a simple and intuitive way. The addition of nearly 3 million new customers, more than half of whom come from digital channels, and nearly 15 million Techcombank users joining the current "Automatic Profit Era" are the clearest proofs.

One initiative - many values

"Automatic profit" not only helps this bank grow rapidly, but also brings many values to customers, the banking industry as well as the whole society.

For customers, the fact that many people turn on "Automatic Profit" and encourage other banks to join in and implement it shows that this product is really attractive and brings practical benefits.

For the banking industry, "Automatic Profit" encourages customers to use digital channels instead of traditional transactions at the counter, helping banks reduce operating costs, optimize resources and move towards a modern banking model. In addition, it also promotes competition between banks, thereby creating increasingly superior products for users.

As for the whole society, it is clear that in the current 4.0 era, financial products and services are increasingly optimized and bring better benefits and experiences, so users coming to digital banks are always the top priority. This contributes significantly to promoting cashless payments in society and soon completing the goal of cashless payments set by the Government.

Pioneering in providing innovative financial products such as "Automatic Profit" also helps Techcombank affirm its position as a leading bank in innovation, enhancing its reputation in the industry.

Source: https://thanhnien.vn/techcombank-sinh-loi-tu-dong-20-va-cau-chuyen-tao-xu-the-ve-trai-nghiem-so-185250319183438315.htm

![[Photo] Prime Minister receives a number of businesses investing in Ba Ria-Vung Tau province](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/8e3ffa0322b24c07950a173380f0d1ba)

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

![[Photo] President Luong Cuong receives Ambassador of the Dominican Republic Jaime Francisco Rodriguez](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/12c7d14ff988439eaa905c56303b4683)

Comment (0)