Vietnam Technological and Commercial Joint Stock Bank (Techcombank) announced its 2024 business results with positive results, many indicators were at the top of the system, reaching a record level. The bank's pre-tax profit reached VND 27.5 trillion - up 20.3%; total operating income (TOI) reached VND 47.0 trillion - up 17.3% over the same period in 2023.

The current account balance (CASA) ratio reached 40.9% with Techcombank’s CASA balance, including the Automated Interest balance, reaching a record high of nearly VND231 trillion. Techcombank continued to maintain its leading position in the industry with its Basel II capital adequacy ratio (CAR) continuing to increase to 15.3% and return on assets (ROA) reaching 2.4%.

Net interest income and investment banking fees grow impressively

Techcombank recorded net interest income (NII) of over VND35.5 trillion for the whole of 2024, a positive growth of 28.2% YoY with a 12-month NIM of 4.2%, up 20 bps YoY. On the other hand, with strong CASA growth, Techcombank maintained its Q4 funding cost at 3.4%, down 76 bps YoY.

Service income (NFI) recorded a 4.4% increase year-on-year to over VND10.6 trillion. The single-digit growth mainly came from the high base level of the previous year. Notably, investment banking service fees reached VND3,461 billion, up 88.2% year-on-year, with nearly VND914.6 billion recorded in the fourth quarter alone, the second highest level achieved in a quarter in the Bank's history.

" By the end of 2024, Techcombank achieved impressive growth with Total Operating Income (TOI) increasing by 17.3% and Profit before Tax (PBT) increasing by 20.3% over the same period last year, exceeding the plan approved by the General Meeting of Shareholders. Up to now, the bank serves nearly 15.4 million customers with outstanding credit increasing by 20.85%, while the bad debt ratio (NPL) has significantly improved to 1.17%. Breakthrough data-driven solutions such as Automatic Profitability, Loyalty Program (Techcombank Rewards), along with many new features for retailers (merchant) have contributed to boosting the balance of non-term deposits (CASA) to increase by 27% in 2024, raising the CASA ratio to 40.9% at the end of Q4.

Moving into 2025, despite the uncertain global economic landscape, Vietnam’s economy is expected to maintain strong growth momentum, giving us confidence in our strategy. Techcombank will accelerate the expansion of its ecosystem with insurance solutions and other comprehensive financial solutions, while further committing to a sustainable development strategy and risk diversification.

With advanced technological capabilities and a customer-centric philosophy, we are ready to embrace opportunities, lead the banking and finance industry in a new era, and create outstanding value for shareholders in the years to come." Mr. Jens Lottner - General Director of Techcombank affirmed.

Techcombank continues to maintain its cost/income ratio (CIR) for the whole year of 2024 at 32.7%, lower than the 33.1% of 2023.

Maintain asset quality and strong balance sheet

As of December 31, 2024, Techcombank's total assets reached VND978.8 trillion, up 15.2% compared to the beginning of the year. Credit grew by 20.85% to VND640.7 trillion within the limit approved by the State Bank. Overall, credit on a consolidated basis increased by 21.7%, of which personal loans increased by 28.4%, significantly higher than the 17.3% increase in corporate credit.

Techcombank's asset quality in Q4/2024 recorded positive improvements. Outstanding loans requiring attention (B2) decreased sharply by 14.0% Q/Q to VND 4,441 billion, equivalent to a B2 ratio of 0.73% (compared to 0.86% in the previous quarter). The B2 ratio before CIC was only 0.56%.

The bank's non-performing loan (NPL) ratio also improved to 1.17%, from 1.35% at the end of the third quarter, including bonds & loans, the bad credit ratio (B3-B5) was only 1.09%. The NPL ratio before CIC was at a low level of 1.0%.

Provision expenses were recorded at VND4,082 billion, up slightly by 4.1% YoY, despite credit growth of 21.7% in 2024, thanks to efforts in risk management, bad debt recovery, and continued improvement in the business environment. Overall, the Bank's credit costs for the whole of 2024 were only 0.8%, flat compared to the previous year and in line with the Board of Directors' forecast. In addition, Techcombank's bad debt coverage ratio increased to 113.8%.

Techcombank’s capital position remains strong at the end of 2024, with a loan-to-deposit ratio (LDR) of 77.1% as at 31 December 2024, an improvement from the previous quarter and remaining below the ceiling of 85% as prescribed by the State Bank of Vietnam (SBV). The ratio of short-term funds used for medium- and long-term loans stood at 26.5%, compared to 24.2% at the end of Q3.

The Bank's Basel II capital adequacy ratio (CAR) continued to increase to 15.3% as at December 31, 2024, much higher than the requirement of Basel II Pillar I (8.0%).

Notably, Techcombank continued to lead the system in terms of CASA ratio index with customer deposits reaching VND565.1 trillion, up 24.3% compared to the beginning of the year. Thanks to the outstanding results from the Automatic Profit feature, the Bank's CASA balance continued to set a new record, recording nearly VND231 trillion, bringing Techcombank's CASA ratio to 40.9%.

TCBS continues to maintain its leading position with impressive market share growth

TCBS had an impressive business year with a 130% increase in plan. In the fourth quarter of 2024, TCBS recorded 933 billion VND in pre-tax profit brings accumulated profit in 2024 to 4,802 billion VND, an impressive growth of 58.6% Y/Y. TCBS maintains market share #3 on HOSE and #2 on HNX with increased market share significant (up 7.7% from 7.1% on HOSE, up 8.3% from 7.9% on HNX in Q3). This shows that TCBS continues to be the top choice of investors thanks to its service quality and Zero fee strategy.

Regarding the bond segment, the volume of bonds issued by TCBS will reach about VND75 trillion in 2024, accounting for nearly 50% of the market share of issued bonds, excluding bank bonds. TCBS's bond distribution volume also recorded strong growth momentum, reaching VND87.3 trillion in the year, 44.4% higher than the previous year.

TCBS continues to affirm its leading position in the financial industry by strongly applying Artificial Intelligence (AI) and especially Generative AI (GenAI) to core business activities, bringing outstanding benefits to customers and organizations. The company applies AI to the programming and automated testing process by using tools such as Co-pilot and AWS, shortening the programming team's time by 40-50%, bringing breakthroughs in performance and cost optimization. In particular, TCBS has developed an Automated Machine Learning (AutoML) platform to search for potential customers, recommend suitable products, forecast business indicators, and detect unusual transactions.

Continued customer growth and positive highlights

Techcombank closed 2024 with approximately 15.4 million customers, attracting more than 1.9 million customers during the year. Of these, 55.1% of customers joined through digital platforms and 43.6% from branch channels, thanks to the Bank's expansion of its retail customer base (merchant) through solutions such as Automatic Profit, Soft POS, and many other attractive programs and products.

According to NAPAS, Techcombank is the top transaction bank in Vietnam in terms of both incoming and outgoing transaction value in all consecutive months since July 2024, and the top market share for the whole year of 2024. In 2024, the volume and value of individual customers' transactions via digital channels will reach 3.3 billion transactions and VND 11.3 million billion, respectively recording growth of 51.1% and 20.0% over the same period of the year.

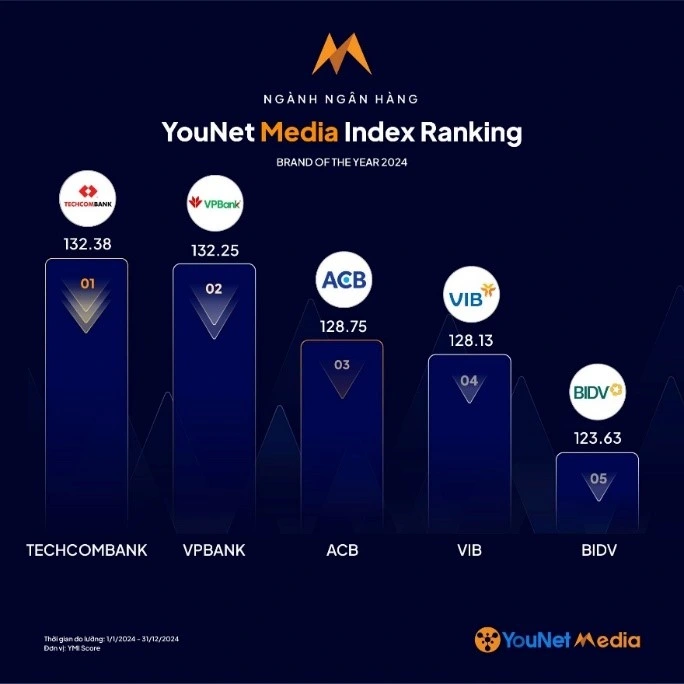

For the first time, Techcombank ranked No. 1 in the Brand Health Index (BEI) and was one of two Vietnamese banks in the "Growing Brand" group according to Nielsen IQ. Techcombank demonstrated remarkable growth thanks to its correct vision, superior technology platform and "Customer-centric" business philosophy. In addition, the Bank's NPS score reached 91 in Q4 2024, ranking 2nd in the industry.

In the fourth quarter of 2024, Techcombank will launch the "Automatic Profit - Version 2.0" feature: A breakthrough solution for customers' idle cash flow and be the first private commercial joint stock bank in Vietnam to issue the Green Bond Framework.

Techcombank has also become the first bank in Southeast Asia to receive the Innovation Excellence Award for its AML anti-money laundering system from Oracle. The system has helped Techcombank further improve the effectiveness of its anti-money laundering control and prevention work according to international standards.

Source: https://thanhnien.vn/techcombank-dat-loi-nhuan-truoc-thue-hon-275-nghin-ti-tang-203-so-voi-cung-ky-185250120213221346.htm

Comment (0)