Fearing a weak recovery from China, global investors have pulled more than $10 billion from the country's stock market - largely through selling their blue-chip holdings.

China's economy is expected to account for a third of global economic growth in 2023. Its sharp slowdown in recent months is therefore setting off alarm bells around the world.

According to economic experts, the impact of China's recession on global economies and financial markets can be observed in many aspects, such as declining international trade , deflationary pressure, slow tourism recovery, declining demand for goods, especially luxury goods, currency and bond impacts, etc.

China’s official data shows that the country’s imports have fallen for nine straight months, as domestic demand has weakened. Among markets, Asia and Africa have been hit hardest, with imports falling more than 14% in the seven months to the start of the year.

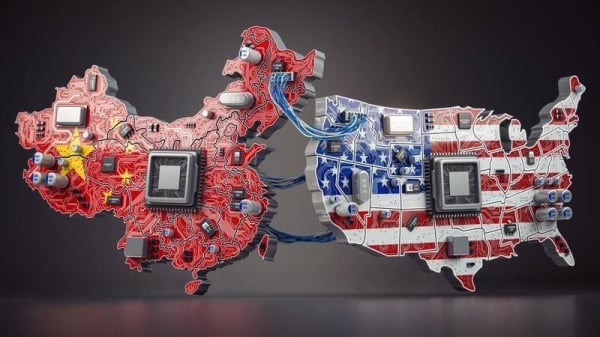

Japan, the world's largest auto exporter, also reported its first fall in exports to China in more than two years in July, after the Asian powerhouse cut purchases of cars and semiconductors .

The central bank governors of South Korea and Thailand last week blamed China's weak recovery for revising down their national growth forecasts.

While actual volumes of raw materials such as iron ore and copper exported to China are still rising, if domestic production continues to shrink, orders could be affected, with implications for miners in Australia, South America and elsewhere.

Gauges of European luxury goods and Thailand's tourism and leisure activity are also seeing declines in China's domestic equity index.

Luxury fashion companies such as LVMH, owner of Louis Vuitton, and Kering SA, owner of Gucci and Hermes International, have acknowledged their vulnerability to any swings in demand from Asia's largest power.

Concerned about China's weak recovery, global investors have pulled more than $10 billion from the country's stock market, largely through selling their blue-chip holdings.

Goldman Sachs and Morgan Stanley recently recommended reducing their exposure to Chinese stocks, warning of risks spreading to the rest of the region.

China’s economic woes have pushed the yuan down more than 5% against the dollar this year. Bloomberg data shows the offshore yuan’s decline is having a bigger impact on currencies in Asia, Latin America, and Central and Eastern Europe.

Widespread weak sentiment could weigh on currencies such as the Singapore dollar, Thai baht, Mexican peso and even the Australian dollar, according to Barclays Bank.

Not all signs are bleak, however. China’s slowdown is likely to drag down global oil prices, and deflation in the country means the cost of goods shipped around the world is falling. That’s a boon for countries like the US and UK that are still struggling with high inflation.

Some emerging markets such as India also see opportunities. The country hopes to attract more foreign investment as a number of global corporations are moving out of China.

But as the world's second-largest economy, a prolonged slowdown in China would hurt rather than help the rest of the world.

An analysis from the International Monetary Fund (IMF) has shown that when China's growth rate increases by 1 percentage point, global growth is boosted by about 0.3 percentage points.

China's deflation is "not a bad thing" for the global economy, said Peter Berezin, chief global strategist at research firm BCA.

But if the rest of the world, including the US and Europe, falls into recession while China's economy remains weak, it will be a problem not only for China but for the entire global economy./ .

Dieu Linh (VietnamPlus)

Source link

Comment (0)