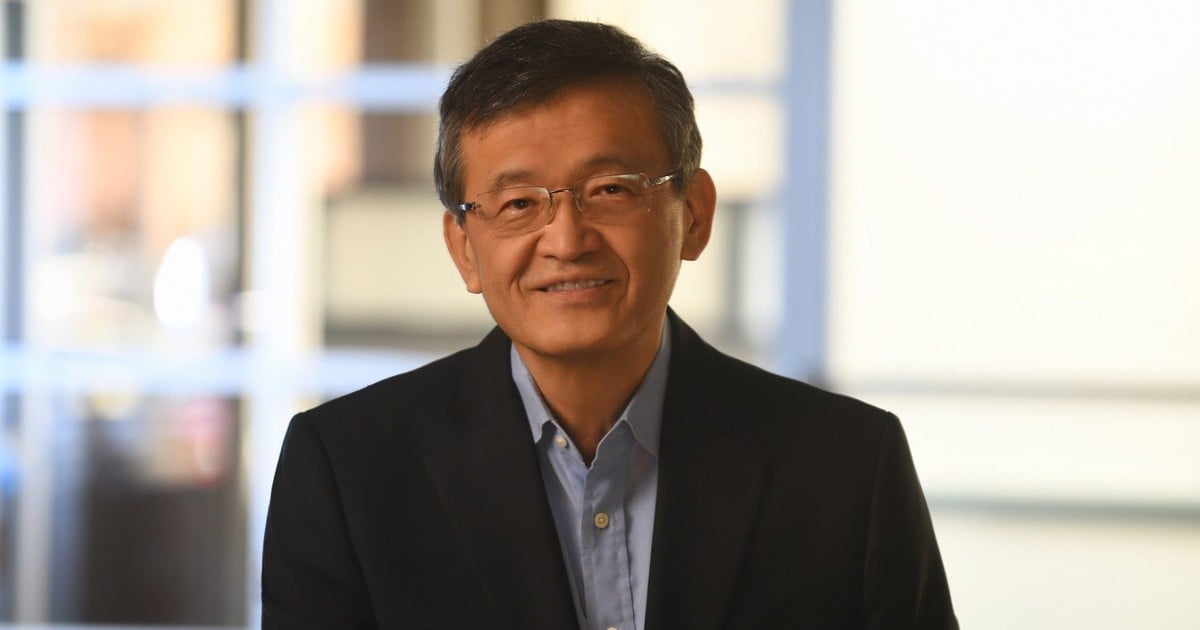

Jack Ma, who retired as Alibaba's executive chairman in 2019, bought about $50 million in Alibaba shares in the fourth quarter of 2023, raising his stake to over 4.3% (the level recorded at the end of 2021) to become the largest shareholder, according to SCMP sources.

Meanwhile, Joe Tsai, who took over as Alibaba chairman from Daniel Zhang in September 2023, also spent $151.7 million to buy 1.957 million shares of the company in the last quarter of last year through his investment firm Blue Pool Management, becoming the second-largest shareholder after Jack Ma. In 2023, he owned 1.4% of Alibaba shares.

The move by the two Alibaba co-founders comes amid a sharp stock market shake-up that has seen the company’s stock drop 11% in value over the same period, reflecting the two men’s confidence that the e-commerce giant they built 25 years ago can be revived, SCMP sources said.

Mr. Ma and Mr. Tsai’s combined stake has surpassed that of SoftBank Group. The Japanese investment group led by Masayoshi Son will hold less than 0.5% of Alibaba by May 2023, according to calculations by Morgan Stanley.

In recent years, as Chinese authorities tightened their grip on the tech sector, Alibaba’s stock has plummeted. In 2020, Alibaba’s $39.7 billion blockbuster IPO of Ant Group was canceled just 48 hours before it was scheduled to go public. Alibaba was subsequently fined a record $2.8 billion and underwent a series of restructurings to comply with domestic antitrust regulations. Alibaba’s stock has fallen 75% from a peak of $300 to $70 on the New York Stock Exchange.

Jack Ma and Joe Tsai's stock purchases helped Alibaba shares rise 7.8% in New York and 5.8% in Hong Kong.

Alibaba has gone from being a symbol of growth to a symbol of economic downturn and unpredictable legal risks. As a result, investor sentiment has also changed. The company has been overtaken by its latecomer rival PDD Holdings as the most valuable Chinese technology company listed in the US, causing employee frustration.

Mr. Ma, who has kept his distance from Alibaba’s day-to-day operations, has maintained a low-key lifestyle, avoiding public scrutiny. Mr. Tsai, by contrast, has returned and embarked on a sweeping restructuring of the group, betting on artificial intelligence and improved services to revive growth.

(According to SCMP)

Source

Comment (0)