VN-Index fell more than 7 points, with liquidity decreasing compared to the previous session, showing that investors are showing caution in trading.

VN-Index faces challenges when reaching the 1,300 zone - Photo: Q.DINH

Breaking the excitement after a session of explosive liquidity, the Vietnamese stock market today (March 5) is facing great profit-taking pressure from investors.

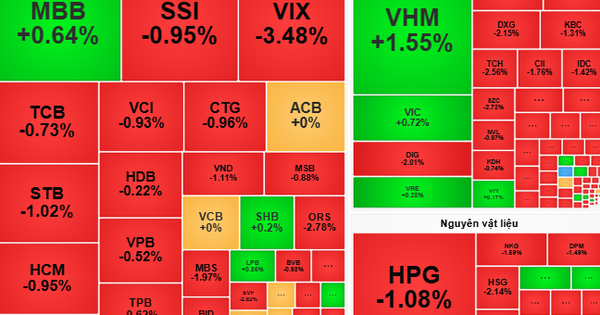

VN-Index drops, more than 500 stocks decrease in price

In the morning session, VN-Index was pulled up to close to the 1,320 point zone thanks to the leadership of the banking group and Vingroup family stocks.

However, cautious sentiment and weakened active demand caused the HoSE representative index to quickly narrow its growth momentum and liquidity to decrease sharply compared to the previous morning.

In the afternoon session, selling pressure increased. VN-Index closed the session down more than 7 points, falling back to 1,304 points.

The entire market had 509 stocks decreasing in points, counterbalancing 246 stocks increasing in points, so red dominated the board. Cash flow was concentrated in banking, real estate, securities, retail, etc.

The codes of the Vingroup "family" such as VHM (Vinhome), VIC (Vingroup) increased points, contributing greatly to pulling the index down.

On the contrary, the adjustment of large-cap stocks such as BID of BIDV, CTG of Vietinbank, HPG of Hoa Phat, FPT, VNM of Vinamilk... has negatively impacted the market index.

Techcombank's TCB shares, after increasing 5.4% in the session on March 4, now also decreased 0.73% as investors wanted to sell to protect their results.

Similarly, Eximbank's EIB (-1.12%) also faced adjustment pressure after 3 consecutive increasing sessions.

Regarding the cash flow trend of the investor group, it seems that foreign investors have no intention of reducing their withdrawals. Continuing the 10-day continuous net selling trend, today this group recorded a net sale of more than 350 billion VND.

The stocks that foreign investors sold the most include: GMD of Gemadept (-95 billion VND), HPG of Hoa Phat (-92 billion VND), NLG of Nam Long (-72 billion VND), VCB of Vietcombank (-65 billion VND)...

Notably, foreign investors matched orders for more than 127 million VIB shares in today's trading session, worth nearly VND2,700 billion.

Money flows into the stock market better

After surpassing 1,300 points from the session on February 24, despite fluctuations, VN-Index still had 7 sessions staying above the strong psychological barrier.

In a recent analysis, Dragon Capital said that compared to previous times, Vietnam's economic context now has many positive supporting factors.

First of all, the loose monetary policy, the Government is pushing to reduce interest rates to stimulate growth. After the telegram to strengthen the implementation of interest rate reduction solutions, many banks have adjusted the deposit interest rate table for all terms.

In fact, cash flow has recently increased significantly compared to the previous period. In yesterday's session, market liquidity was close to the 1 billion USD mark. Today's session, despite a decline, still reached nearly 24,000 billion VND on all 3 floors.

Speaking to Tuoi Tre Online, Mr. Vu Duy Khanh, director of analysis for Smart Invest Securities, said that investor psychology was challenged, and profit-taking pressure increased as the index approached higher levels.

However, liquidity has improved and domestic cash flow is still strong enough to keep the market in rhythm, despite continued net foreign withdrawal.

Mr. Khanh gave two scenarios for the market this week. In scenario 1: Break out of 1,300 points if domestic cash flow continues to remain high (over 20,000 billion VND/day) and the index surpasses 1,310 (the nearest resistance).

VN-Index may head towards the 1,320-1,340 range in the short term, but needs more positive catalysts, such as positive macroeconomic information or good Q1-2025 profit reports from large enterprises.

Scenario 2, according to Mr. Khanh, is more likely that the market will fluctuate around 1,300-1,310 to consolidate the new price base. If there is not enough demand to surpass 1,310, the index may return to test the support zone of 1,290-1,300.

Mr. Khanh is more inclined towards this scenario, but notes that market developments depend largely on investor sentiment and foreign investors’ actions, whether net withdrawals will decrease or not. Furthermore, if the international market continues to be unstable, domestic investors may be more cautious.

Source: https://tuoitre.vn/hon-500-co-phieu-giam-diem-nha-dau-tu-ngoai-sang-tay-khoi-luong-khung-o-vib-20250305154443914.htm

Comment (0)