(NLDO) - The selling pressure on stocks is quite strong, securities companies recommend investors wait for the market to recover before deciding to trade.

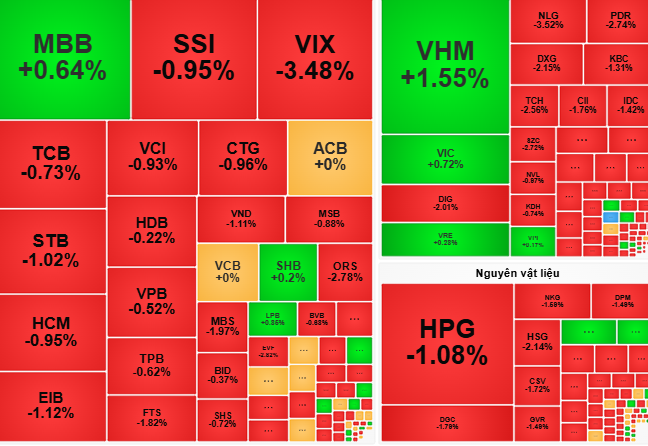

At the end of the session, the VN-Index closed at 1,304 points, down 7 points, equivalent to 0.55%.

Stocks opened trading on March 5 in green thanks to banking stocks and some large-cap stocks such as VIC, VHM, and VRE. However, immediately after that, the supply of stocks appeared, causing the market to reverse and decrease.

Entering the afternoon session, the selling pressure to take profits was quite strong. The number of red codes reached 343 units, overwhelming the 128 codes that remained green. Trading liquidity continued to be high at 22,000 billion VND.

At the end of the session, the VN-Index closed at 1,304 points, down 7 points, equivalent to 0.55%.

VCBS Securities Company believes that profit-taking pressure is quite strong and is overwhelming the demand for stocks. The market may correct in the next sessions.

However, the company recommends that investors should not "sell" when stocks fall sharply, but wait for recovery periods in each session to decide on trading. When the market reaches equilibrium, they can disburse to buy new stocks.

Meanwhile, Dragon Viet Securities Company (VDSC) stated that investors should consider the market correction to accumulate stocks at good prices, prioritizing stocks with recent positive developments.

Source: https://nld.com.vn/chung-khoan-ngay-mai-6-3-khong-nen-ban-duoi-co-phieu-196250305171410877.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in March](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/8393ea0517b54f6791237802fe46343b)

![[Photo] Solemn Hung King's Death Anniversary in France](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/786a6458bc274de5abe24c2ea3587979)

![[Photo] Vietnamese rescue team shares the loss with people in Myanmar earthquake area](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/ae4b9ffa12e14861b77db38293ba1c1d)

Comment (0)