Trading on the market was still relatively active with liquidity on the three floors reaching nearly VND24,000 billion. However, the market faced pressure and the VN-Index retreated to nearly the 1,300 point mark.

VN-Index fluctuates strongly, close to 1,300 point mark, VIB stock trading surges

Trading on the market was still relatively active with liquidity on the three floors reaching nearly VND24,000 billion. However, the market faced pressure and the VN-Index retreated to nearly the 1,300 point mark.

The market opened the trading session on March 5 in a positive state, continuing to try to expand the uptrend thanks to the remaining excitement. However, when approaching the important resistance level of 1,320 points, profit-taking pressure increased, causing the index to quickly narrow the increase range and at times retreat close to the reference. Market liquidity decreased significantly, showing that cash flow is tending to slow down, especially in the mid- and small-cap groups. Meanwhile, large-cap stocks continued to play a pivotal role, helping the index maintain green but not enough to create a strong breakthrough.

In the afternoon session, trading was more cautious, market differentiation was strong and VN-Index fluctuated around the reference level with alternating increases and decreases. Near the end of the session, the "goods" holders seemed to lose patience, causing selling pressure to spike. VN-Index fell quite deep below the reference level and approached the 1,300 point mark.

At the end of the trading session, VN-Index decreased by 7.2 points (-0.55%) to 1,304.71 points. HNX-Index decreased by 1.94 points (0.82%) to 235.41 points. UPCoM-Index decreased by 0.41 points (-0.41%) to 98.69 points.

|

| Vingroup and Vinhomes stocks pull the index up |

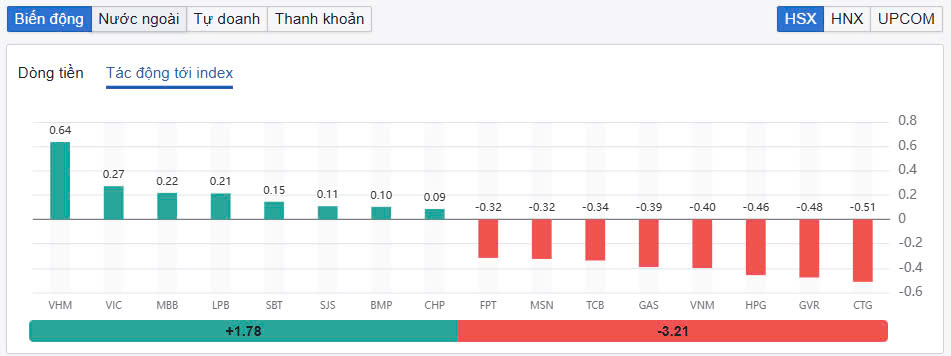

Today's session saw 509 stocks fall, while only 246 stocks rose. The entire market recorded 19 stocks hitting the floor while 26 stocks hit the ceiling. The strong pressure in today's session caused many pillar stocks to sink into red. In the VN30 group, 19 stocks rose while only 7 stocks increased. Stocks such as CTG, GVR, HPG, VNM... had the most negative impact on the VN-Index. Of which, CTG fell 0.96% and took away 0.51 points from the VN-Index. GVR fell 1.5% and took away 0.48 points.

On the other hand, Vingroup stocks had the most positive impact on the VN-Index and somewhat restrained the decline of the index. VHM increased by 1.55% and contributed 0.64 points to the VN-Index. VIC also contributed 0.27 points with an increase of 0.72%.

In the group of small and medium-cap stocks, related stocks such as VIX, EVF or EIB were all in red. Of which, VIX decreased by 3.5%, EVF decreased by 2.8%, EIB decreased by 1.12%. At one point during the closing order matching session (ATC), a large amount of EIB shares were sold on the sell side. However, support quickly appeared and helped to significantly lift this stock. Meanwhile, some stocks continued to trade negatively such as BCG and TCD, which had their third consecutive floor price drop.

Selling pressure in today's session was concentrated in mid- and small-cap stocks. In the real estate group, NLG suddenly fell by more than 3.5%, NTL fell by 3.3%, PDR fell by 2.7%, and DXG fell by more than 2%.

The group of securities stocks also recorded many codes in red. VDS decreased by 2.4%, BSI decreased by 2.2%, MBS decreased by 1.97%, BVS decreased by 1.3%...

|

| Foreign investors net sell on stock exchange |

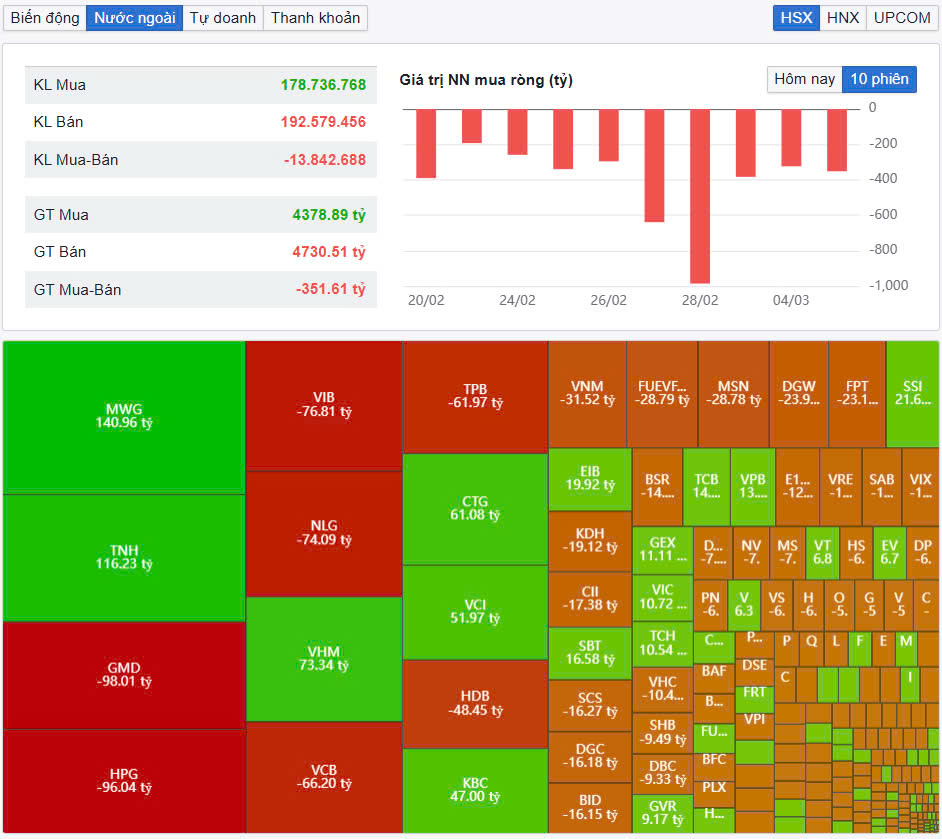

Market liquidity remained relatively high. Total trading volume on HoSE reached 980 million shares, equivalent to a trading value of VND22,216 billion, down 4% compared to the previous session, of which negotiated transactions contributed VND4,863 billion. Trading values on HNX and UPCoM reached VND995 billion and VND624 billion, respectively.

Hoa Phat (HPG) shares topped the market in terms of trading value with VND2,068 billion. FPT followed with a value of VND1,052 billion. VNM and SSI traded VND723 billion and VND642 billion, respectively. Regarding negotiated transactions, VIB had an intra-bloc negotiated transaction of about 127 million units, worth more than VND3,000 billion.

Foreign investors continued to net sell VND375 billion across the market. Of which, GMD topped the list of foreign net sellers with VND98 billion. HPG and VIB traded VND96 billion and VND77 billion respectively. On the other hand, MWG was the most net bought with VND141 billion. TNH was behind with a net buying value of VND116 billion.

Source: https://baodautu.vn/vn-index-rung-lac-manh-ve-sat-moc-1300-diem-dot-bien-giao-dich-co-phieu-vib-d251119.html

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

Comment (0)