| Commodity market today, June 25, 2024: Cocoa drops sharply to the lowest level in 1 month Commodity market today, June 26, 2024: World raw material prices plummet |

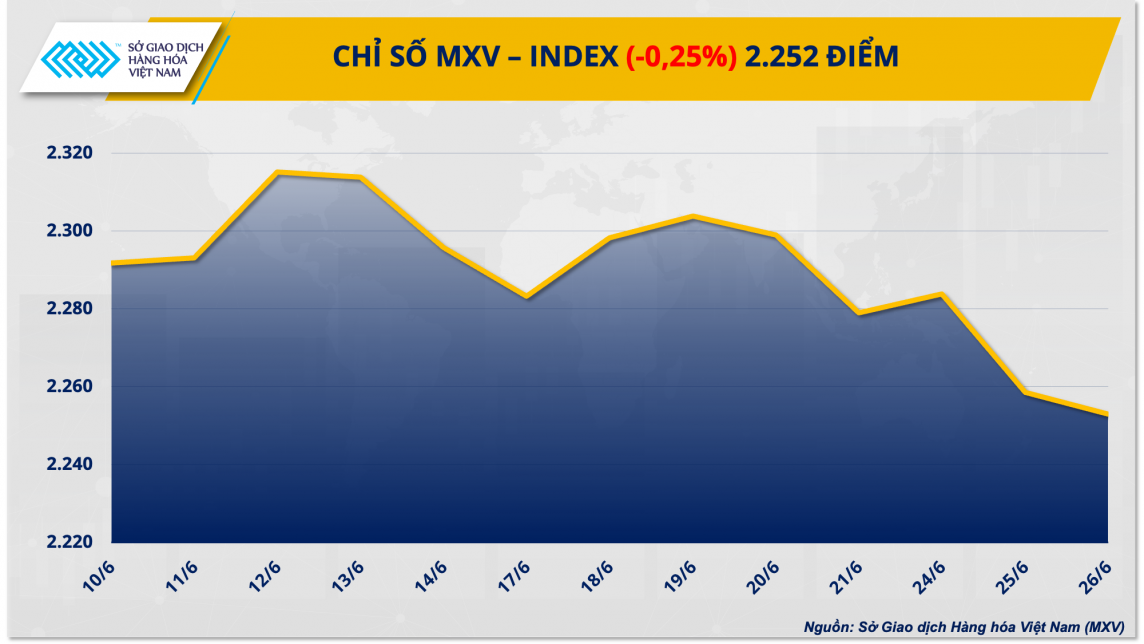

While the metal group increased in price, red dominated the price list of the remaining 3 commodity groups, causing the MXV-Index to decrease by 0.25% to 2,252 points.

|

Platinum prices surge due to supply shortage

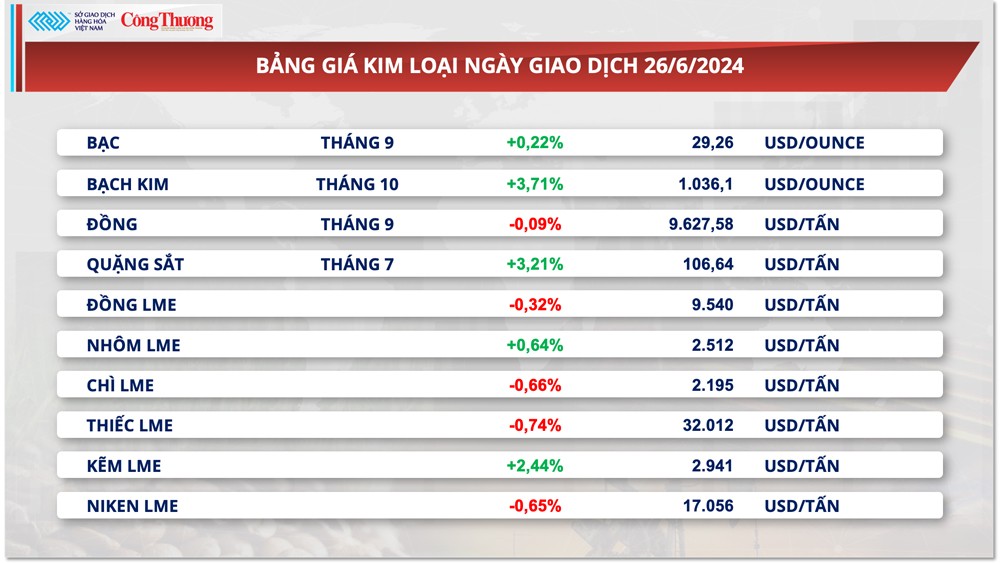

At the end of the trading session on June 26, red and green colors intertwined on the metal price chart. For precious metals, silver prices increased slightly by 0.22% to 29.25 USD/ounce. The price of this commodity has been fluctuating within a narrow range in recent sessions as the market cautiously awaited new macroeconomic data. In particular, the US first quarter GDP growth data released on Thursday (June 27) and the personal consumption expenditure price index (PCE) released on Friday (June 28). Both of these figures affect the interest rate expectations of the US Federal Reserve (FED) and impact the price movements of precious metals.

|

| Metal price list |

In the same trend, platinum prices jumped more than 3% to $1,036.2/ounce yesterday due to concerns about increasing supply shortages. This was also the strongest increase in platinum prices in nearly two months.

Sibanye Stillwater, one of the world's leading platinum miners, said it could close a platinum supply deal in the third quarter, Reuters reported. It also warned that it may have to close some of its US mines to cut costs. The company, along with major rivals Anglo American Platinum and Impala Platinum, have already cut thousands of jobs and halted investment in new projects. These moves could disrupt platinum mining operations and cause future supply shortages.

For base metals, iron ore prices increased the most in the group, up 3.21% to 106.64 USD/ton, marking the strongest increase of this commodity in nearly two months.

Iron ore is sensitive to China’s economic stimulus. Expectations that China will continue to roll out more measures to revive the economy, especially to boost the crisis-hit property market, have pushed iron ore prices up sharply yesterday. Beijing on Wednesday lowered the minimum down payment for first-time homebuyers to no less than 20%, according to a local government statement.

On the other hand, weak demand continued to put pressure on copper prices. At the close of the session, COMEX copper prices fell 0.09% to $9,627.58/ton. However, the decline was much narrower than in previous sessions, as prices were slightly supported by the risk of supply shortages. Specifically, yesterday, Codelco, the world's largest copper producer, said it produced only 103,100 tons of copper in May, 8.6% lower than its target.

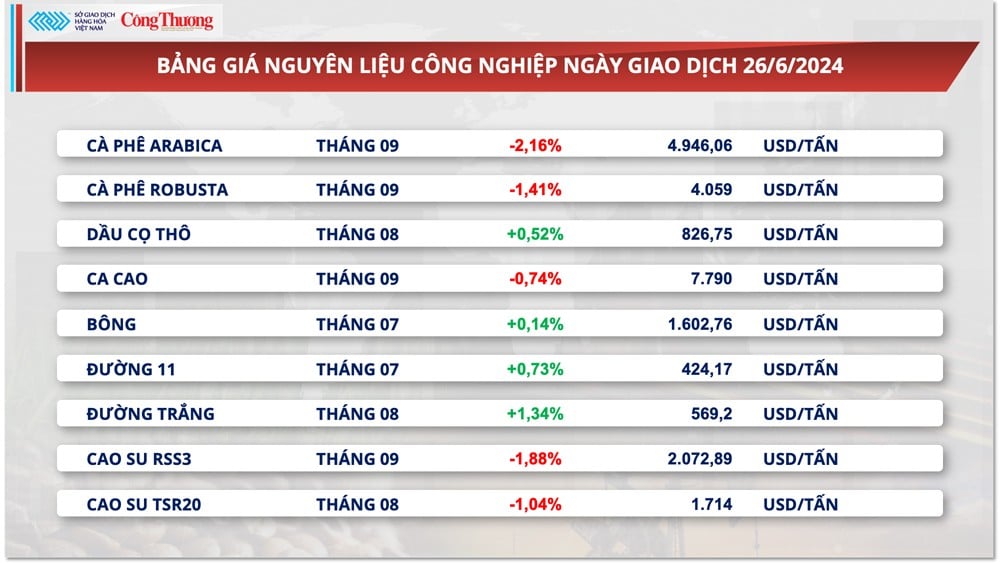

Cotton prices increased slightly

|

| Industrial raw material price list |

Cotton prices edged up just 0.14% to $1,062 a tonne as a stronger dollar curbed buying. The market is also focused on awaiting the important acreage report from the US Department of Agriculture (USDA) due later this week.

Market analysts are now estimating U.S. cotton acreage in 2024 at 10.50 million to 10.20 million hectares, with an average of 10.83 million hectares. This is also slightly higher than the 10.67 million hectares forecast by the USDA in March.

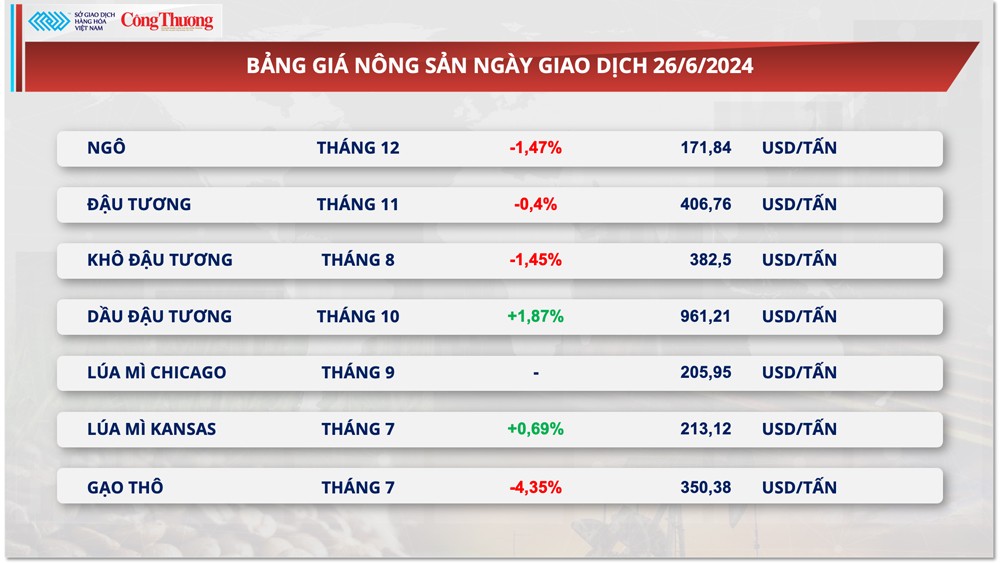

Prices of some other goods

|

| Agricultural product price list |

|

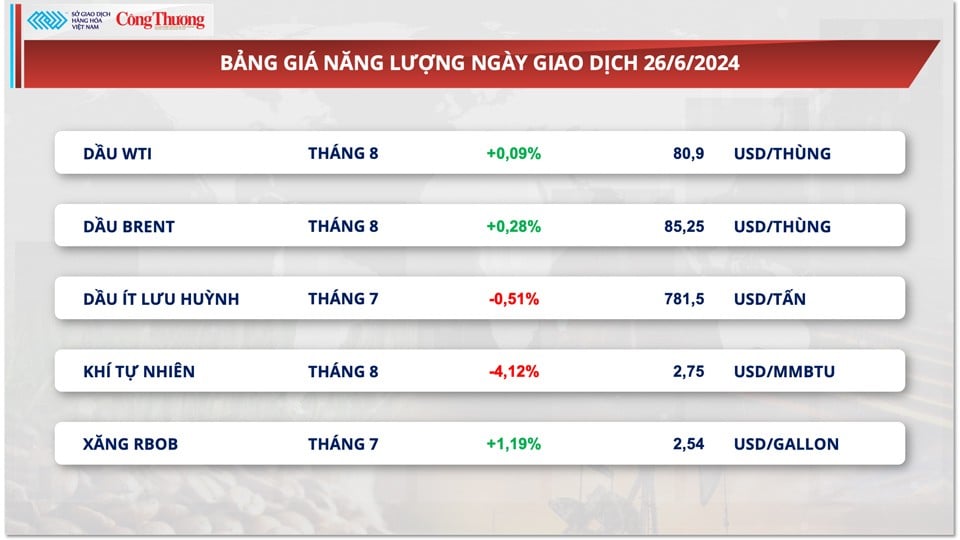

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-2762024-gia-hang-hoa-nguyen-lieu-the-gioi-dien-bien-phan-hoa-328495.html

Comment (0)