Closing the trading session last week, Robusta coffee prices reached a historical high of over 5,800 USD/ton in the session of February 12, Arabica maintained an impressive growth momentum.

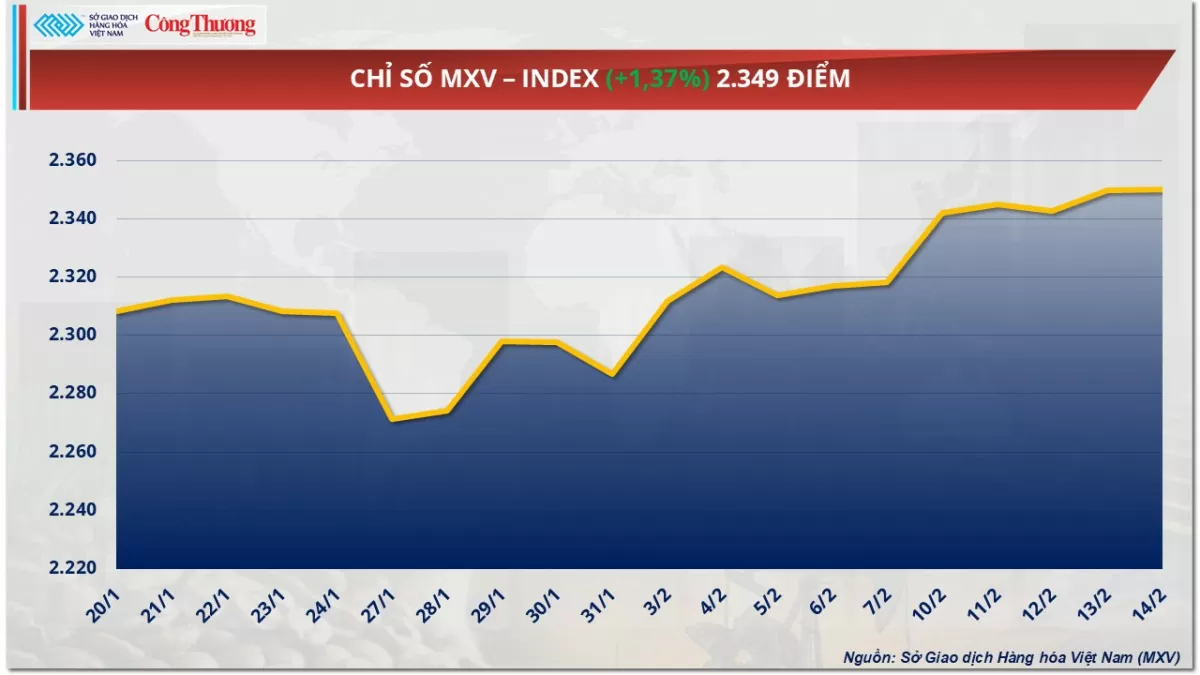

The Vietnam Commodity Exchange (MXV) said that the world raw material market fluctuated strongly in the past trading week (February 10-16). The raw material group continued to create highlights when the prices of all 9 items in the group increased sharply. In particular, coffee strongly attracted investment cash flow. In addition, the metal market also witnessed an upturn due to the intertwined impact of macro factors and supply and demand. At the end of the week, the overwhelming buying force pulled the MXV-Index up nearly 1.4% to 2,349 points.

|

| MXV-Index |

Robusta coffee prices hit new high

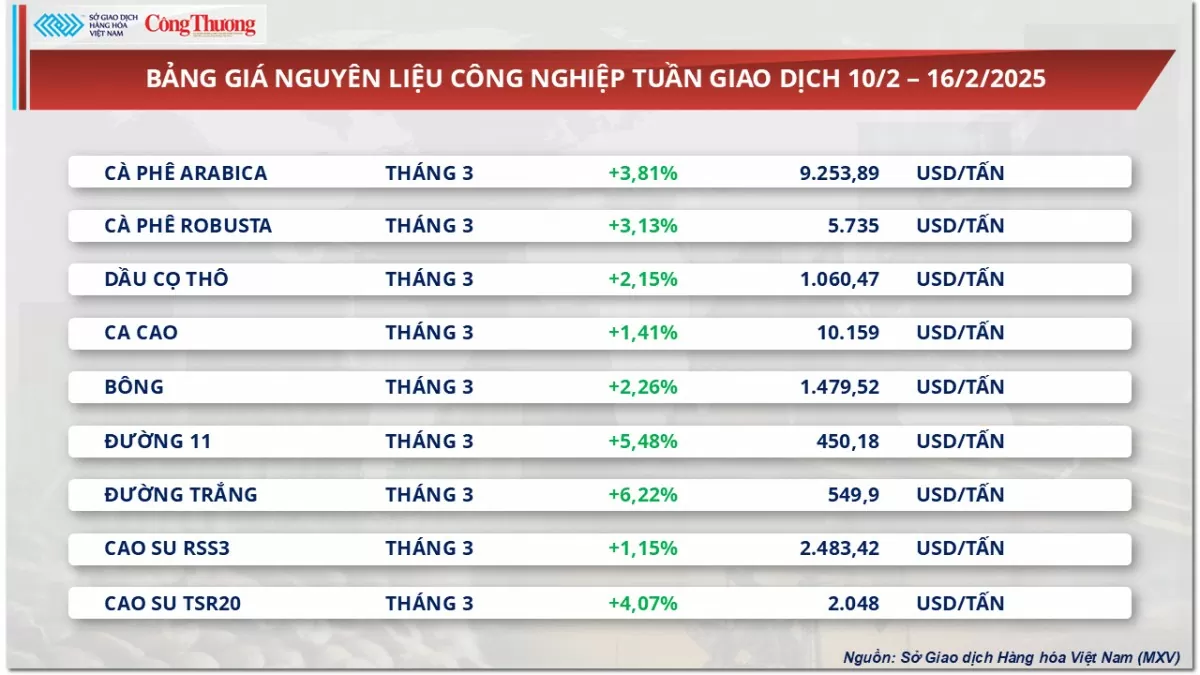

According to MXV, the industrial raw material market was bright green after closing the last trading week. Notably, the coffee market continued to fluctuate strongly. In particular, Robusta prices reached a historical high of over 5,800 USD/ton in the session of February 12, while Arabica maintained an impressive increase. The high price was maintained for many days after that.

|

| Industrial raw material price list |

Right at the opening session of the week, the market witnessed a strong correction with Arabica down 3.6% to 9,115 USD/ton and Robusta down slightly 0.3% to 5,653 USD/ton. This correction came from profit-taking activities of investors after a long increase.

However, the market quickly recovered and returned to the "price increase" in the session of February 12 when Robusta increased by 2.9% to 5,817 USD/ton - the highest level in history, while Arabica skyrocketed by 4.44% to 9,519 USD/ton. The sharp increase in Arabica transaction costs on the ICE exchange contributed to pushing prices to a record high for 14 consecutive sessions.

|

| Robusta coffee prices hit an all-time high of over $5,800 per ton. Photo: Hien Mai |

The rally was fueled by concerns about tight supplies after Hedgepoint Global Markets cut its forecast for Brazil’s 2025-26 crop year to 64.1 million bags. Notably, Arabica production, which accounts for 70% of total output, is forecast to reach 41.1 million bags, down 4.9% from the previous season.

The supply shortage is reflected in inventory figures. Robusta stocks have fallen to a five-week low of 260,880 bags, after hitting a four-month high of 276,180 bags on Jan. 31. Similarly, Arabica stocks have also fallen from a peak of 993,562 bags on Jan. 6 to 841,795 bags, the lowest in more than three months.

In addition, data from the Brazilian Coffee Exporters Association (Cecafe) shows that the volume of green coffee exports in January reached only 3.98 million bags, down 1.6% compared to the same period last year. This is the second consecutive month of decline in exports from the world's largest Arabica supplier.

Adverse weather conditions also contributed to the price increase, with the latest report from Somar Meteorologia showing that rainfall in Minas Gerais, Brazil’s largest Arabica coffee growing region, was just 53.9 mm last week, 15% below the historical average. This information further exacerbated concerns about crop prospects in the world’s top Arabica coffee producing country.

Citigroup said coffee prices may have peaked as demand begins to slow and supplies from other markets are gradually replenished. However, low liquidity in recent sessions suggests the market may continue to be volatile in the short term.

Looking to the medium term, Hedgepoint forecasts Brazil’s 2025-26 export volume to fall to 47.6 million bags, 0.8 million bags lower than the current crop. This trend, coupled with the severe supply shortage, could continue to put upward pressure on prices in the coming months, although the pace of increases may slow as demand adjusts to higher prices.

In a notable development in the industrial raw material market, the price of sugar 11 increased sharply by 5.48% to over 450 USD/ton, setting the highest level since mid-December 2024. Prices were supported by information that Indonesia planned to urgently import 200,000 tons of raw sugar. The increase was also reinforced when the export activities of the world's second largest producer, India, showed signs of slowing down.

Metal market is booming

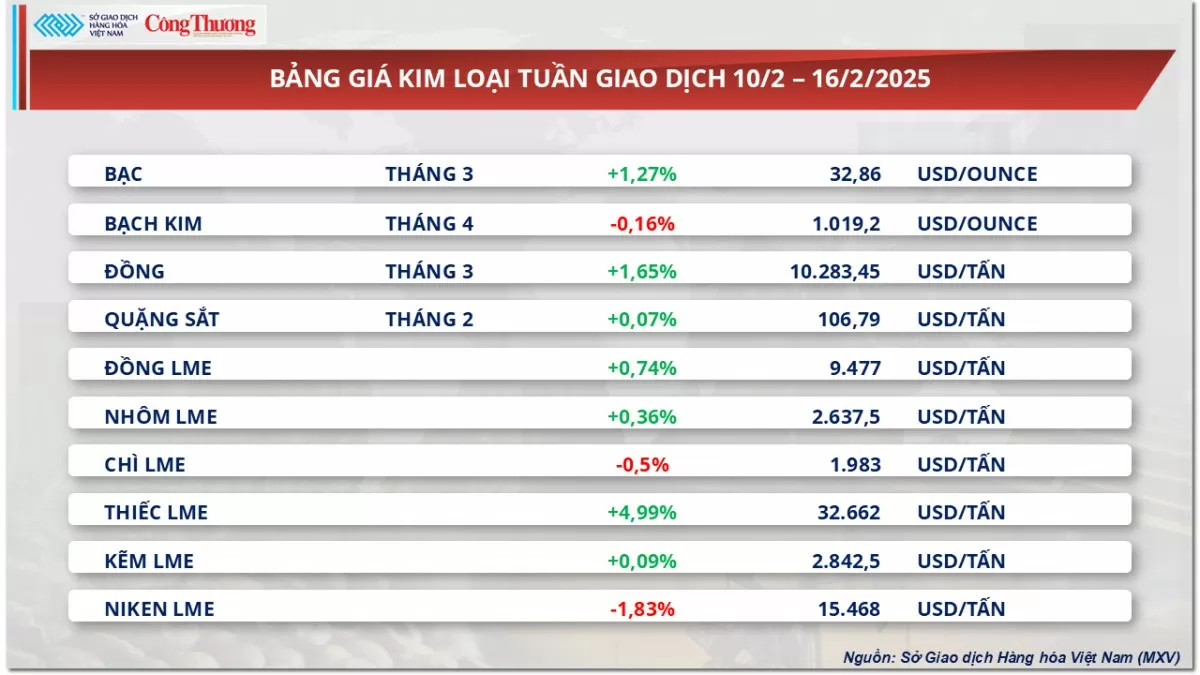

MXV said the metal market recovered significantly in the past trading week with buying power dominating.

In the precious metals market, at the end of the trading session on the weekend (February 14), the price of silver continued to rise to 32.86 USD/ounce, equivalent to an increase of 1.27%. Although it decreased slightly by 0.16% to 1,019 USD/ounce in the weekend session, the price of platinum is still in the high price range.

|

| Metal price list |

Over the past week, a series of economic data and many changes in US tariff policies have attracted money into the precious metals market.

Notably, on February 12, the US Bureau of Labor Statistics also released its January Consumer Price Index (CPI) report. The report revealed that US inflation increased by 0.5%, surpassing the 0.4% increase in December and the market forecast of 0.3%. Concerns continued to rise after US President Donald Trump announced that he would impose reciprocal tariffs on countries that tax imports from the US. In addition, the US also released its January PPI index, showing that producer prices increased by 0.4% this month.

Hot economic data from the US has caused fluctuations in expectations for the US Federal Reserve’s interest rate policy. This reflects the strong demand for safe havens, especially from central banks around the world, amid concerns that new US trade tariffs could slow global economic growth. These factors have kept precious metals prices firmly in the high range over the past week.

On the base metals side, the COMEX copper market had a busy trading week, closing the week with a sharp increase of 1.65% to $10,283/t. Iron ore also recorded a slight increase of 0.07% to $106.79/t, 7% higher than January prices. According to MXV, recovering demand in China after the Lunar New Year holiday, combined with mining giant BHP's forecast that global copper demand could increase by up to 70% by 2050, contributed to the increase in copper prices last week.

Meanwhile, severe storms in Australia have reduced China’s iron ore imports in the first two months of the year, with an estimated drop of more than 10% year-on-year to 191.7 million tonnes. Concerns about disruptions to Australian supplies have supported iron ore prices, which supply nearly two-thirds of China’s iron ore needs. However, India’s consideration of a 15-25% tariff on Chinese steel could force mills in the country to cut production, weakening demand for iron ore and thus dampening the price rally.

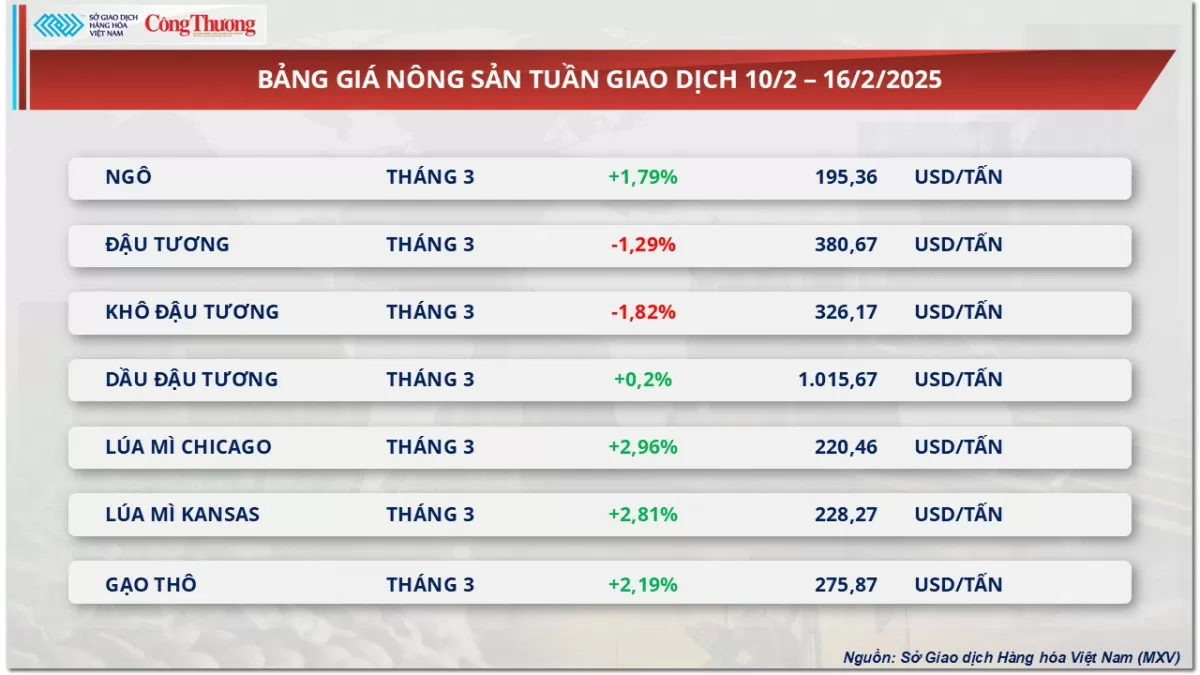

Prices of some other goods

|

| Agricultural product price list |

|

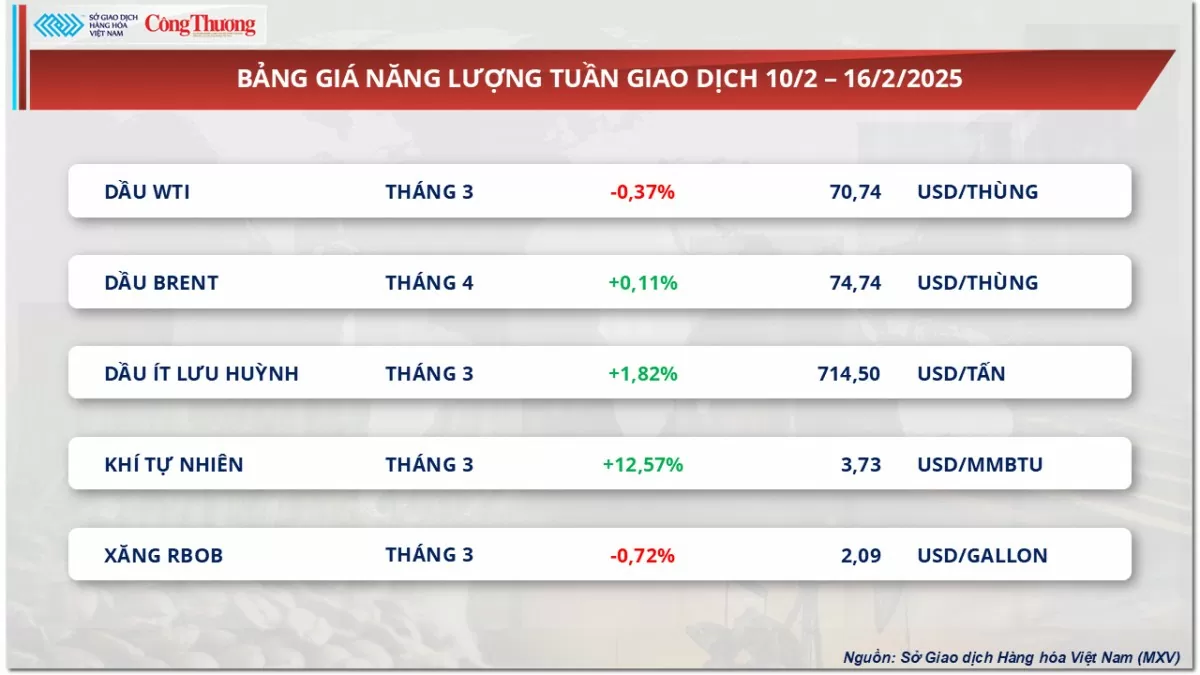

| Energy price list |

Source: https://congthuong.vn/gia-ca-phe-robusta-cham-muc-cao-nhat-vuot-5800-usdtan-374146.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)