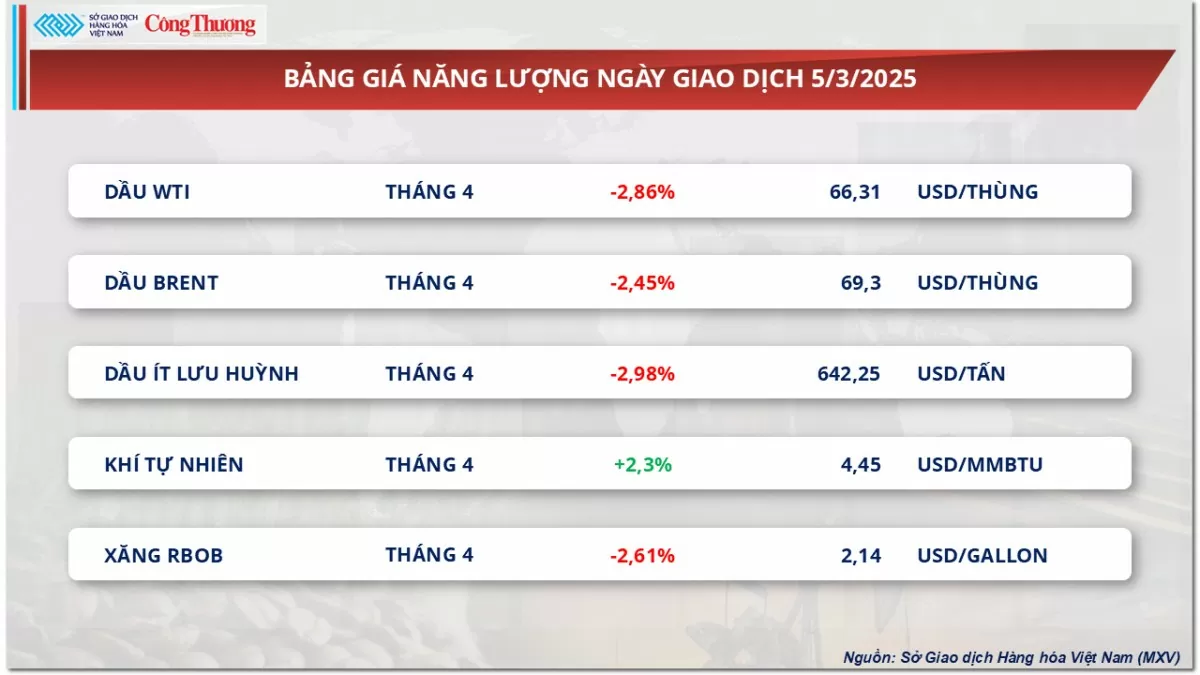

At the end of the trading session, Brent oil price decreased by 1.74 USD/barrel, down to 69.30 USD/barrel, WTI crude oil lost 1.95 USD/barrel, closing the session at 66.31 USD/barrel.

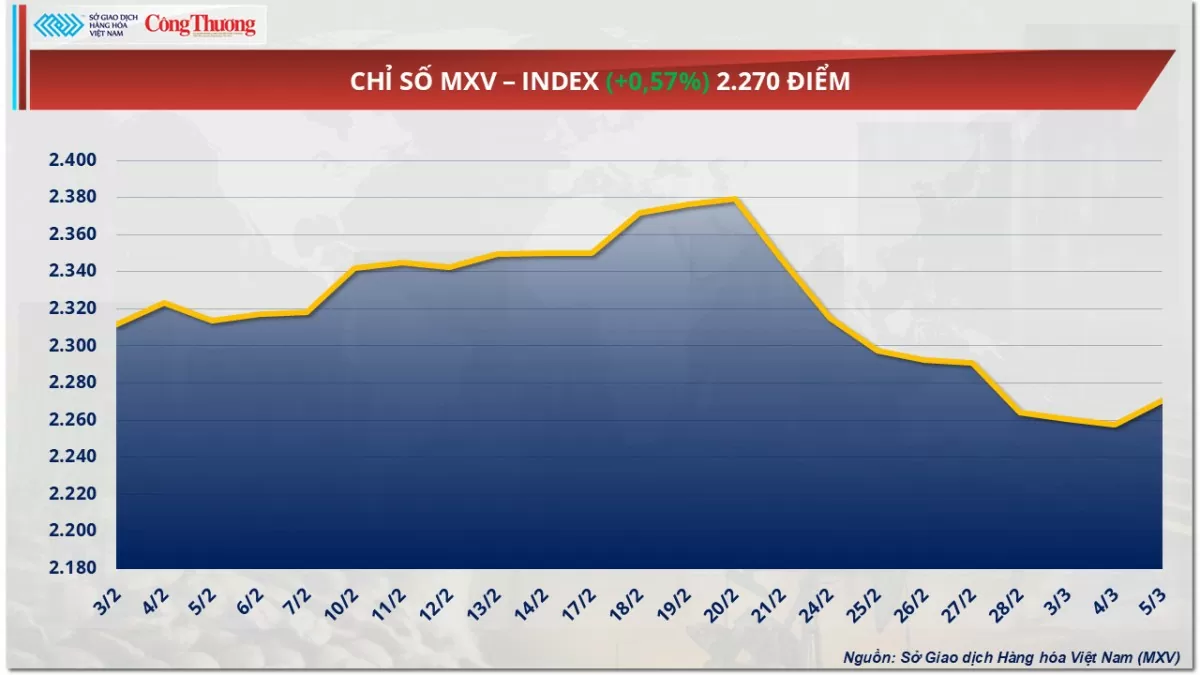

The Vietnam Commodity Exchange (MXV) said that after 8 consecutive sessions in the red, the world raw material market has recovered at the end of yesterday's trading day (March 5). The dominant buying force pushed the MXV-Index up nearly 0.6% to 2,270 points. The metal market witnessed a breakthrough in the price of COMEX copper when it increased by 5.2% to more than 10,500 USD/ton - the highest level since May last year. On the contrary, crude oil prices slid after the EIA's inventory report.

|

| MXV-Index |

Money flows back into the metals market

According to MXV, at the end of yesterday's trading session, strong buying pressure occurred in the metal market amid the US tightening tariff barriers, raising concerns about supply disruptions.

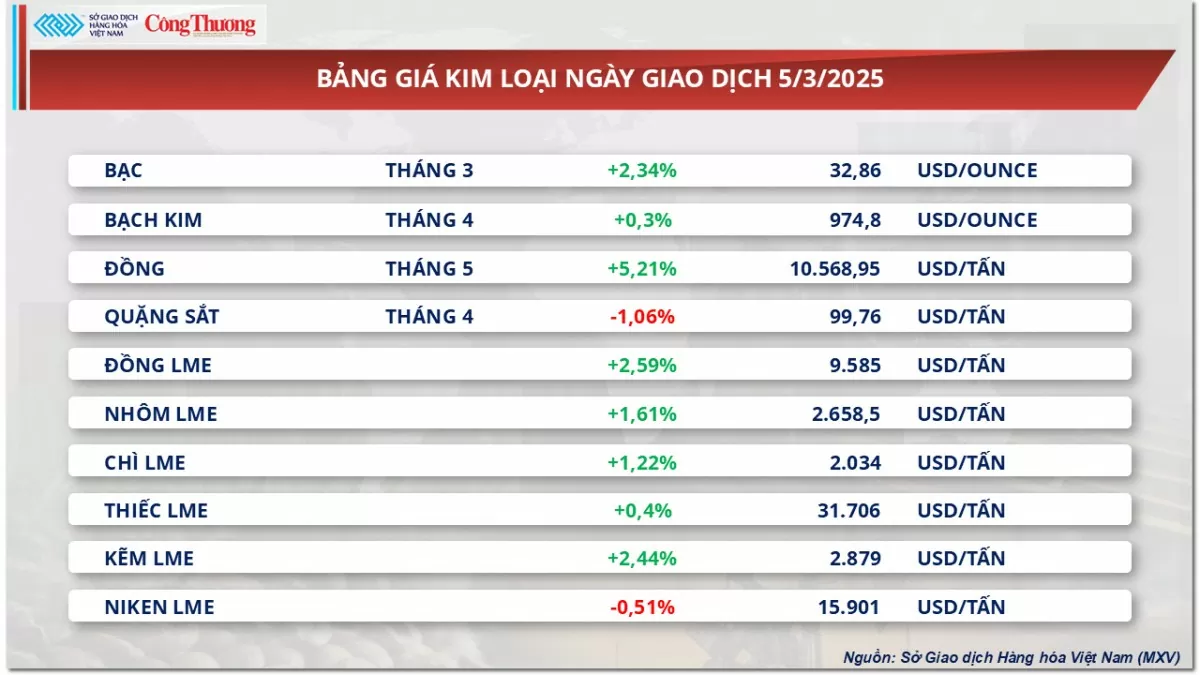

Silver closed up 2.34% at $32.86 an ounce, marking its third straight gain. Platinum also edged up 0.3% to $974.8 an ounce, supported by concerns about a supply shortage this year.

|

| Metal price list |

In the precious metals market, money flows continued to be stronger due to increased demand for safe havens. Not only were there concerns about retaliation from major US trading partners, especially China, but the market was also concerned that Washington's tariff policies could seriously disrupt the global supply chain.

Meanwhile, the World Platinum Investment Council (WPIC) forecasts a global platinum market deficit of 848,000 ounces this year, a more severe deficit than previously estimated. The main reason is the decline in recycled supply and low mining output in South Africa. Although the market still faces the risk of declining demand due to US tariffs, concerns about scarce supply supported platinum prices yesterday.

On the other hand, data from the Institute for Supply Management (ISM) showed that the US non-manufacturing PMI rose to 53.5 in February, higher than the expectation of 52.5. This shows that the US economy is still growing. However, inflationary pressures in the service sector continued to increase as the price index reached 62.6 in February, higher than the 60.4 in January. This is the first time since March 2023 that the index has recorded three consecutive months above 60%. Inflation in the service sector continued to heat up, reinforcing the view that the US Federal Reserve (FED) may keep monetary policy tight for longer. This could be a factor supporting precious metal prices in the long term, as investors seek shelter from prolonged inflation risks.

In addition, the base metals group also attracted attention when COMEX copper prices recorded an impressive increase of 5.21%, to 4.79 USD/pound (equivalent to 10,568 USD/ton), reaching the highest level since late May 2024. The main driving force came from concerns about the new US tax policy.

In his speech to Congress on March 4, US President Donald Trump proposed a 25% tariff on imported copper. The move triggered a wave of strong buying in the market, as investors expected prices to continue to rise due to a possible tightening of domestic supplies. According to the US Geological Survey (USGS), Chile, Canada and Peru account for more than 90% of all refined copper imports into the US in 2024, so any trade barriers could significantly disrupt supply.

Oil prices continue to slide

At the close of yesterday's trading session, world oil prices recorded their third consecutive decline, down more than 2%.

Specifically, Brent oil price decreased by 1.74 USD/barrel (equivalent to 2.45%), down to 69.30 USD/barrel, while WTI crude oil lost 1.95 USD/barrel (equivalent to 2.86%), closing the session at 66.31 USD/barrel.

|

| Energy price list |

The decline in oil prices is believed to be a result of previous economic policies, including the US imposing a 25% tariff on goods imported from Canada and Mexico, along with the decision by OPEC+ to increase production in April. According to forecasts, the tariffs and retaliation could slow US GDP growth by about 100 basis points, leading to a reduction in global oil demand of about 180,000 barrels per day.

The global crude oil market was also under pressure as the latest data showed that US crude oil inventories rose more than expected last week, mainly due to regular maintenance at refineries. According to the US Energy Information Administration (EIA), crude oil inventories increased by 3.6 million barrels to 433.8 million barrels, far exceeding the 341,000 barrel forecast by analysts.

Immediately after the news was announced, oil prices plunged to a two-year low. Brent crude fell to $68.33 a barrel, its lowest since December 2021, while WTI hit a low of $65.22 a barrel, its lowest since May 2023.

However, oil prices have shown signs of recovery after US Commerce Secretary Howard Lutnick announced that the President may consider reducing tariffs for some industries this year. Accordingly, although the 25% tariff on Canadian and Mexican goods will remain, the US may remove the 10% tariff on some energy products imported from Canada, including crude oil and gasoline, to comply with the provisions of the US-Mexico-Canada Trade Agreement (USMCA).

Despite the volatility, analysts at JP Morgan said global oil demand averaged 103.6 million barrels per day last month, up 1.6 million barrels per day from a year earlier. However, that was still below the bank’s previous forecast of a rise of 1.8 million barrels per day.

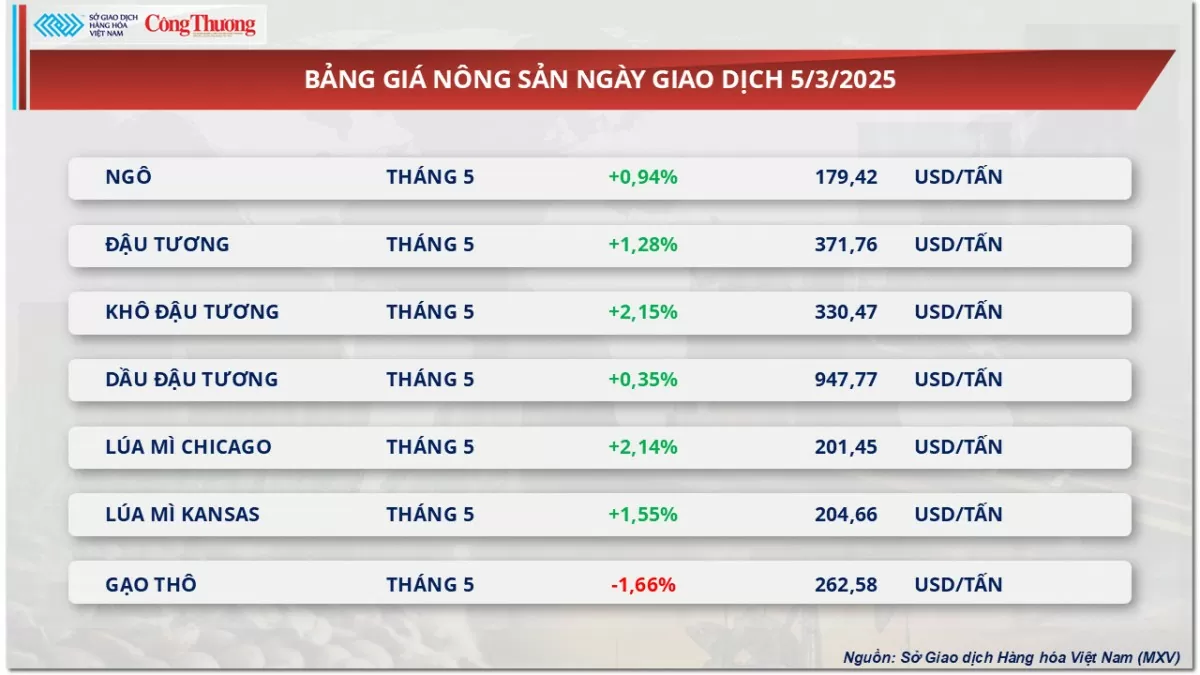

Prices of some other goods

|

| Energy price list |

|

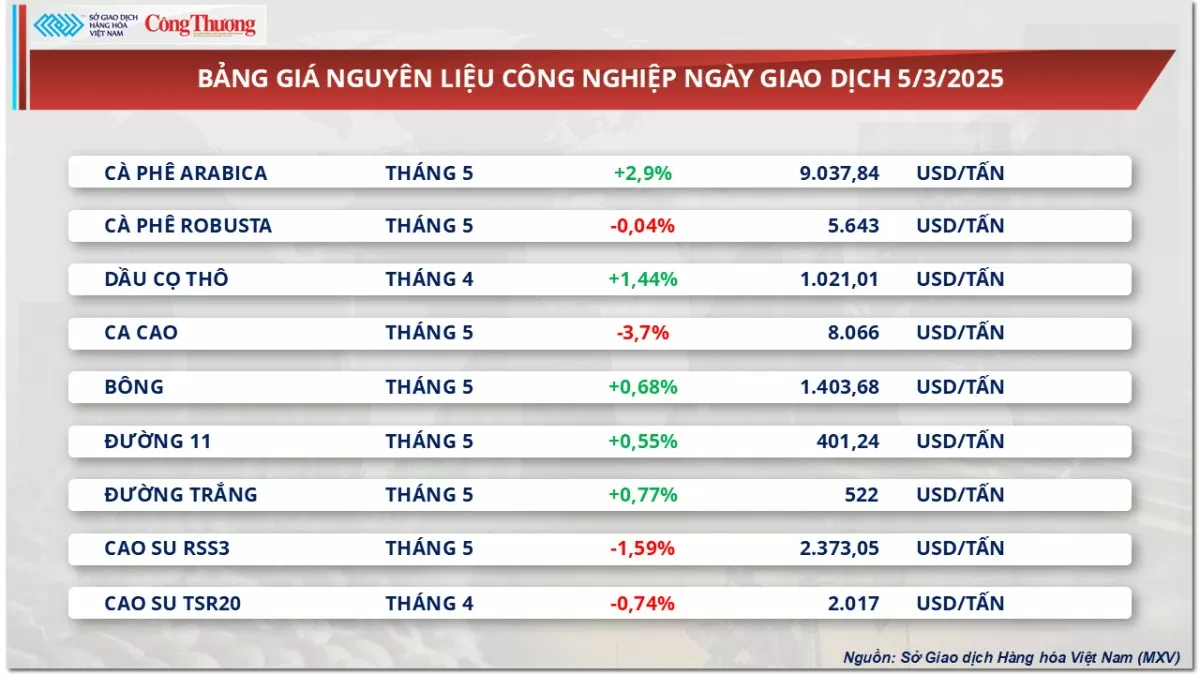

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-gia-dau-giam-ba-phien-lien-tiep-376986.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)