The central exchange rate increased by 38 VND, the VN-Index decreased slightly by 2.93 points (-0.23%) compared to the previous weekend, or by the end of the third quarter of 2024, the State Treasury had mobilized nearly 70% of the government bond issuance plan in 2024... are some notable economic information in the week from October 14-18.

| Economic news review October 15 Economic news review October 17 |

|

| Economic news review |

Overview

By the end of the third quarter of 2024, the State Treasury had mobilized nearly 70% of the government bond issuance plan for 2024.

On October 9, the State Treasury announced the plan to auction government bonds in the fourth quarter of 2024 with a total issuance of VND 128,000 billion, including the issuance volume for Vietnam Social Security. Specifically, the expected volume by term includes: 5-year term is VND 10,000 billion, 7-year term is VND 5,000 billion, 10-year term is VND 53,000 billion, 15-year term is VND 48,000 billion, 20-year and 30-year terms are both at VND 6,000 billion.

Previously, the State Treasury announced a plan to issue VND150,000 billion in government bonds in the third quarter of 2024, VND120,000 billion in bonds in the second quarter of 2024 and VND127,000 billion in government bonds in the first quarter of 2024. The total planned volume of government bonds mobilized for the whole year of 2024 is VND400,000 billion. In 2024, the Ministry of Finance will not provide guarantees for bonds of the Vietnam Bank for Social Policies and the Vietnam Development Bank.

In September 2024, the State Treasury organized 18 government bond auctions with a total bid value of VND50,150 billion, with a winning bid rate of 66.5%. The State Treasury auctioned 5-year, 7-year, 10-year, 15-year, and 30-year terms, with the 10-year and 15-year terms accounting for the majority of the winning bid value, at VND22,150 billion (66%) and VND8,550 billion (26%), respectively. The 5-year, 7-year, and 30-year terms won VND700 billion (28%), VND395 billion (39.5%), and VND179 billion (59.6%), respectively.

Government bond interest rates at the end of September tended to decrease compared to the end of August for the 5-year, 10-year and 15-year terms with decreases of 0.03%/year, 0.05%/year and 0.04%/year, respectively. The 7-year term had a winning bid in September with an interest rate slightly increasing by 0.03%/year compared to the most recent winning bid at the end of March, while the 30-year term had an unchanged winning interest rate compared to the previous month.

From the beginning of the year to September 30, 2024, the total capital mobilized through the issuance of government bonds was VND 271,671 billion, reaching 68% of the annual plan. The amount of government bonds mobilized by the end of the third quarter of this year was almost equal to the entire volume mobilized in 2023 (VND 298,476 billion of government bonds, reaching 74.6% of the 2023 plan); the average issuance term is 11.13 years (12.58 years in 2023); the average maturity of the government bond portfolio is 9.09 years; the average issuance interest rate is 2.51%/year (3.21%/year in 2023).

In the secondary market, the listed value of government bonds as of September 30, 2024 reached VND 2,171,028 billion, up 1.18% compared to the previous month. The total value of government bond transactions in September reached VND 258,105 billion, with an average session of VND 13,584 billion/session, up 23.01% compared to August 2024.

Of which, the Outright trading value accounted for 57.06%, the Repos trading value accounted for 42.94% of the total trading value of the whole market. The most traded terms in September were 10-year, 25-30-year, and 10-15-year terms, with their respective proportions to the total trading value of the whole market being 26.03%, 16.49%, and 15.90%. The average trading yield of government bonds increased the most in the 2-year term, currently reaching an average yield of about 2.0499%; the highest decrease was in the 20-25-year, 7-10-year, and 10-year terms, currently reaching an average yield of about 3.1627%; 2.5698%, and 2.2091%, respectively.

The transaction value of foreign investors in September accounted for 3.01% of the total transaction value of the whole market, an increase of 0.89% compared to August. In September 2024, the monthly banking sector still accounted for a large market share, with the proportion of Outright and Repos transaction value compared to the whole market being 59.62% and 93.55%, respectively.

In the report summarizing 15 years of operation of the separate government bond trading market, Hanoi Stock Exchange (HNX) said that HNX will focus on implementing the following key solutions:

(i) diversifying new bond products, suitable for market development and investment needs such as green bond products, floating-rate bonds, bonds with principal and interest traded separately (strip bonds), inflation-indexed bonds, etc. to create more capital mobilization channels for the state budget and attract investors towards the goal of sustainable economic development;

(ii) diversify issuance terms, focusing on long-term bonds (over 5 years) and being flexible with short-term terms to create a full reference yield curve;

(iii) develop modern and professional trading technology infrastructure, ensuring consistency with regulations of management agencies, increasingly better meeting the needs of investors in the market and being ready for new products;

(iv) Complete and develop a system of market makers with full rights and obligations to perform market making functions in both primary and secondary markets to increase market liquidity.

Domestic market summary week from October 14 - 18

In the foreign exchange market, during the week of October 14-18, the central exchange rate continued to be adjusted upward by the State Bank in most sessions. At the end of October 18, the central exchange rate was listed at 24,213 VND/USD, an increase of 38 VND compared to the previous weekend session.

The State Bank of Vietnam's transaction office continued to list the USD buying rate at 23,400 VND/USD in all sessions while listing the USD selling price closing on October 18 at 25,373 VND/USD, 50 VND lower than the ceiling exchange rate.

The interbank USD-VND exchange rate during the week from October 14 to 18 increased sharply in most sessions. At the end of the session on October 18, the interbank exchange rate closed at 25,160, a sharp increase of 342 VND compared to the previous weekend session.

The dollar-dong exchange rate on the free market only increased slightly last week. At the end of the session on October 18, the free exchange rate increased by 20 VND in both buying and selling directions compared to the previous weekend session, trading at 25,260 VND/USD and 25,360 VND/USD.

Interbank money market, week from October 14-18, interbank VND interest rates continued to decrease sharply in all terms from 1 month and below. Closing on October 18, interbank VND interest rates were traded around: overnight 2.73% (-0.49 percentage points); 1 week 2.96% (-0.49 percentage points); 2 weeks 3.24% (-0.38 percentage points); 1 month 3.67% (-0.23 percentage points).

Interbank USD interest rates remained little changed across all terms during the week. On October 18, the interbank USD interest rate closed at: overnight 4.83% (unchanged); 1 week 4.88% (-0.01 percentage point); 2 weeks 4.92% (unchanged) and 1 month 4.94% (unchanged).

In the open market last week, in the mortgage channel, the State Bank of Vietnam offered a 7-day term with a volume of VND15,000 billion, the interest rate remained at 4.0%. There was no winning volume, no maturity volume last week.

Last weekend, the State Bank of Vietnam offered SBV bills for 14-day and 28-day terms, with interest rates. The 14-day term had VND4,400 billion in winning bids, with an interest rate of 3.74%; the 28-day term had VND7,900 billion in winning bids, with an interest rate of 4.0%.

Thus, the State Bank of Vietnam has withdrawn a net VND12,300 billion from the market last week through the open market channel. There is no more volume circulating on the mortgage channel, there are VND12,300 billion of treasury bills circulating on the market.

Bond market, October 16, the State Treasury successfully bid 7,851 billion VND/11,000 billion VND of government bonds called for bid, with a winning rate of 71%. Of which, the 5-year term mobilized the entire 500 billion VND called for bid, the 10-year term mobilized 6,860 billion VND/7,000 billion VND called for bid and the 30-year term mobilized 491 billion VND/500 billion VND called for bid. The 7-year and 15-year terms respectively called for bids of 500 billion and 2,500 billion VND, but there was no winning volume. Winning interest rates for most terms remained unchanged compared to the previous auction, specifically the 5-year term was 1.89%, the 10-year term was 2.66% and the 30-year term was 3.10%.

This week, on October 23, the State Treasury plans to bid for VND10,000 billion in government bonds, of which VND1,000 billion will be offered for 5-year and 30-year terms, VND6,000 billion for 10-year terms, and VND2,000 billion for 15-year terms.

The average value of Outright and Repos transactions in the secondary market last week reached VND11,203 billion/session, down from VND13,503 billion/session the previous week. Government bond yields last week fluctuated slightly in the 5-30 year terms. At the end of the session on October 18, government bond yields were trading around 1 year 1.85% (unchanged compared to the session at the end of last week); 2 years 1.86% (unchanged); 3 years 1.88% (unchanged); 5 years 1.90% (-0.003 percentage points); 7 years 2.15% (+0.008 percentage points); 10 years 2.67% (+0.01 percentage points); 15 years 2.86% (+0.003 percentage points); 30 years 3.17% (+0.002).

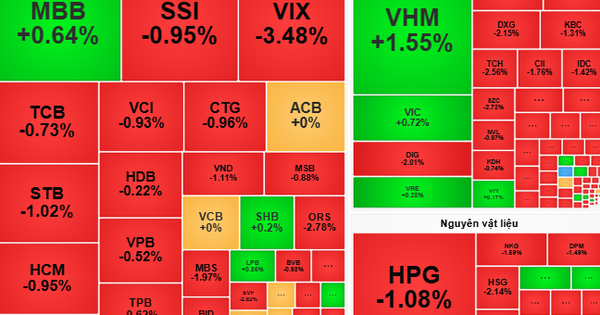

Stock market, week from October 14-18, the indices on the stock market traded sideways around the reference level. At the end of the session on October 18, VN-Index stood at 1,285.46 points, down slightly by 2.93 points (-0.23%) compared to the previous weekend; HNX-Index lost 2.16 points (-0.93%) to 229.21 points; UPCom-Index inched up 0.10 points (+0.11%) to 92.70 points.

Average market liquidity reached about VND16,600 billion/session, equivalent to VND16,200 billion/session of the previous week. Foreign investors strongly net sold nearly VND2,400 billion on all three exchanges.

International News

The US economy recorded some notable indicators. First, the US Census Bureau announced that total retail sales and core retail sales in the country increased by 0.4% and 0.5% respectively compared to the previous month in September after increasing by 0.1% in the previous month, stronger than the forecast of 0.3% and 0.1% respectively. Compared to the same period in 2023, total retail sales increased by about 1.7.

On the manufacturing front, US industrial production fell 0.3% in September from the previous month after rising 0.3% in August, deeper than the forecast 0.1% decline. Compared to the same period in 2023, industrial production in September showed a decline of 0.6%.

Next, in the construction market, the number of housing permits in the US reached 1.43 million units in September, down slightly from 1.47 million units in the previous month and below the forecast of 1.45 million units. In addition, the number of housing starts last month reached 1.35 million units, down slightly from 1.36 million units in August and in line with expectations.

Finally, in the labor market, the number of initial jobless claims in the US in the week ending October 12 was 241 thousand, down from 260 thousand the previous week and in line with experts' forecasts. The 4-week average was 236.25 thousand, up about 4.75 thousand from the previous 4-week average.

The European Central Bank (ECB) cut its policy interest rate for the third time in 2024, while the Eurozone also received important economic news. At its meeting on October 17, the ECB said that inflation in the Eurozone is expected to rise again in the coming months, before falling back to its target in 2025. Inflation still seems to have room to rise due to high wage growth.

However, wage pressures on inflation are likely to ease gradually due to weak corporate earnings. The ECB is determined to return inflation to its 2.0% target in a timely manner, and will keep its policy rates at sufficiently restrictive levels for as long as necessary to achieve this target. The ECB decided to cut all three policy rates by 25 basis points, taking the refinancing rate, marginal lending rate and ECB deposit rate to 3.25%; 3.40% and 3.65% respectively. The ECB will also monitor future economic and inflation data to make further monetary policy decisions.

Regarding the Eurozone economy, the core CPI in this area officially increased by 2.7% compared to the same period in September, unchanged from the preliminary statistical results. However, the headline CPI last month was officially announced to increase by 1.7% compared to the same period, slightly adjusted down from the previous result of 1.8%.

Next, the Eurozone trade balance recorded a surplus of 11.0 billion EUR in August, lower than 13.7 billion in July and much lower than the expected surplus of 17.8 billion.

Finally, in Germany, the ZE weekly survey organization said the economic confidence index in the country was at 13.1 points in October, up from 3.6 points in the previous month and at the same time surpassing the forecast of 10.2 points. However, this is still the second lowest confidence level since the beginning of this year.

Source: https://thoibaonganhang.vn/diem-lai-thong-tin-kinh-te-tuan-tu-14-1810-156921-156921.html

Comment (0)