At the regular Government press conference in October 2023 held on the afternoon of November 4, the press sent to Deputy Minister of Finance Nguyen Duc Chi regarding the current situation of the corporate bond market and whether the launch of a private bond trading floor will help the market improve or not?

At the press conference, Deputy Minister of Finance Nguyen Duc Chi informed about the bond market and the operation of the private bond market concentrated at the Hanoi Stock Exchange. "Regarding the situation of the private bond market in the first 10 months of the year, by the end of October, we have summarized that 70 enterprises have tested the issuance of private corporate bonds with a volume of 180.4 trillion VND," Mr. Chi informed.

Deputy Minister of Finance Nguyen Duc Chi.

According to the Deputy Minister of Finance, enterprises have previously issued and repurchased 190.7 trillion VND before maturity, and a very noteworthy point is that since Decree 08/2023/ND-CP of the Government took effect on March 5, 2023, until the end of October, the issuance volume was 179.5 trillion VND. "This is issuance and repurchase, after Decree 08/2023/ND-CP was issued and by the end of October, the issuance volume was the same," said Mr. Chi.

Deputy Minister Nguyen Duc Chi also informed that in the primary market, that is, when enterprises issue, institutional investors account for over 95% and individual investors only account for about 5%, have participated in buying privately issued corporate bonds. The maturity volume from now until the end of the year is 61.6 trillion VND for bonds that enterprises have issued.

Regarding the situation of trading individual corporate bonds on the centralized trading system, Mr. Nguyen Duc Chi said that after more than 3 months of operation, the Hanoi Stock Exchange has coordinated with members as well as businesses to safely and smoothly operate this trading system.

Notably, according to Mr. Chi, the market size and liquidity have grown. As of October 31, the market has received and put into trading 451 bond codes of 114 enterprises with a registered trading value of about VND 336,768 billion.

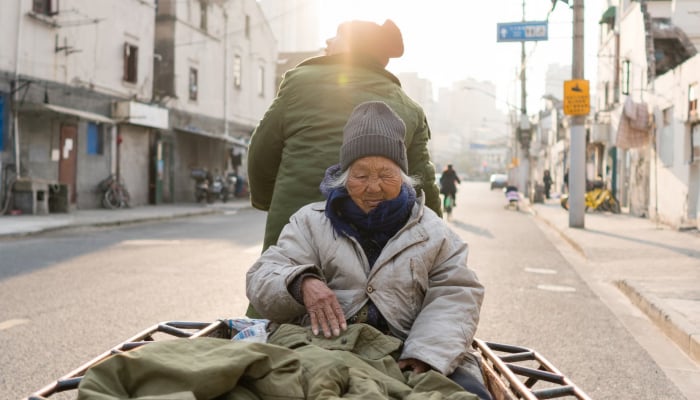

Hanoi Stock Exchange (HNX). Illustration photo

Regarding the transaction scale, Deputy Minister Nguyen Duc Chi said that by the end of the trading session on October 31, 2023, the total transaction value of the entire market reached VND 49,392 billion, with an average transaction value of VND 676.6 billion/session. "In October alone, the total market value reached VND 29,292 billion, with an average transaction value of about VND 1,331 billion/session," Mr. Chi informed.

According to Mr. Nguyen Duc Chi, by the end of October, there were only 451 bond codes of 114 enterprises registered to trade on this market and there are also many bond codes of enterprises that have issued but have not registered.

"The Ministry of Finance has directed the State Securities Commission, the Vietnam Stock Exchange and the Hanoi Stock Exchange to conduct supervision and inspection and will strictly handle according to the law if enterprises have issued bonds without registering for trading on this system according to the law," Mr. Chi emphasized.

Source

Comment (0)