After the previous day's shocking drop, the market shook like a roller coaster. However, in this derivatives expiration session, VN-Index had a spectacular "turnaround" at the end of the session, surprising investors despite a sharp drop in liquidity.

The stock market opened the morning session of July 18, VN-Index increased by nearly 5 points thanks to banking stocks. At the end of the morning session, the market turned to decrease due to weak demand in the market. In the afternoon session, the market continued to fall sharply, VN-Index at times decreased by more than 10 points due to high demand, but by the end of the session, bottom-fishing force entered the market, pulling VN-Index back to increase by nearly 6 points at the close. Of which, foreign investors net bought more than VND974 billion on the HOSE floor.

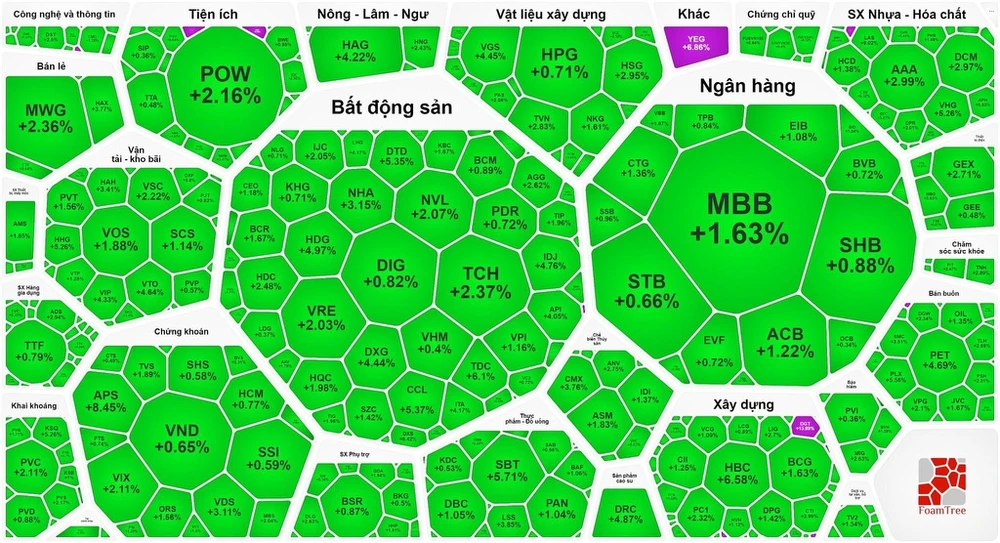

Banking stocks maintained good growth momentum: MBB increased by 1.63%, CTG increased by 1.36%, ACB increased by 1.22%, BID increased by 1.04%, EIB increased by 1.08%; STB, SHB, VPB, TPB, SSB increased by nearly 1%. Securities stocks also regained green: VDS increased by 3.11%, VIX increased by 2.11%, VCI increased by 1.6%, TVS increased by 1.89%; SSI, VND, HCM, FTS, VND, CTS increased by nearly 1%.

The real estate - construction group also recovered quite well after the sharp decline yesterday: HDG increased by 4.97%, VRE increased by 2.03%, TCH increased by 2.37%, NVL increased by 2.07%, CII increased by 1.25%, HDC increased by 2.48%, DPG increased by 1.42%... The manufacturing stock group also traded positively: SBT increased by 5.71%, GEX increased by 2.71%, HSG increased by 2.95%, DCM increased by 2.97%, DBC increased by 1.05%, GVR increased by 1.41%, ANV increased by 2.75%...

However, some large stocks still decreased, contributing to slowing down the increase of VN-Index, such as FPT decreased by 3.03%, HVN decreased by 3.44%, GMD decreased by 1.36%...

At the end of the trading session, VN-Index increased by 5.78 points (0.98%) to 1,274.44 points with 285 stocks increasing, 158 stocks decreasing and 62 stocks remaining unchanged. At the end of the session on the Hanoi Stock Exchange, HNX-Index also increased by 1.59 points (0.66%) to 242.49 points with 90 stocks increasing, 78 stocks decreasing and 54 stocks remaining unchanged. Liquidity decreased sharply, the total transaction value on the HOSE floor was about 19,000 billion VND, down about 10,300 billion VND compared to yesterday's session.

Another positive point is that foreign investors have net bought for the second consecutive session on the HOSE with a large proportion, over 974 billion VND. The stocks with the strongest net buying: HDB over 495 billion VND, STB over 345 billion VND, MWG over 130 billion VND, HPG nearly 54 billion VND, HVN over 46 billion VND, POW nearly 43 billion VND, CTG over 30 billion VND...

HBC achieved record profit in the second quarter

Hoa Binh Construction Group Corporation (stock code HBC) has just announced that its financial revenue in the second quarter of 2024 reached more than 46 billion VND, double that of the same period last year; financial expenses were reduced by 8% to 128 billion VND.

HBC reported a profit after tax of VND684 billion in the second quarter of 2024. This is also a record profit in a quarter that the company has achieved since it started operating. In the first 6 months of the year, the company recorded net revenue of VND3,811 billion, and its profit after tax skyrocketed to VND741 billion (the same period last year, it lost VND713 billion). Thanks to the above results, HBC has exceeded 71% of the profit target set for the whole year of 2024.

NHUNG NGUYEN - HAI NGOC

Source: https://www.sggp.org.vn/chung-khoan-quay-xe-ngoan-muc-cuoi-phien-hbc-dat-muc-lai-ky-luc-trong-quy-2-post749940.html

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

![[Photo] Close-up of the construction of the first dam to retain water on the To Lich River](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/0b561f1808554026a87a8cb1f79c8113)

Comment (0)