Increasing tobacco tax needs a reasonable roadmap: Lessons from international experience

Draft 2 of the Law on Special Consumption Tax (amended) recently sent by the Ministry of Finance for comments is attracting great attention from many organizations and the business community, including the tobacco industry.

The contents of the Draft that are attracting much discussion are taxable subjects, tax calculation methods, tax increase roadmap and tax rates...

For the tobacco industry, the proposal to apply a mixed tax method, supplementing an absolute tax, is expected to create an effective special consumption tax policy that meets the price increase target, contributing to reducing the consumption of cheap, low-quality tobacco products, while limiting access to them by young people.

Around the world, many countries have been switching to a mixed tax method (a combination of absolute tax and proportional tax) as a solution to balance the goals of public health protection and economic stability.

|

International experience in applying mixed taxes on tobacco

Oxford Economics' study of the tobacco tax structure in the European Union (EU) has shown that countries that apply mixed taxes with increasing absolute tax rates and decreasing relative tax rates tend to have stable or increasing tax revenues, even when legal tobacco consumption rates decline.

The case of Latvia can be considered as an example. Before joining the EU in 2004, in order to comply with its commitments to the EU, the country mainly increased excise taxes through increasing the tax rate. However, since 2011, the country has rebalanced the excise tax structure towards increasing excise taxes through increasing the absolute tax rate and reducing the relative tax rate. This change has contributed to reducing tobacco consumption, reducing contraband, ensuring a stable increase in tax revenue at 1.7% per year in the period 2010-2022.

In contrast, countries such as Italy and Spain, where absolute tax rates are low and there has been no significant change in the tax structure, have seen a decline in tobacco tax revenues. For many years, the excise tax systems of these two countries relied heavily on relative tax increases, but the compounded tax revenue growth rate has declined sharply.

The reason is that when relative taxes are increased, low-cost products have a much greater advantage than high-priced tobacco products, and manufacturers have less incentive to increase product prices than when absolute taxes are increased. Cigarette prices are suppressed, while consumers prefer cheap brands, causing tax revenue to plummet because the amount of tax collected from low-cost tobacco brands does not increase. This phenomenon causes the Government to face tax losses. This is the story that happened in the period 2010 - 2022 in Italy and the period 2010 - 2013 in Spain.

This shows that absolute tax plays an important role in ensuring stable revenue for the state budget.

Consider roadmap to increase tobacco tax for Vietnam

Based on practical international experience, experts believe that the Ministry of Finance's proposal to apply a mixed tax in the Draft Special Consumption Tax, which is being widely consulted, is completely appropriate, both reducing tobacco consumption and increasing budget revenue. However, the tax increase needs to be implemented cautiously and with a clear roadmap.

In the Draft Law on Special Consumption Tax (amended) which was put out for comments on June 13, 2024, the Ministry of Finance proposed to maintain the relative tax rate of 75% on tobacco and add an absolute tax rate according to the roadmap with 2 options.

Specifically, option 1 increases by 2,000 VND/bag in the first year (2026) and increases by 2,000 VND/bag each year in the next 5 years to reach an increase of 10,000 VND/bag in 2030; option 2 increases by 5,000 VND/bag in 2026 and increases by 1,000 VND/bag each year to reach an increase of 10,000 VND/bag in 2030.

Speaking at the Workshop on providing comments to complete the Special Consumption Tax Law Project organized by VCCI on July 11, the representative of the Vietnam Tobacco Association (VTA), Mr. Nguyen Chi Nhan, General Secretary, shared that according to the Association's calculations, in the period of 2026 - 2030, when applying the Special Consumption Tax Law as proposed by the Ministry of Finance, the entire industry's output will gradually decrease by 17% - 18%. By 2030, the output will decrease from 43 billion cigarettes (2023) to about 1.5 billion cigarettes (2030). This is also accompanied by a corresponding decrease in the growing area of about 2/3.

It can be seen that if VTA's calculations take place in reality, it will cause many difficulties for the entire industry, including manufacturing and supplying enterprises of raw materials and accessories as well as people in raw material growing areas.

From international experience, Germany has succeeded in stabilizing tobacco tax revenue by applying a roadmap to increase excise tax at a moderate rate of 2% in the period 2011 - 2015 despite the decrease in official cigarette consumption. Previously, Germany had increased excise tax sharply in the period of 4 years (2002 - 2005) at a rate of 50% but still did not achieve the expected revenue, at the same time, the consumption of smuggled cigarettes increased too much, forcing this country to temporarily suspend the increase in excise tax since 2006.

However, on the contrary, Malaysia's excessive increase in excise tax, with an increase of 37% in 2015, has led to a significant increase in the consumption of smuggled cigarettes, causing a loss of tax revenue for the State, while the overall consumption of cigarettes has not decreased significantly. It is estimated that up to 59% of the cigarettes consumed in this country in 2018 were smuggled cigarettes, causing a loss of about 2.7 billion USD in tax revenue.

Tobacco businesses generally support the Draft Law Amendment according to the Party and State's policy. However, they propose to extend the tax increase roadmap and have appropriate tax rates to avoid creating conditions for smuggled cigarettes, causing tax losses while failing to achieve the goal of reducing the rate of tobacco use in the community.

Source: https://baodautu.vn/tang-thue-voi-thuoc-la-can-mot-lo-trinh-hop-ly-bai-hoc-kinh-nghiem-tu-quoc-te-d221093.html

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

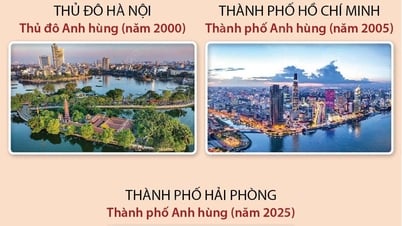

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

Comment (0)