The market was under strong selling pressure, especially from foreign investors, and at one point fell below the 1,210 point mark. However, the strong bottom-fishing demand helped the VN-Index recover. Green has returned, although the VN-Index still slightly decreased.

Net selling pressure from foreign investors remains strong, VN-Index recovers thanks to bottom-fishing demand

The market was under strong selling pressure, especially from foreign investors, and at one point fell below the 1,210 point mark. However, the strong bottom-fishing demand helped the VN-Index recover. Green has returned, although the VN-Index still slightly decreased.

VN-Index had a "forgettable" trading week when it fell by 2.71% and 4/5 sessions closed in red. Entering the new week, red still dominated. The index opened slightly above the reference level for a short time before reversing. Selling pressure at the beginning of the session was somewhat lighter and recovery sometimes appeared. However, demand was generally weak and cut-loss pressure reappeared when the recovery was not strong. A series of stock groups were submerged in red and caused the indices to widen their decline. VN-Index fell deeply to around 1,200 points. Foreign investors accelerated their selling right from the beginning of the session and were the main pressure on the market. This capital flow net sold about 1,100 billion VND in the morning session alone.

In the afternoon session, trading was completely opposite to the morning. In the early afternoon session, strong selling pressure pushed VN-Index to fall deeper. However, a surprise occurred later when bottom-fishing demand appeared along with the selling pressure of foreign investors slowing down. The indices therefore had a significant recovery. VN-Index was pulled up above the reference level at times. However, VN-Index still closed the session with a slight decrease.

At the end of the trading session, VN-Index stood at 1,217.12 points, down 1.45 points (-0.12%). HNX-Index rebounded 0.26 points (0.12%) to 221.79 points. UPCoM-Index increased 0.31 points (0.34%) to 91.64 points.

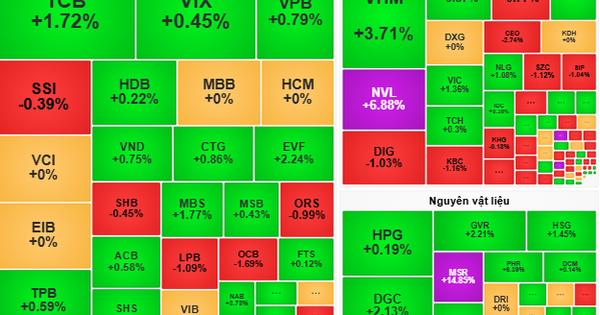

The whole market had a fairly equal number of stocks increasing and decreasing with 368 stocks increasing and 340 stocks decreasing, the number of stocks remaining unchanged and not traded was 867. Today's session still had 12 stocks hitting the floor while 24 stocks hit the ceiling.

|

| Top 10 stocks increased/decreased strongly in the session of November 16 |

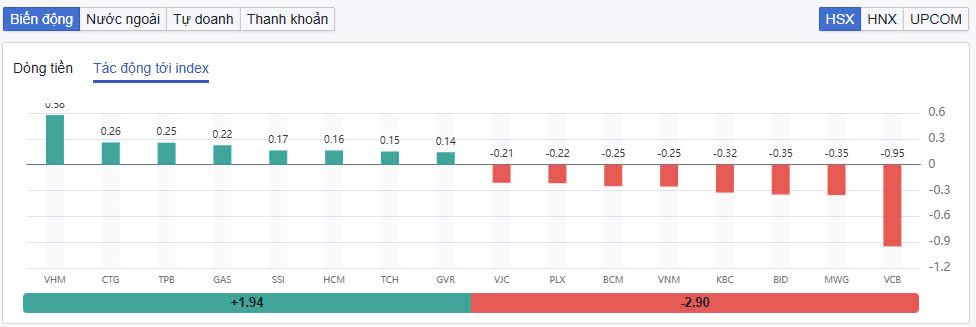

A series of stocks in the VN30 group are still under strong selling pressure and are the main factor causing the market to fluctuate strongly. However, the support at the end of the session was quite good, helping this group regain balance, thereby helping the general market recover. MWG continues to be the focus of the market when it is under strong selling pressure. MWG decreased by 1.7% to only 58,900 VND/share. At one point in the session, MWG dropped to only 57,100 VND/share, equivalent to a loss of 4.7%.

Besides, PLX, VCB, BID, VNM, BCM... were also in red. VCB decreased by 0.76% and was the stock that took away the most points from the VN-Index with 0.95 points. MWG ranked second in the list of stocks that negatively affected the VN-Index with 0.35 points.

On the other hand, the recovery was strong in stocks such as TPB, SSI, VHM, STB, CTG... Of which, VHM increased by 1.4% and contributed 0.58 points to the VN-Index. CTG and TPB increased by 0.6% and 2.56% respectively with the contribution points of 0.26 and 0.25.

SSI increased by 1.46% today and was also among the stocks that had a positive impact on the VN-Index. Not only SSI, many stocks in the securities group also recovered well and helped investors' sentiment become less pessimistic. Other securities stocks that increased strongly were CTS up 4%, MBS up 3.8%, HCM up 3.6%, AGR up 3.4%...

In the real estate group, recovery also took place. In which, TCH was pulled up to the ceiling price, NTL also increased by 4.4%, DXG increased by 1.9%, PDR increased by 1.5%, NVL increased by 1.44%.

One stock that caught attention in today's session was KBC, which unexpectedly hit the floor. At the end of the session, KBC fell nearly 6%. Previously, on November 15, KBC decided to issue cheap shares to strategic investors. Specifically, the company plans to offer 250 million shares, equivalent to 32.57% of the number of shares outstanding on the market. The selling price is only 80% of the average closing price of 30 sessions and not less than VND16,200/share, 41% lower than the current market price.

Although the market recovered significantly at the end of the session, liquidity remained quite weak. The total trading volume on the HoSE reached 646 million shares, equivalent to a trading value of VND15,557 billion, down 16.6% compared to the previous session. The negotiated trading value on the HoSE reached nearly VND2,100 billion, down 10%. The trading value on the HNX and UpoM was VND955 billion and VND590 billion, respectively.

|

| Foreign investors continue to sell strongly |

VHM was the most traded stock today with VND924 billion. Following that, MWG and SSI had trading values of VND703 billion and VND600 billion, respectively.

Foreign investors net sold a total of VND1,460 billion in the whole market, of which, this capital flow net sold the most SSI code with VND269 billion. Next, VHM was net sold VND243 billion. MWG, HDB and MSN were all net sold over VND100 billion. In the opposite direction, STB topped the net buying list but the value was only VND33 billion.

Source: https://baodautu.vn/ap-luc-ban-rong-tu-khoi-ngoai-van-manh-vn-index-hoi-phuc-nho-cau-bat-day-d230323.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)