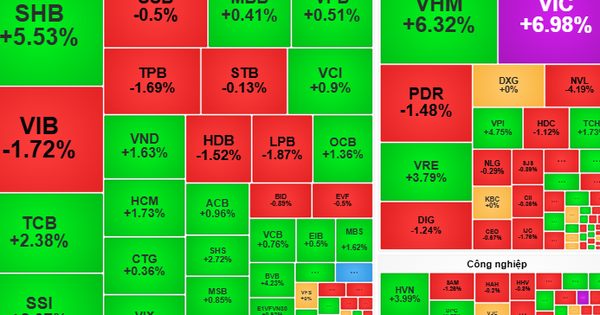

Mr. Phan Manh Ha, Business Director, VNDirect Securities Company, said that there is no bad news in the stock market today, but instead there are driving forces for growth.

Accordingly, the Government and the Prime Minister have given strong instructions for the economy to achieve the growth target of 8% or more in 2025 and double digits in the following years. This information will stimulate cash flow into the market.

In addition, the information that Vietnam's stock market will be upgraded from now until the third quarter has strongly affected investor sentiment.

Along with that, the market has been quite gloomy for many months, investors have been holding money and waiting, now with positive information, they are more likely to invest.

Therefore, according to Mr. Ha, this is the time when cash flow is returning to stocks. " From now until the second quarter, the market will be very good. Some groups will meet growth expectations, such as public investment, manufacturing and securities. The market can reach 1,400 points ," said Mr. Ha.

Stocks have surpassed the 1,300 point threshold. (Illustration photo).

Similarly, Mr. Nguyen The Minh, Director of Research and Development of Individual Clients at Yuanta Securities Vietnam, also said that the positive factors of the market took place a week ago when the Government introduced a series of solutions to stimulate economic growth from the beginning of the year. And to increase growth, a series of policies have been introduced to facilitate public investment, infrastructure investment, and continue to implement the 8th power plan. Along with that, the Prime Minister has asked banks to maintain low interest rates to stimulate credit growth from the beginning of the year.

For investors, they expect the stock market upgrade to take effect in September, to continue affirming that this is an important capital channel for the economy and businesses.

“When the Vietnamese stock market is upgraded to an emerging market, this growth rate will certainly be much larger,” Mr. Minh predicted, emphasizing that there is still room for the VN-Index to grow beyond 1,300 points, possibly reaching 1,400 points. Thus, according to this expert, in the coming days, the VN Index will continue to increase quite high.

Regarding the groups of stocks that can continue to increase and attract investors, Mr. Minh commented: "Currently, the accumulation of investors' cash flow may continue to return to the market with the banking, securities, real estate, especially industrial real estate groups."

Meanwhile, Mr. Dinh Quang Hinh, Head of Macro and Market Strategy at VNDirect Securities, also said that concerns about exchange rate risks have been "largely" reflected in prices and the market is gradually shifting to more current stories such as the 8% GDP growth target and upcoming government policies to boost the economy.

"Last week, the National Assembly officially approved the GDP growth target of 8% or more in 2025. This is a very ambitious target, so it is expected that the Government will soon introduce drastic policies to realize this growth target, including expanding fiscal and monetary policies," said Mr. Hinh.

The weekend also saw important information related to steel stocks when the Ministry of Industry and Trade issued Decision No. 460/QD-BCT, applying temporary anti-dumping tax on hot-rolled coil (HRC) steel products from China and India. This information will have a positive impact on steel stocks, especially HPG.

With current developments, Mr. Hinh believes that the VN-Index may continue to move upward and challenge the strong resistance level of 1,300 points next week.

"The market may experience some fluctuations in this area when some investors realize profits. However, the probability of the market surpassing 1,300 points has increased significantly and investors should take advantage of short-term corrections, if any, to increase the proportion of stocks, prioritizing businesses in industries with support stories such as public investment, construction materials, banking, housing real estate and securities," Mr. Hinh analyzed.

PHAM DUY - Vtcnews.vn

Source: https://vtcnews.vn/chuyen-gia-dong-tien-dang-tro-lai-vn-index-co-co-hoi-dat-1-400-diem-ar928020.html

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

Comment (0)