An Gia said that the suspension of the offering is to ensure the interests of shareholders due to the unsuitable market situation.

An Gia Real Estate stops plan to offer shares to increase capital

An Gia said that the suspension of the offering is to ensure the interests of shareholders due to the unsuitable market situation.

An Gia Real Estate Investment and Development JSC (AGG) has just announced a Resolution approving the suspension of the plan to offer shares to the public to existing shareholders to increase charter capital.

Specifically, stop implementing the plan to offer 40.6 million shares to existing shareholders by exercising purchase rights, equivalent to the offering rate of 25% of outstanding shares at the time of offering.

An Gia said that the suspension of the offering is to ensure the interests of shareholders because the market situation is not suitable for the offering and to ensure the feasibility of the issuance. An Gia's Board of Directors will consider and decide to implement it at another suitable time.

Previously, this plan was approved by the General Meeting of Shareholders held on October 18, 2024 by collecting opinions in writing.

The General Meeting of Shareholders at that time approved the plan to offer 40.6 million shares to existing shareholders at a ratio of 4:1, equivalent to each shareholder owning 1 share will be entitled to 1 purchase right and every 4 purchase rights will be entitled to buy 1 new share offered for sale.

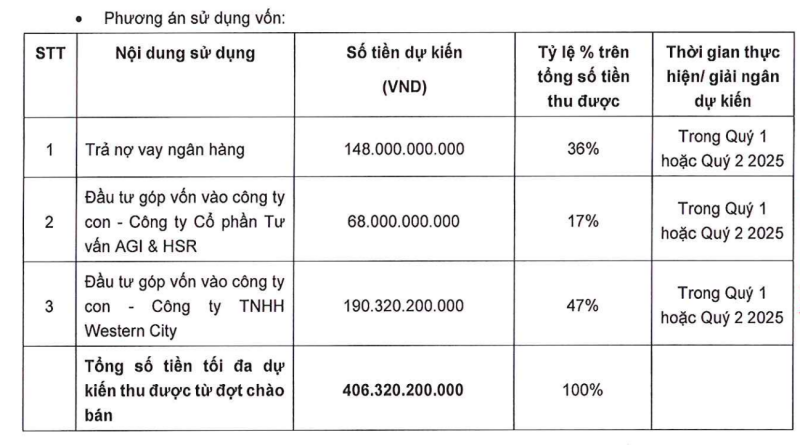

The expected offering price is VND10,000/share. The amount of more than VND406 billion raised will be used for the purpose of repaying bank loans, and/or investing in subsidiaries. Of which, 36%, equivalent to VND148 billion, will be used to repay bank loans. The remaining, AGG will use VND190.3 billion to invest in Western City Company Limited, and VND68 billion to invest in AGI & HSR Consulting JSC.

|

| Plan for using initial capital of the issuance. |

On the stock market, AGG shares are currently priced at VND 16,000 - 17,000/share, currently higher than the trading price of this stock at the end of December 2024.

According to An Gia 's financial report, as of December 31, 2024, the company's total assets were VND 7,035 billion, down 24% compared to the beginning of the year. Of which, VND 4,717 billion is in short-term receivables, including VND 2,558 billion in short-term loan receivables and VND 1,660 billion in other short-term receivables.

An Gia 's cash and cash equivalents decreased from VND772 billion at the beginning of 2024 to VND167 billion.

An Gia has a long-term financial investment of more than VND 89 billion, however, by the end of 2024, the company must make provisions for a decrease in the entire value of this investment.

In 2024, An Gia achieved 1,913 billion VND in net revenue, down 50% compared to the previous year. Meanwhile, financial expenses increased and the company still suffered losses in other activities, causing after-tax profit to fall to 261 billion VND, down 43%.

Source: https://baodautu.vn/bat-dong-san-an-gia-dung-ke-hoach-chao-ban-co-phieu-de-tang-von-d248031.html

Comment (0)