Selling pressure increased as VN-Index gradually approached the 1,300-point mark. Stocks in some sectors adjusted. Foreign investors continued to net sell but the selling value was lower than yesterday.

"Green on the outside, red on the inside", VN-Index moves closer to the psychological threshold of 1,300 points

Selling pressure increased as VN-Index gradually approached the 1,300-point mark. Stocks in some sectors adjusted. Foreign investors continued to net sell but the selling value was lower than yesterday.

|

| Stock market fluctuates due to profit-taking pressure |

Profit-taking pressure after a series of increasing days caused the market to fluctuate on February 21. Opening in a tug-of-war state, the general index was at times under strong selling pressure but quickly received support from positive cash flow, helping to maintain stability.

Market liquidity remains relatively good, showing that investor sentiment remains quite optimistic. Despite some fluctuations, the differentiation between industry groups has helped the index avoid a deep correction. Large-cap groups play an important role in balancing the trend, as the cash flow rotation is quite smooth.

In the afternoon session, market fluctuations were somewhat stronger and selling pressure also increased as the VN-Index approached the important resistance level of 1,300 points. Strong selling pressure caused the VN-Index to briefly fall below the reference level. However, with the support of some pillar stocks, the VN-Index quickly recovered and even continued to close at the highest level of the session.

At the end of the trading session, VN-Index increased by 3.77 points (0.29%) to 1,296.75 points. HNX-Index decreased by 0.45 points (-0.19%) to 237.57 points. UPCoM-Index increased by 0.53 points (0.53%) to 100.61 points.

More selling pressure appeared, causing the number of stocks decreasing to dominate with 426 stocks, while there were 364 stocks increasing and 723 stocks remaining unchanged/not traded. The whole market recorded 68 stocks increasing to the ceiling while there were 23 stocks decreasing to the floor.

|

| Vietcombank and VietinBank shares pull VN-Index up |

Despite the relatively strong differentiation, thanks to the push of many pillar stocks, the VN-Index still maintained its green color. In particular, VCB was the key factor helping to maintain the general market rhythm. At the end of the session, VCB increased by 1.53% and contributed 1.87 points to the VN-Index. Recently, the Joint Stock Commercial Bank for Foreign Trade of Vietnam (VCB) announced that it had received a document from the State Securities Commission on the report on issuing shares to pay dividends. Shares of VietinBank (CTG) also increased by 1.59% and contributed 0.83 points to the VN-Index. Shares such as BCM, MWG, BVH, VPB or VNM all increased by over 1%.

On the other hand, VIC, FPT, VHM, MSN... all closed the trading session in red and put significant pressure on the general market. FPT decreased by 0.7% and took away 0.35 points from the VN-Index. VIC decreased by 0.73% and took away 0.27 points. In the small and medium-cap group, red was somewhat dominant. In the securities group, stocks such as SHS, BVS, MBS, FTS, VDS... were all in red. SHS decreased by 1.4%, BVS decreased by 1.38%, MBS decreased by 1%. Real estate stocks were also quite negative such as KDH decreased by 1.6%, PDR decreased by 1.3%, DXG also decreased by 0.98%...

Meanwhile, the focus was on some stocks in the construction group. FCN increased by nearly 6%, CTD increased by 3.89%. On February 19, Vietnam Airports Corporation (ACV) announced the decision to approve the results of the contractor selection for Package No. 11.5 "Construction, equipment installation and construction drawing design of the Parking Lot" under component project 3 - essential works in the airport under the Long Thanh International Airport investment project phase 1. In which, the winning consortium was Construction Corporation No. 1 - Coteccons Construction Joint Stock Company - Fecon Joint Stock Company with a winning bid price of nearly VND 3,144 billion.

|

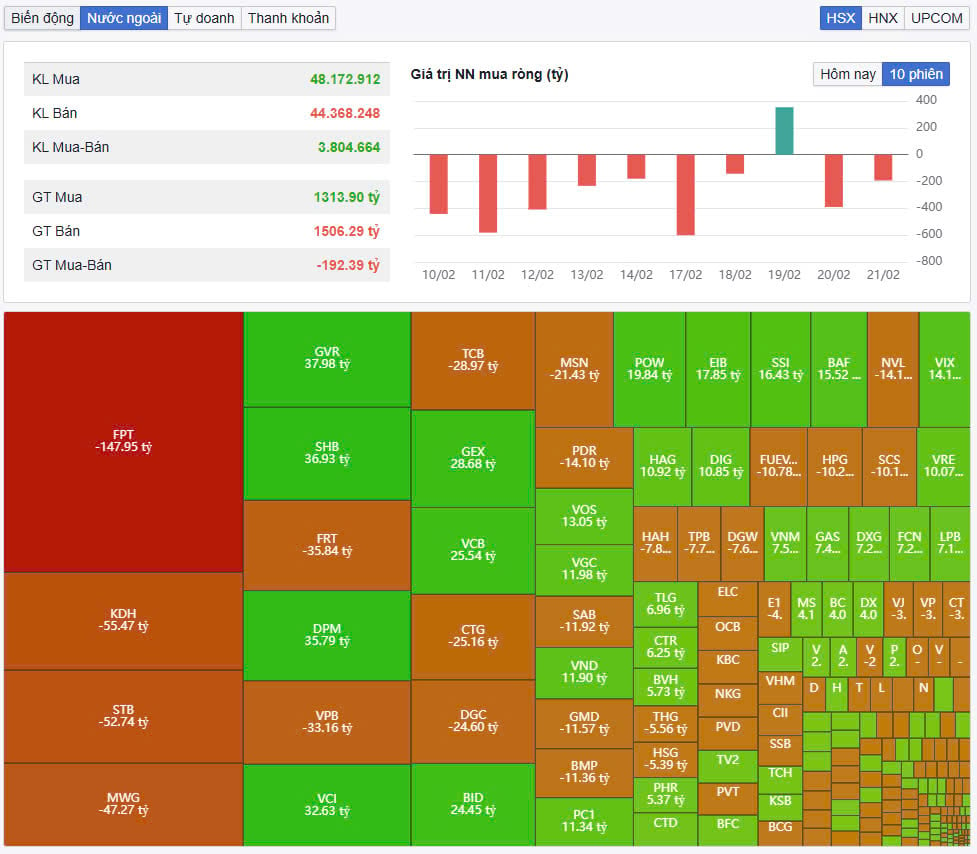

| Foreign net selling value decreased sharply |

Total trading volume on HoSE reached VND741 billion, equivalent to a trading value of VND15,937 billion, down 2% compared to the previous session, of which negotiated transactions accounted for VND1,467 billion. Trading values on HNX and UPCoM reached VND1,070 billion and VND755 billion, respectively.

VPB topped the list of transactions in the entire market with a value of VND820 billion. FPT and MWG followed with values of VND754 billion and VND383 billion, respectively.

Foreign investors net sold about 190 billion VND in the whole market. FPT was the most net sold by foreign investors with 148 billion VND. KDH and STB were net sold with 55.5 billion VND and 52.7 billion VND respectively. In the opposite direction, GVR was the most net bought with 38 billion VND. SHB and DPM were also net bought with 37 billion VND and 36 billion VND respectively.

Source: https://baodautu.vn/xanh-vo-do-long-vn-index-tien-gan-hon-nguong-tam-ly-1300-diem-d248270.html

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

Comment (0)