Market liquidity increased sharply, especially in the group of small and medium-sized stocks. Green color covered the number of stocks decreasing in price. The number of stocks hitting the ceiling price also reached over 50 stocks.

VN-Index increased by more than 10 points, green dominated the day foreign investors returned to net buying

Market liquidity increased sharply, especially in the group of small and medium-sized stocks. Green color covered the number of stocks decreasing in price. The number of stocks hitting the ceiling price also reached over 50 stocks.

In contrast to the previous gloomy trading session with a slight adjustment in points and a sharp decrease in liquidity, trading was more active in the session on February 19. VN-Index started with a cautious sentiment, although it sometimes approached the important resistance level but did not have enough momentum to break out. Investor sentiment was cautious as tomorrow will be the expiration date of VN30 Index Futures Contract.

However, after a period of cautious trading at the beginning of the session, cash flow gradually changed positively when some groups of stocks increased sharply, creating a spillover effect and helping the index overcome the resistance level after many previous failures.

In the afternoon session, trading continued to be active and the market's upward momentum was maintained quite firmly. The VN-Index even closed at the session's highest level.

Market liquidity has also improved, especially in the mid- and small-cap stocks, showing that cash flow is shifting to stocks with larger fluctuation ranges. Meanwhile, large-cap stocks, although not yet really booming, still play a role in keeping the market in tune. Divergence continues to occur. However, the overall trend is still positive as green dominates.

At the end of the trading session, VN-Index increased by 10.42 points (0.82%) to 1,288.56 points. HNX-Index increased by 1.95 points (0.83%) to 237.79 points. UPCoM-Index unexpectedly decreased by 0.17 points (-0.17%) to 99.34 points.

All three exchanges had 533 stocks increasing while only 253 stocks decreased. The number of stocks that remained unchanged and were not traded was 767. The entire market recorded 50 stocks hitting the ceiling while only 8 stocks hit the floor.

|

| Photo caption |

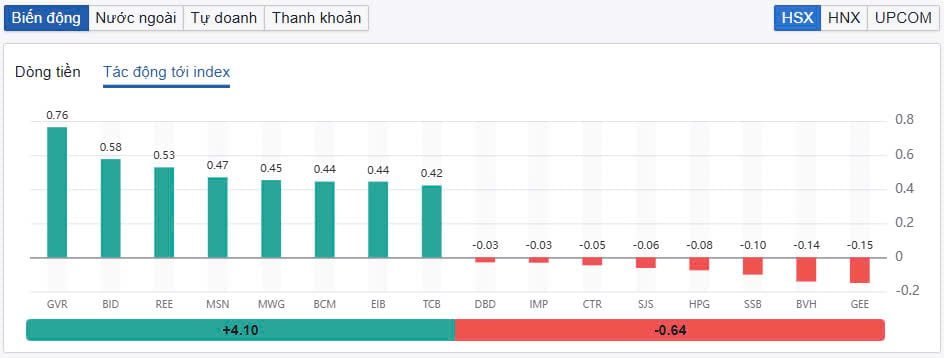

Large-cap stocks recorded overwhelming green. In the VN30 group, 26 stocks increased, while only 3 stocks decreased. Stocks such as GVR, BID, MSN, MWG... all increased strongly and made important contributions to maintaining the upward momentum of the VN-Index. GVR increased by 2.6% and was the stock that contributed the most positively to the VN-Index with 0.76 points. BID increased by 0.86% and contributed 0.58 points.

Besides, REE is a stock that attracts great attention from investors when it was suddenly pulled up to the ceiling price of 72,200 VND/share. At the end of the trading session, REE still had a ceiling price of 868,000 units.

Cash flow today is still strongly focused on mid- and small-cap stocks. Real estate continues to be the name that cash flow seeks in today's session. CEO increased sharply by 6.6%, NTL increased by 4.3%, DXG increased by 3.7%, NLG increased by 3%.

Besides the real estate group, the industrial park group also had a positive trading session. SIP was pulled up to the ceiling price. VGC increased by 3.9%, IDC increased by 3.7%, SZC increased by 3.5%, KBC increased by 3.3%. Stock groups such as retail, seaport - shipping... also had positive developments and attracted good cash flow.

On the other hand, BVH adjusted back after yesterday's breakout session with a decrease of 1.4%. Other insurance stocks such as VNG, MIG... were also in red. GEE, BVH, SSB, HPG... were the stocks that put the most pressure on VN-Index. GEE took the lead when it took away 0.15 points from VN-Index. At the end of the session, GEE decreased by 3.8%. Meanwhile, mineral stocks have not stopped falling. This group of stocks continued to be sold heavily, in which, KSV and HGM hit the floor. MSR decreased by 12%...

|

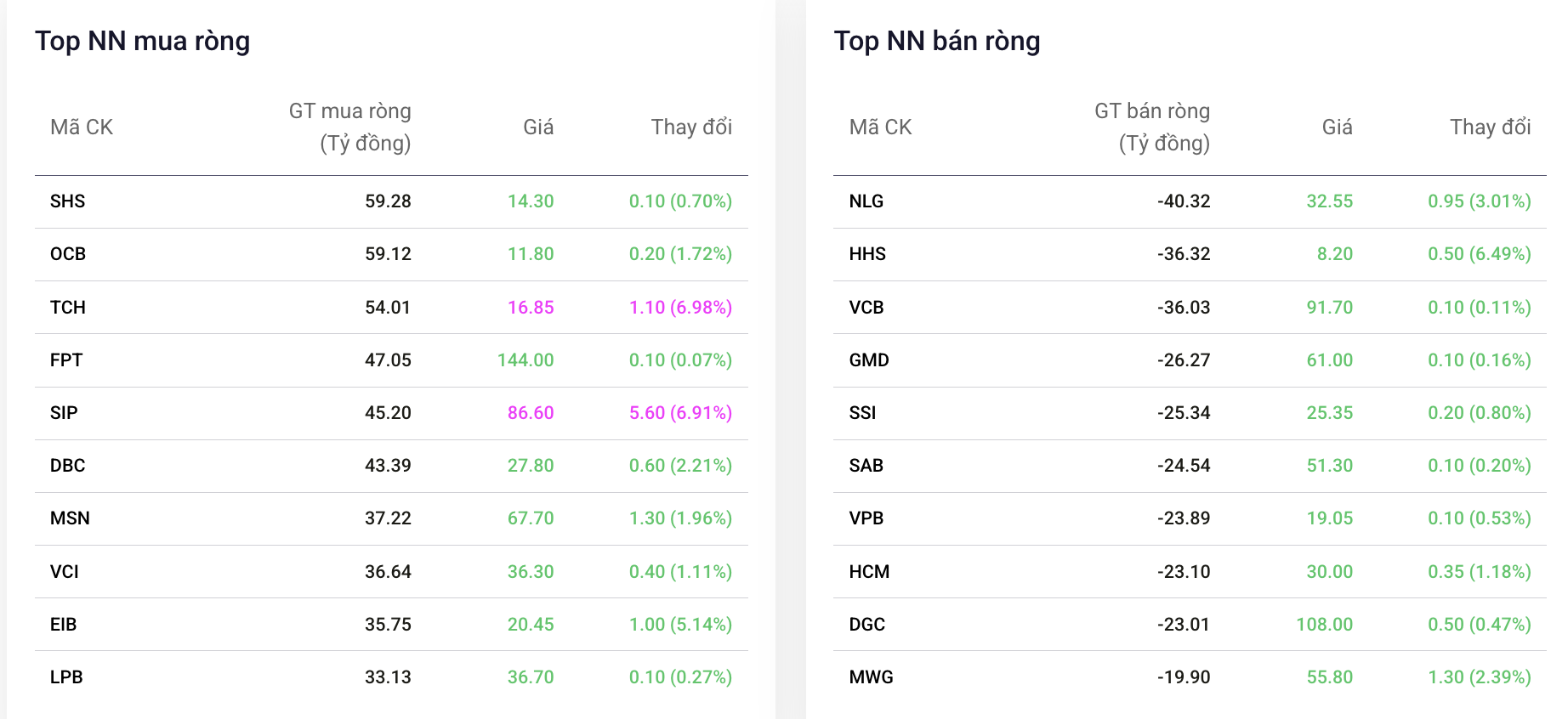

| Top stocks traded most strongly by foreign investors on February 19 |

The total trading volume on the HoSE floor reached 815 million shares, equivalent to a trading value of VND17,496 billion, up 22.7% compared to the previous session, of which the negotiated value accounted for VND2,142 billion. The trading value on the HNX and UPCoM reached VND1,594 billion and VND866 billion, respectively.

VIX ranked first in terms of total market trading value with over VND546 billion. FPT and MWG traded VND435 billion and VND419 billion respectively.

Foreign investors reversed course when they net bought nearly 400 billion VND across the market. Of which, foreign investors net bought the most SHS code with 61 billion VND. OCB and TCH followed with net buying values of 59 billion VND and 54 billion VND respectively. Meanwhile, NLG was the net sold the most with 40 billion VND.

Source: https://baodautu.vn/vn-index-tang-hon-10-diem-sac-xanh-ap-dao-ngay-khoi-ngoai-tro-lai-mua-rong-d247621.html

![[Photo] General Secretary To Lam receives Secretary General of the Mozambique Liberation Front Party](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/360d46b787c547bbaa5472c490ddeded)

![[Photo] President Luong Cuong receives Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/44f0532bb01040b1a1fdb333e7eafb77)

![[Photo] President Luong Cuong offers incense to commemorate Uncle Ho at House 67](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/162df748c87348e1821cc4c83745a888)

![[Photo] Ho Chi Minh City: full of flags and flowers before the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/ab41c3d5013141489dee6471f4a02b96)

Comment (0)