(NLDO) – VCBS Securities Company believes that stock prices will increase significantly if the market has a consensus on increasing strength from cash flow and large-cap stocks.

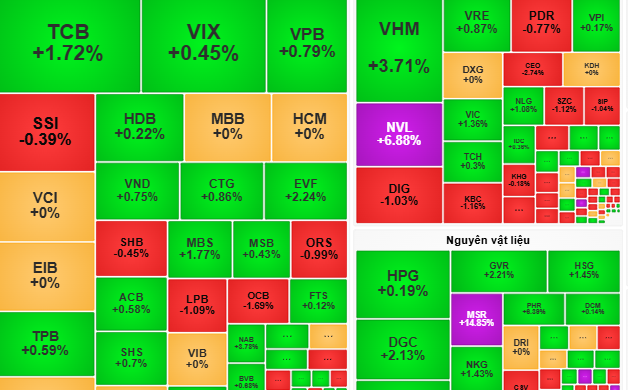

At the end of the session on February 20, the VN Index closed at 1,292 points, up 4.4 points, equivalent to 0.34%.

Vietnamese stocks continued to increase at the beginning of the session on February 20. Although there were some slight fluctuations due to profit-taking pressure, with strong active buying cash flow, typically real estate stocks and rubber stocks, at times, impressive price increases: NVL (+6.35%), VHM (+3.45%), GVR (+1.74%), PHR (+5.35%), DPR (+4.12%)... helped VN Index maintain its upward momentum.

On the other hand, the large-cap stock group maintained a green price base, contributing to the general index's balance and increase in points.

VN-Index is getting closer to the 1300 point mark and this development is accompanied by a more cautious market sentiment. This is shown through the ups and downs and tug-of-war of the general index in the afternoon session when red was more present than in the morning session.

However, most of the stocks that increased in value maintained a stable range, and demand supported prices quite well, so the market did not show any negative signs. The biggest negative point of the session on February 20 was that foreign investors net sold VND394 billion worth of stocks, focusing on selling FPT, MWG, and VCB.

At the end of the session, the VN Index closed at 1,292 points, up 4.4 points, equivalent to 0.34%.

VCBS Securities Company believes that the market's breakthrough picture is not clear and needs to be reinforced by the consensus of cash flow and large stocks.

Therefore, investors should consider partial profit-taking for stocks that have recorded strong growth and show signs of correction at high prices. In addition, stock "players" should only hold stocks that attract impressive demand.

Meanwhile, Dragon Capital Securities Company (VDSC) warned that profit-taking pressure could put pressure on the market in the next trading session. However, cash flow is expected to continue to support and the market will recover to continue moving towards the resistance zone of 1,300 - 1,310 points.

"Investors can consider exploiting short-term buying opportunities for stocks with positive performance, while taking profits on stocks that have increased rapidly to the resistance zone" - VDSC recommends.

Source: https://nld.com.vn/chung-khoan-ngay-mai-12-2-dong-tien-va-co-phieu-lon-co-the-tang-suc-manh-196250220173156751.htm

![[Photo] Vietnamese and Chinese leaders attend the People's Friendship Meeting between the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7d45d6c170034d52be046fa86b3d1d62)

![[Photo] Prime Minister Pham Minh Chinh works with state-owned enterprises on digital transformation and promoting growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f55bfb8a7db84af89332844c37778476)

![[Photo] Celebrating the 70th Anniversary of Nhan Dan Newspaper Printing House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a7a2e257814e4ce3b6281bd5ad2996b8)

![[Photo] President Luong Cuong holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f7e4c602ca2f4113924a583142737ff7)

![[Photo] Tan Son Nhat Terminal T3 - key project completed ahead of schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/85f0ae82199548e5a30d478733f4d783)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/ef636fe84ae24df48dcc734ac3692867)

Comment (0)