The Machine Learning-based gasoline price forecasting model of the Vietnam Petroleum Institute (VPI) shows that, in the upcoming November 14 adjustment period, gasoline prices may decrease by 0.5 - 2% if the Ministry of Finance and the Ministry of Industry and Trade do not set aside or use the Petroleum Price Stabilization Fund.

According to Mr. Doan Tien Quyet, data analysis expert of VPI, the gasoline price forecasting model applying the Artificial Neural Network (ANN) model and the supervised learning algorithm in Machine Learning of VPI predicts that the retail price of E5 RON 92 gasoline may decrease by 101 VND (0.5%) to 19,639 VND/liter, while RON 95-III gasoline may decrease by 183 VND (0.9%) to 20,667 VND/liter.

VPI's model predicts that retail oil prices will also trend downward this period; in which, fuel oil may decrease by 2% to VND16,057/kg, diesel oil is forecast to decrease by 1.4% to VND19,079/liter, and kerosene may decrease by 1.1% to VND19,079/liter. VPI predicts that the Ministry of Finance - Industry and Trade will continue not to set aside or use the Petroleum Price Stabilization Fund this period.

In the world market, in the early afternoon trading session today, November 12 (Vietnam time), Brent oil futures price decreased by 0.2%, down to 71.66 USD/barrel; US light sweet crude oil price (WTI) also decreased by 0.3%, down to 67.84 USD/barrel.

Oil prices fell for a variety of reasons; among them, investors were concerned that China's latest economic stimulus plan (the world's largest oil importer) had not yet reached the level needed to boost growth, so energy demand would follow suit.

Meanwhile, the Organization of the Petroleum Exporting Countries (OPEC) and its partners (also known as OPEC+) will have to continue to postpone the decision to withdraw voluntary cuts, leading to increased pressure on excess supply, especially in 2025. In addition, non-OPEC crude oil supply is expected to increase by 1.4 million barrels/day in 2025 and 900,000 barrels/day in 2026 according to the latest report by Bank of America (BofA).

Additionally, the US dollar was at a four-month high on November 12, making dollar-denominated commodities, such as oil, more expensive for holders of other currencies, thus putting downward pressure on oil prices.

According to VNA

Source: https://doanhnghiepvn.vn/kinh-te/vpi-du-bao-gia-xang-dau-giam-0-5-2-trong-ky-dieu-hanh-ngay-14-11/20241113084650942

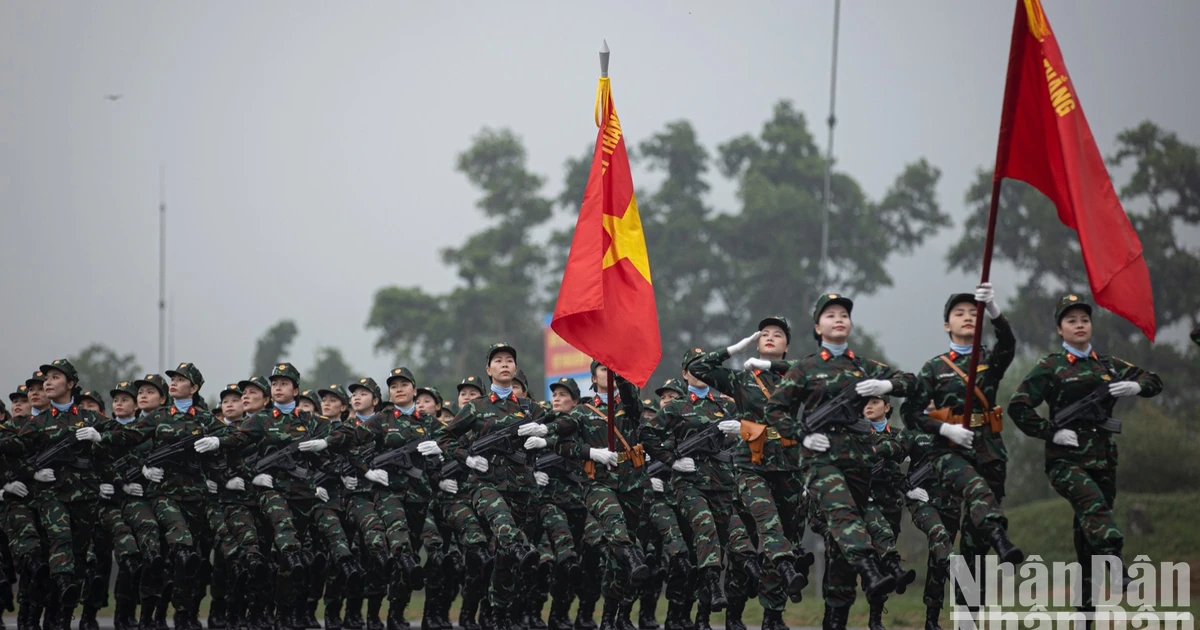

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

Comment (0)