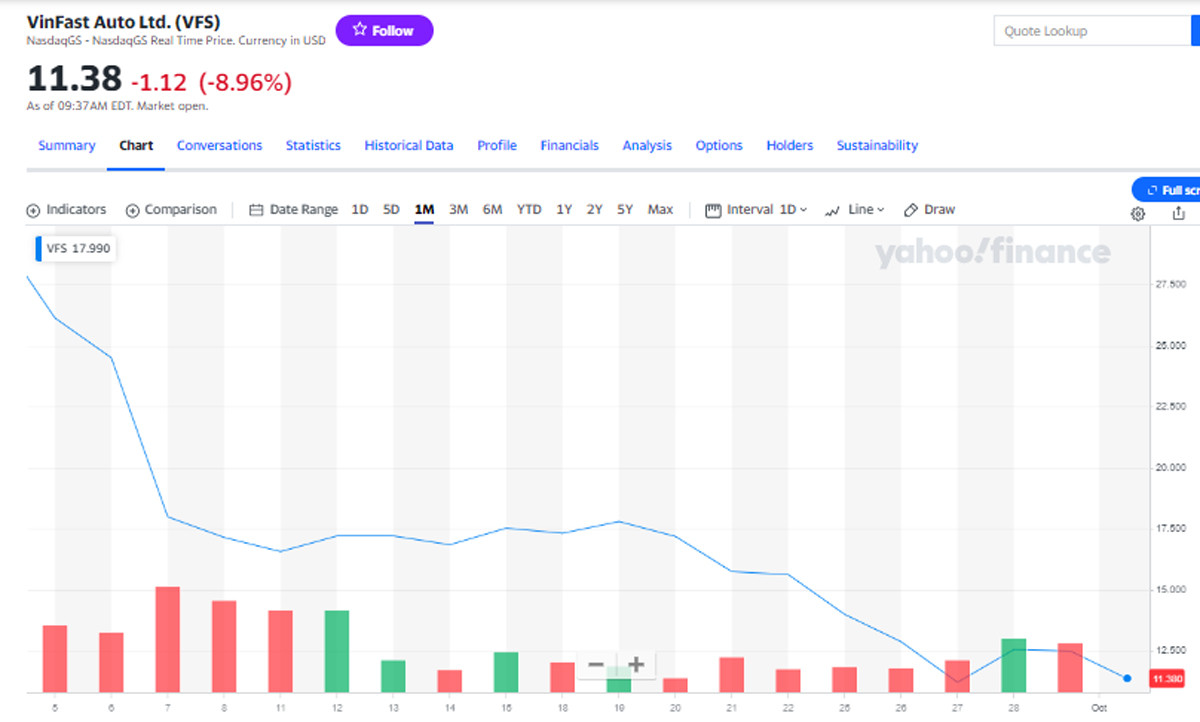

Opening the official trading session on October 2 on the US Nasdaq stock exchange (October 2 evening Vietnam time), VinFast Auto (VFS) shares of billionaire Pham Nhat Vuong fell for the second consecutive session, to the bottom of 11-12 USD, the lowest level since being listed on the US Nasdaq exchange on August 15.

Specifically, as of 8:40 p.m. on October 2 (Vietnam time), VFS shares decreased by more than 8% compared to the previous session to below 11.5 USD/share.

At the current price, VinFast Auto’s (VFS) market capitalization has dropped to $27 billion, almost equal to the initial valuation when it merged with Black Spade. This market capitalization has decreased by 85% compared to its peak in late August.

With this capitalization, the electric car company of billionaire Pham Nhat Vuong falls below India's Tata Motors and ranks 17th among car companies in the world. If only counting electric car companies, VinFast ranks 4th after billionaire Elon Musk's Tesla (as of October 2, capitalization is 775 billion USD); China's BYD (92.6 billion USD) and China's Li Auto (35.6 billion USD).

In the past 17 sessions, VinFast shares have fluctuated between 11-18 USD/share. Liquidity has improved in recent sessions, reaching 3-5 million units/day, but is still much lower than the 10-20 million units/session during the bustling days at the end of August.

In the last session of the week, September 29, VinFast recorded liquidity of more than 4.65 million units.

According to information in the Indian economic newspaper Economic Times, VinFast is considering setting up an automobile manufacturing plant in India. The factory will likely be built in the states of Tamil Nadu or Gujarat.

However, it is not yet clear whether VinFast is considering producing cars for export or will only sell them in the Indian market, where BYD is also expanding its presence.

Investors are particularly interested in the outcome of the plan to offer more than 75 million shares of VinFast shareholders to the public. In this plan, Mr. Pham Nhat Vuong's two private investment companies (VIG and Asian Star) will bring 46.29 million VinFast shares to the market, equivalent to about 2% of the outstanding shares.

The money will be reinvested in VinFast as committed by billionaire Pham Nhat Vuong and Vingroup.

Source

Comment (0)